1 min read

Breaking Out Cost Components in Wood Supply Agreements

LeAndra Spicer : November 10, 2014

Wood supply agreements are as unique as the buyers and suppliers that enter into them, yet each contract should include a credible index that buyers and sellers will use to pay and receive market price at the time of sale. An index can be as broad as the terms of the contract, however, accuracy is greatly improved when cost components are identified for specific supply sheds (as opposed to larger geographic regions).

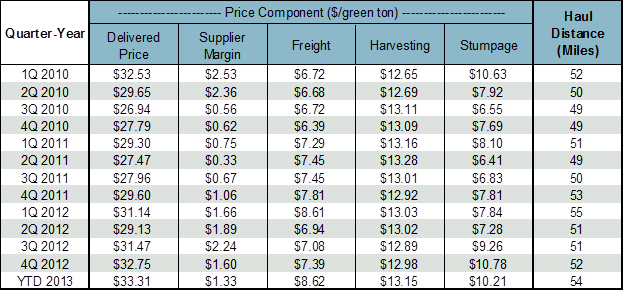

It is prudent to understand the components that can affect overall price before negotiations proceed. Five components are typically found in the total volume-weighted delivered prices reported in a reliable index:

- Supplier Margin

- Freight

- Harvest

- Volume-Weighted Stumpage Price

- Average Haul Distance

Here we talk about the most volatile components – stumpage price, freight, and harvest costs.

Stumpage Price

Stumpage price volatility is a function of supply and demand changes within the marketplace and has little correlation to energy prices or inflation. In fact, timberland is often held as an investment to hedge against rising energy prices and inflation.

Current market prices should serve as the basis for stumpage price. This price should be adjusted on a periodic basis (monthly or quarterly) to stay in line with market trends. Likewise, an index should be reexamined and adjusted on an annual basis.

Stumpage price power is, for the most part with the buyer, which is typical of markets with fragmented sources of supply. Local average stumpage prices are affected by area competition among buyers, available volume of supply, and the weather (read our blog 5 Causes of Stumpage Price Variation to learn more).

Stumpage price is amazingly independent of energy price, inflation, or the market price of the products produced from wood raw material. The same cannot be said for freight and harvest costs.

Freight and Harvest

A significant portion of total delivered cost is freight to transport bulky feedstock. Both freight and harvest components are highly correlated to CPI and diesel. Accordingly, these two components account for the majority of price volatility seen in delivered prices.

However, it is problematic to assume an increase in diesel will translate to an increase in freight costs. The wood supply chain is a smart supply chain that self-adjusts to offset such increases. For example, facilities often shrink procurement zones in response to increased freight costs. This response is a more consistent predictor than prices that react to increases inconsistently over time.

Tomorrow, we will discuss why fuel escalators can actually do more harm than good when it comes to supply agreements.