Spring has officially sprung. It’s an important time of year for companies like Home Depot, who began filling more than 80,000 temporary positions in February to prepare for the April rush of foot traffic. While this enthusiasm represents stable consumer confidence on the retail level, it also underscores the trend towards home improvement rather than home buying. Despite the positive outlook, compelling mortgage rates and new-home inventories, Q12015 US GDP (0.2 percent expansion) and housing market data were both unimpressive, and expectations for the second quarter and beyond remain lukewarm.

Housing Starts: Current Data

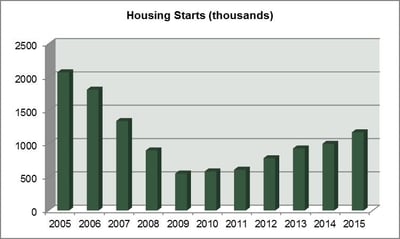

Housing data is prone to volatility and is frequently revised on a monthly basis, but the latest info from the US Census Bureau tells an uninspiring story. With forecasted 2015 privately-owned housing starts of just over 1 million units, the industry is on pace to fall short of expectations with new, seasonally-adjusted data of 926,000 units in March. This represents a 2 percent increase over the revised February estimate (908,000), but a 2.5 percent decrease over March 2014 (950,000).

Home Sales & Economic Climate

While the housing industry as a whole continues to bounce back in the wake of the 2008 economic recession (note the meager 2009 housing starts data above), sales of new and existing homes remain unstable on a monthly basis. According to recent data from The Commerce Department, new home sales declined 11.4 percent in March—the biggest percentage decrease since July 2013. Conversely, existing-home sales in March rose 6.1 percent above February's number, which is the highest sales increase since December 2010.

Additionally, an improved economic climate and aggressive home-buyer incentives have failed to give this sector a real shot in the arm:

-

The Conference Board’s Consumer Confidence Index® highlights improved data over last month (101.3 vs. 98.8).

-

Home prices climbed 0.7 percent in February, effectively increasing homeowners’ net worth.

-

The four-week moving average of unemployment claims was 284,500 as of April 18, roughly 11 percent below the previous-year number of 319,500.

Finally, and most importantly for potential home-buyers, the 30-year fixed-rate mortgage averaged 3.67 percent for the week ending April 16, which is down from 4.27 percent a year ago. This piece of information is significant, considering that the lowest 30-year rate posted during the last 40 years—a timeframe that includes the 2008 recession—was 3.41 percent in January of 2013.

What do the Experts Say?

The National Association of Home Builders’ confidence index climbed four points in April to 56; a reading above 50 denotes that most builders generally have a positive market outlook for newly built, single-family homes.

Concurrently, Anthony Mirhaydari at The Fiscal Times notes, “The iShares Dow Jones U.S. Home Construction ETF (ITB) recently notched a new 7.5-year high as sentiment on the housing sector warms along with the arrival of spring. This new upward excursion for the industry group breaks a funk going back to 2013, which coincides with a slowdown in the pace of home price gains according to the S&P/Case-Shiller Home Price Index.”

Near-Term Outlook

For the forest products industry, the most telling data in the near-term is also detailed in the Census Bureau’s report: Applications for building permits, an indicator for new construction in the coming months, declined by 5.7%. Understandably, the frigid winter weather did nothing to help drive new housing starts and, based on this information, it appears that a spring thaw may not offer much in the way of near-term building growth.

It simply may be too early in the season to accurately forecast housing market performance for 2H2015. As we reported last month, indicators may look promising but weather developments will continue to have a substantial impact on actual housing-start numbers.

Favorable economic conditions and enticing buyer incentives can’t seem to move the needle for the housing market and, with 80,000 new employees to pay, mass retailers like Home Depot are betting on spring being a season of (existing) home improvement. That said, will a further decrease in mortgage interest rates—as some are predicting—be enough to coax consumers to move from home improvement to home buying? Stay tuned.

Daniel Stuber

Daniel Stuber