3 min read

NAFO Report Highlights Part 2: Economic Impact of Forest Products Industry

Hannah Jefferies : June 3, 2016

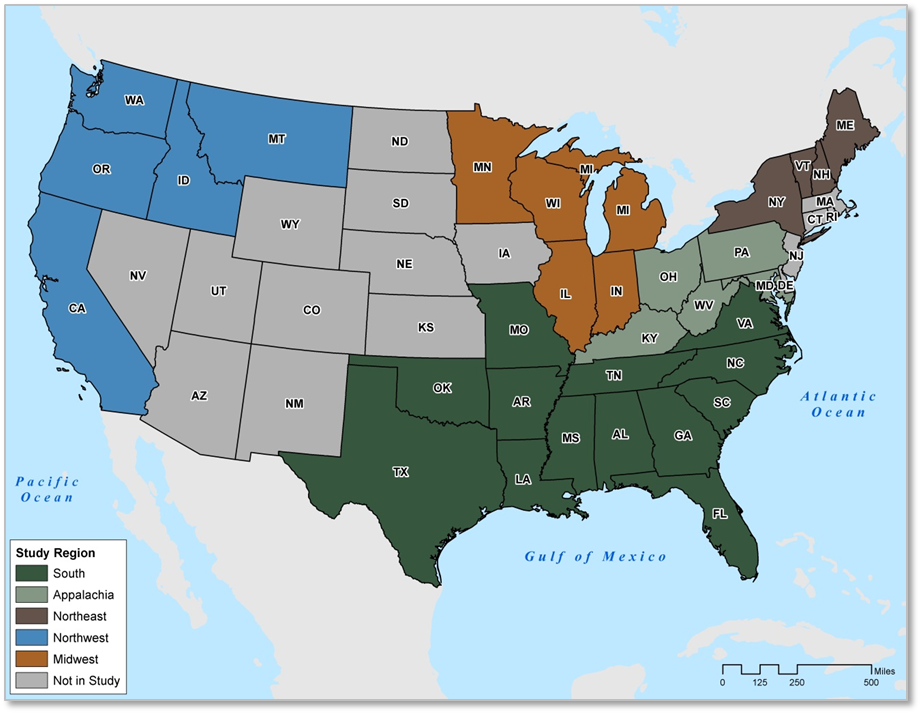

Forest2Market recently completed an economic impact study for the National Alliance of Forest Owners (NAFO). The study quantifies the contribution that forestry-related industries make to state, regional and national economies, and analyzes the most forested regions of the United States based on the most recent year of data available, which is 2013. The following map identifies the regions that were the subject of the study.

Economic Impact of Working Forests: Employment & Payroll

Direct employment refers to the number of full- and part-time jobs at forestry-related businesses. Direct payroll refers to the payroll contributions associated with direct employment. Forestry-related businesses support over 1 million direct jobs, which are associated with over $48.8 billion in direct payroll (Table 3‑1).

In addition to direct employment and payroll, forestry-related businesses create further employment opportunities via both indirect and induced impacts.

- Indirect impacts are the production, employment and income changes occurring in other businesses that supply inputs to the industry under consideration.

- Induced impacts are the effects of spending by households as the result of direct and indirect effects. The induced effects arise when direct employees spend their income in the community.

The combined effect of direct, indirect and induced impacts is referred to as total employment and total payroll. Forestry-related businesses support 2.7 million total jobs and are associated with $112.7 billion in total payroll.

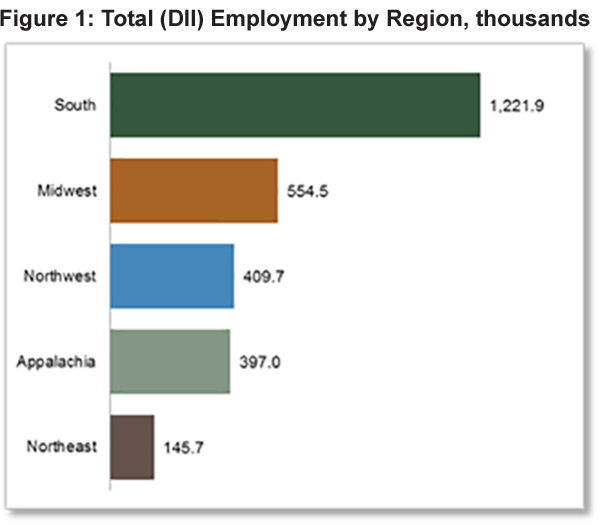

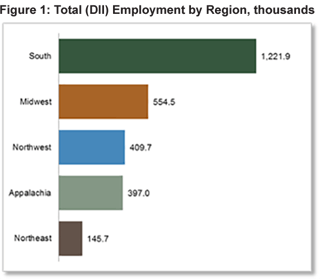

Including direct, indirect and induced employment, forestry-related businesses support over 1.2 million jobs in the South, 554.5 thousand jobs in the Midwest, 409.7 thousand jobs in the Pacific Northwest, 397.0 thousand jobs in Appalachia and 145.7 thousand jobs in the Northeast (Figure 1). Approximately 45 percent of the direct, indirect and induced jobs in the study area are attributable to the South.

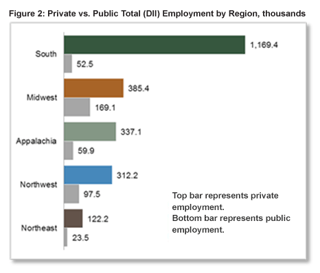

Private timberland supports around 1.2 million jobs in the South, 385.4 thousand jobs in the Midwest, 337.1 thousand jobs in Appalachia, 312.2 thousand jobs in the Pacific Northwest and 122.2 thousand jobs in the Northeast (Figure 2).

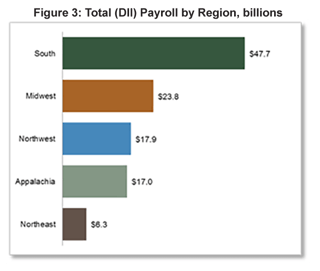

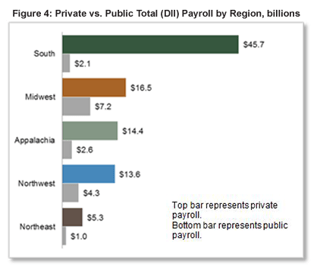

Total payroll in forestry-related businesses is $47.7 billion in the South, $23.8 billion in the Midwest, $17.9 billion in the Pacific Northwest, $17.0 billion in Appalachia and $6.3 billion in the Northeast (Figure 3). Total payroll contributions attributable to private timberland are $45.7 billion in the South, $16.5 billion in the Midwest, $14.4 billion in Appalachia, $13.6 billion in the Pacific Northwest and $5.3 billion in the Northeast (Figure 4).

Economic Impact of Working Forests: Contribution to GDP

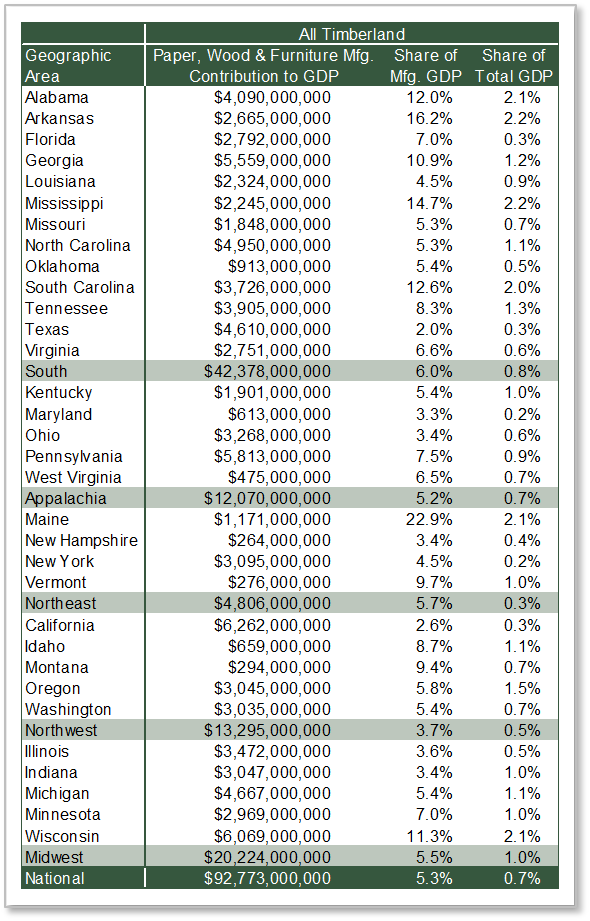

GDP associated with paper, wood and furniture manufacturing industries totals nearly $92.8 billion.

Nationally, paper, wood and furniture manufacturing industries are 5.3 percent of total manufacturing GDP, and approximately $81.3 billion of forestry-related businesses’ contribution to GDP is associated with private timberland.

In the South, forest products manufacturing industries contributed over $4 billion to GDP in Georgia, North Carolina, Texas and Alabama. Forest products manufacturing companies in Oklahoma and Missouri contributed the least to GDP in the South at $913 million and $1.8 billion, respectively.

In Appalachia, Pennsylvania has the highest forest products manufacturing contribution to GDP at $5.8 billion, which is 7.5 percent of Pennsylvania’s manufacturing GDP and 0.9 percent of total state GDP. Maryland forest products manufacturing companies contribute the least to state GDP at $613 million, which is 3.3 percent of manufacturing GDP and 0.2 percent of total state GDP.

In the Northeast, New York’s forest products manufacturing companies contribute just under $3.1 billion to the state’s GDP, which is the highest in this region. However, as a share of state manufacturing and total GDP, Maine’s $1.2 billion contribution represents 22.9 percent of the state’s manufacturing GDP and 2.1 percent of total GDP. New Hampshire forest products companies contribute the least to their state’s GDP at $264 million annually (3.4 percent of manufacturing GDP and 0.4 percent of state GDP).

In the Northwest, forest products manufacturing companies in California contribute $6.3 billion to GDP, which is 2.6 percent of state manufacturing GDP and 0.3 percent of total state GDP. Oregon and Washington companies contribute over $3 billion each to their states’ GDP, and forest products manufacturing is 5.8 percent and 5.4 percent of total manufacturing GDP, respectively. Montana forest products companies contribute the least to GDP in terms of dollar output at only $294 million, but this is 9.4 percent of Montana’s manufacturing GDP, the highest share in this region.

In the Midwest, Wisconsin forest products manufacturing companies contribute nearly $6.1 billion (2.1 percent) to their state’s GDP, and forest products represent 11.3 percent of state manufacturing GDP. Minnesota companies contribute just under $3.0 billion to their state’s GDP, the lowest in the region. Illinois forest products manufacturing at $3.5 billion represents 0.5 percent of state GDP.

Read the full study and use the interactive state data feature on NAFO's website.