As the uncertainty of the global economy continues to influence the forest products industry, 2015 has proven to be a noteworthy year in terms of industry change. No other US region with significant forest resources has experienced this pace of change as acutely as the Pacific Northwest (PNW), which has seen at least 15 mills change hands, alter capacity or shutter altogether this year alone. As the industry continues to evolve by improving supply-chain efficiencies and go-to-market strategies, adaptive change—and oftentimes consolidation—becomes necessary for survival.

Notable PNW Consolidations in 1H2015

-

Interfor: After purchasing four mills in the PNW from Simpson Lumber Co. in March, Interfor closed the Tacoma facility in Washington (Commencement Bay) in May and currently has the property on the selling block. Interfor reportedly lost $7.7M on the Tacoma mill in roughly ten weeks of operation. The onsite equipment and assets will be sold at auction in November.

-

Sierra Pacific Industries: With three existing Washington mills, SPI purchased the remaining two Simpson Lumber sawmills in Shelton and Dayton. The company does not have plans to re-open the two mills, but instead will construct at least one contemporary sawmill and lumber planing operation on the Shelton site. SPI anticipates its new mill will be operational sometime in 2017.

-

Olympic Panel Products: Swanson Group Manufacturing acquired the assets of Olympic Panel Products in Shelton, Washington. Olympic was the largest overlay plywood manufacturer in North America. Swanson plans to relocate the Olympic Panel assets in 2016 to a state-of-the-art facility that will be built in Springfield, Oregon.

-

Allen Logging Company: Operating the last production lumber mill on the West End—and the last production softwood mill west of Port Angeles—Allen Logging shuttered its Forks facility earlier this summer.

-

Seattle-Snohomish: Snohomish’s last remaining mill, which produced surfaced, finished lumber, recently closed after almost 75 years in operation.

-

SierraPine Composite: SierraPine Ltd. recently sold its medium-density fiberboard facility in Medford, Oregon to Roseburg Forest Products and Timber Products Co.

-

SP Fiber Technologies: WestRock Company recently announced the acquisition of SP Fiber, a purchase that will include the Newberg, Oregon mill that has been in operation for over 120 years.

Changing Markets, Revenues & Considerations

Over the course of the last few decades, a number of factors have converged that have had lasting effects on the timber industry in the PNW; many have directly led to the closures and consolidations noted above. The three primary challenges that the industry is currently facing as it adapts to changing markets and economic realities include:

-

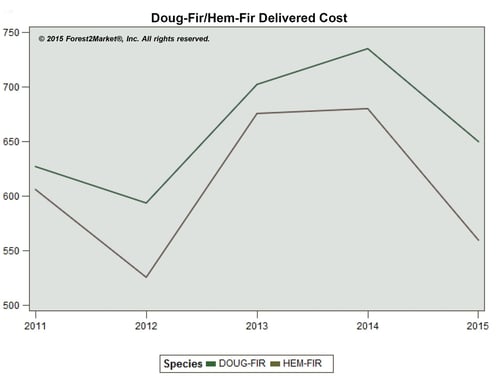

China: In recent years, China has been the primary force that has driven regional log production and pricing higher. As the Chinese economy has been in a decline since the beginning of the year, it has prompted many landowners and timber suppliers to local mills to alter planned harvest volumes. Since 1Q2015, many domestic buyers have taken advantage of what appeared to be a good deal by filling up their log inventories. But as China’s growth has slowed, the US dollar has continued to maintain its strong position, which has created a very difficult situation for log exporters in the PNW. As US export positions have quickly become compromised due to the strong dollar and reduced demand, the Chinese marketplace has been filled with cheaper logs from New Zealand and other Pacific Rim suppliers. Consequently, these dismal market conditions have resulted in many port operations being shuttered or curtailed as the industry waits for a spike in offshore demand. The recent move by China to bolster its economic growth by devaluing its currency will not help the situation in the PNW, as the trade deficit will only widen and the wait for overseas demand will become longer. In fact, the Forest2Market Benchmark for the PNW has seen pricing on DF logs go from a combined domestic and export weighted average of $687 to $579 over the last six months; a 16 percent decrease.

-

Reduced Timber Revenues: A reduction in domestic and export market volume (which has caused log prices to drop considerably) and the responsive decrease in harvest volumes have converged to create difficult conditions for regional timber companies; most are reporting reduced earnings. While timber harvests drive the majority of the revenue stream, land dispositions will become the next opportunity to generate cash, forcing many landowners to market their non-strategic timberland holdings. In the near term, we will likely see a wave of new acquisitions and dispositions as TIMOs and REITs attempt to realize budget goals with land sales.

-

Exchange Rates & Economic Realities:

-

Due to current exchange rates, Canadian producers have pricing advantages on both the North American and overseas markets, which severely limits PNW producers’ ability to remain competitive and profitable.

-

Housing starts have continued to be relatively flat and are forecasted to remain so for some time. Even a temporary domestic surge in lumber demand is unlikely over the next few months as severe weather continues to hamper regional building efforts: wildfires in the West and record heat and localized flooding in parts of the South.

-

The growing preference for kiln-dried Doug Fir over green DF lumber is an indication that the market is saturated and becoming more efficient as it adapts to weakened demand. High inventories of OSB and Southern Pine plywood have kept prices of structural panels on a slide since 2014.

-

Mill Consolidation = Industry Evolution

As Pacific Northwest mills and the forest products industry continue to consolidate, we can expect the implementation of new technology and best practices to benefit the resulting recovery. Savings will be realized through efficient and productive conversion facilities and streamlined supply chain strategies. With an accessible and reliable fiber supply, this value-added approach will position regional mills for success in the future. It will also help to create log resources with higher market values over the long term.

While the rate of change in the PNW seems alarming, there is also every reason to believe that the region’s industry is taking strategic steps to remain healthy and competitive and is simply adapting to changing markets to better position itself for the future.