3 min read

Super-Cycle Falters as Northwest Log Prices Soften in 1H2015

Gordon Culbertson

:

July 1, 2015

Gordon Culbertson

:

July 1, 2015

Mirroring what has become a worldwide trend, the Pacific Northwest forest products industry has not lived up to predictions for a 2015 “super-cycle”—a forecasted period of unprecedented growth in demand and prices for US lumber and logs resulting from high housing start projections (1.5 million annually), declining Canadian shipments and sizeable demand from China. Modest improvements have occurred in some peripheral markets. However, while western softwood lumber production is up slightly over 2014, Northwest log prices are well below what they were a year ago, largely because US housing starts are still relatively flat at an annualized rate of just over 1 million.

Beyond the tepid US housing starts data, a series of far-reaching events has coalesced to keep prices and demand in check:

- Weather: the US west recently experienced the mildest and driest winter in recent history, which has allowed for easy log flow and high inventories for mills already hamstrung with limited lumber sales.

- Exchange Rates and Imports: The strength of the US dollar has made exports less attractive and created a favorable environment for imports. Canadian lumber shipments to the US, for instance, are up; British Columbia lumber sales to US points increased 17% so far in 2015, effectively adding to the oversupply.

- China: The Chinese economy has been weaker and construction has slowed from recent levels; US companies are feeling the pinch.

Impacts in Western Export Markets and Beyond

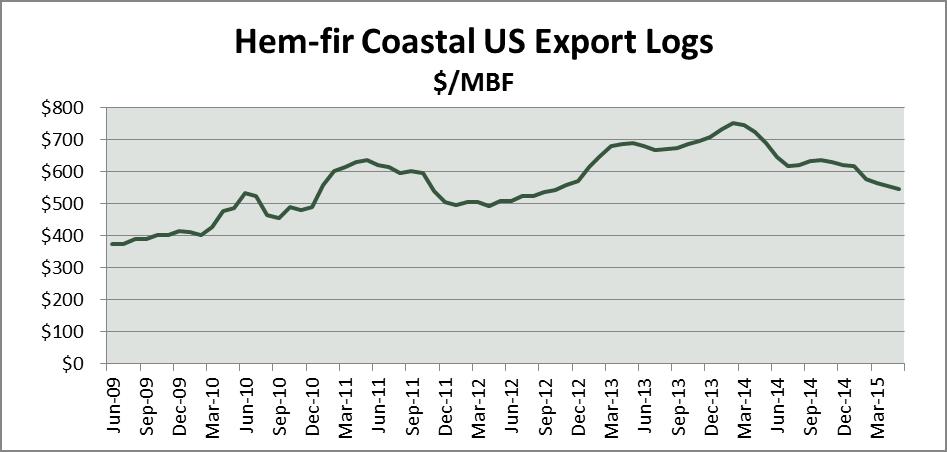

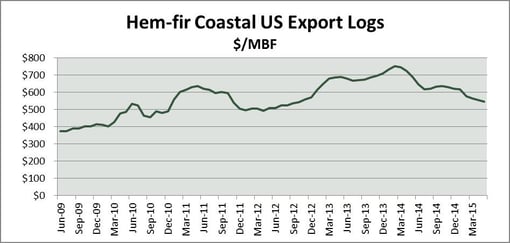

Chinese forest product imports from western US ports are down dramatically; lumber is off 50 percent and logs declined nearly 40 percent during first quarter of 2015 compared to a year ago. Forest2Market benchmarks demonstrate that prices for US coastal hem-fir logs destined for China were down by nearly 27 percent from the 2014 high, which occurred in February.

The ramifications of changes in demand have hit other countries supplying timber to China. New Zealand, for instance, which has become the largest volume exporter of logs to China over the past two years, saw log prices drop 11.7 percent from April to May 2015 to a three-year low, with year-to-date volumes 11.1 percent below the level they were for the same period in 2014.

The strong dollar is one reason that both export volumes and log prices in New Zealand have not dropped as significantly as those in the Western US. However, as western US log prices fall, the lower price may offset the costs associated with the US dollar, making US logs more attractive and strengthening US exporters’ competitive position.

Domestic Log Markets

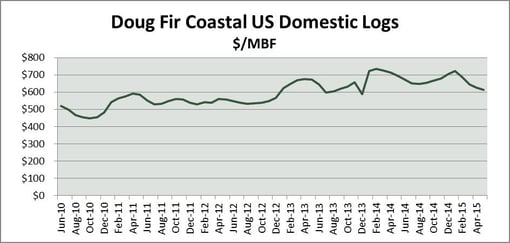

Slack demand and a combination of the factors highlighted above have also reduced current prices for sawmill-grade logs. For example, Douglas fir logs declined by more than 16 percent compared to the highs of early 2014, though they remain above export prices. A number of mills have slowed production and announced extended curtailments until margins improve.

Near-Term Outlook

While the beginning of 2015 has been disappointing for those expecting an uninterrupted super-cycle, signs of market improvements have begun to appear on the horizon.

- Weather: Hot summer weather can quickly diminish supply when forest fire restrictions, slowed logging operations and depleted mill inventories affect the market. Buyers are starting to question future wood availability as early summer temperatures soar; both lumber and log prices have recently turned and are moving up.

- Housing: US housing continues its month-to-month up/down pattern. While May’s housing starts data was disappointing on the heels of a banner April, the segment is still showing signs of growth and sales of existing homes continue to trend upwards. Housing should remain relatively stable at just over 1 million units throughout the rest of 2015.

- China: If we can rely on history to predict coming trends, it is almost time for Chinese importers to renew interest in US logs. Since the Chinese reentry into the US log market in 2009, surging prices have followed steep declines in pricing and shipments. Lower prices for US logs, declining inventories and improved optimism for building may increase the Chinese appetite for Northwest wood. In fact, New Zealand log prices ticked upward in June as a result of higher demand, a positive sign for western log exporters.

As we noted in our five-year forecast for western logs, the two most important market drivers are housing start activity and demand from China. As these indicators seem to be pointing in a positive direction, the western forest products industry may yet recover from this disappointing start to 2015.