3 min read

1Q2012 Containerboard Mill Activity – US South and Pacific Northwest

Suz-Anne Kinney

:

May 9, 2012

Suz-Anne Kinney

:

May 9, 2012

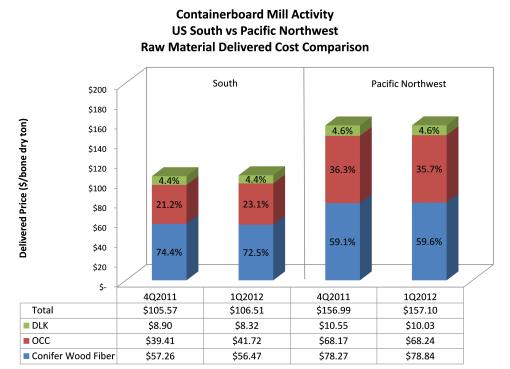

Containerboard mills in the US South and Pacific Northwest experienced increased raw material costs in 1Q2012. Figures 1 and 2 compare 1Q prices for conifer wood fiber, OCC and DLK with 4Q2011 prices.

Figure 1. Containerboard Mill Raw Material Costs – 4Q2011-1Q2012

Conifer wood fiber[1]costs in the two regions moved in opposite directions during the quarter. US South delivered prices were up 1.2% or $0.91 per bone dry ton (BDT) while Pacific Northwest prices were down $0.21 per BDT, a 0.2% decrease. US South wood fiber prices were 59% ($77.88) of the cost of the Pacific Northwest average of $132.20 per bone dry ton. (For a deeper look at why this happening, see Gordon Culbertson's report on Northwest chip prices.)

Seasonal weather patterns restricted wood fiber supply for southern mills; they consumed 1.9% less volume in 1Q2012. Pacific Northwest consumption volume was flat, increasing only 0.5%.

Delivered prices for old corrugated containers (OCC) moved in the opposite direction of virgin wood fiber. US South prices decreased $4.90 per ton, or 2.9%. To make up for supply constraints with wood fiber and to take advantage of declining recycled fiber prices, southern mills increased their consumption of OCC volume by 1.9%. In the Pacific Northwest[2], prices increased $2.71 per ton (1.6%) despite the fact that consumption volume fell by 0.6%. For 1Q2012, price differences between the regions expanded. In 4Q2011, southern delivered prices were 99% of the northwestern average of $169.18 per ton. For 1Q2012, southern delivered prices averaged $162.56 per ton or 95% of the Pacific Northwest average.

For double-lined, kraft corrugated cuttings (DLK), US South prices fell by $10.39 per ton (-5.7%). In the Pacific Northwest, prices decreased $10.57 per ton (-5.1%). Consumption volume was unchanged in both regions. US South DLK prices averaged $170.43 per ton and were 88% of the cost of the Pacific Northwest average of $194.71 per ton.

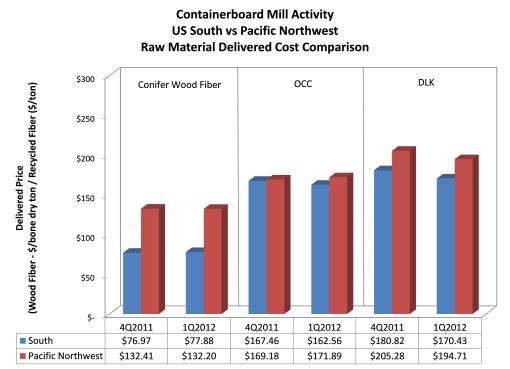

Forest2Market collects pricing data for wood fiber (through its Forest2Mill delivered raw material benchmark) and recovered fiber (through its Market2Mill recovered fiber benchmark). By combining these resources, we can take a more granular look at product mix; Figure 2 combines wood fiber and recycled fiber into a composite raw material cost.[3]

Figure 2. Containerboard Raw Material Product Mix – 4Q2011-1Q2012

In the US South, the product mix for 1Q2012 containerboard production was approximately 72.5% virgin wood fiber, 23.1% OCC fiber, and 4.4% DLK fiber.

The product mix for northwestern containerboard production was approximately 59.6% wood fiber, 35.7% OCC fiber, and 4.6% DLK fiber. From 4Q2011 to 1Q2012, northwestern mills moved 0.5% of their product mix to virgin wood fiber, 0.6% away from OCC fiber and none from DLK fiber (discrepancy from Figure 2 can be attributed to rounding error).

Based on the composite delivered price, southern mills experienced a $0.94 per BDT increase in raw material costs (0.9%) to average $106.51 per ton in 1Q2012. In the Pacific Northwest, the composite delivered price averaged $157.10 per ton in 1Q2012, an increase of $0.11 per ton (0.1%).

Overall, the cost of containerboard production in the US South was 67% of the cost of Pacific Northwest production.

[1]Conifer wood fiber for the US South includes pine pulpwood in chip equivalent volume combined with pine chipmill, in-woods, and residual chip volume – i.e. all pine wood fiber volume. For the Pacific Northwest this includes all chipped pulpwood, chipmill, in-woods and residual chip volume for Doug Fir, Hemlock, True Fir and pine species.

Comments

The West Is Still the High Cost Region for Wood Fi

05-30-2012

[...] During much of 2010, chip prices rose dramatically as demand from increased pulp and paper production aggravated chip supply anxiety in the western region. Traditionally, sawmill residuals have been the lowest cost source of western wood chips. Declining sawmill production settled to very low levels in 2009, forcing western pulp mills to rely on costly whole log chips for as much as 50 percent of their furnish. For a deeper look at the numbers, see Daniel Stuber’s containerboard activity report. [...]

Comments

The West Is Still the High Cost Region for Wood Fi

05-30-2012

[...] During much of 2010, chip prices rose dramatically as demand from increased pulp and paper production aggravated chip supply anxiety in the western region. Traditionally, sawmill residuals have been the lowest cost source of western wood chips. Declining sawmill production settled to very low levels in 2009, forcing western pulp mills to rely on costly whole log chips for as much as 50 percent of their furnish. For a deeper look at the numbers, see Daniel Stuber’s containerboard activity report. [...]

Comments

Western wood chip prices are declining rapidly in

06-05-2012

[...] During much of 2010, chip prices rose dramatically as demand from increased pulp and paper production aggravated chip supply anxiety in the western region. Traditionally, sawmill residuals have been the lowest cost source of western wood chips. Declining sawmill production settled to very low levels in 2009, forcing western pulp mills to rely on costly whole log chips for as much as 50 percent of their furnish. For a deeper look at the numbers, see Daniel Stuber’s containerboard activity report. [...]

Comments

08-27-2012

how many containerboard mills are there in southern california today?