4 min read

Analysis of a Natural Disaster: Hurricane Michael’s Lasting Impacts on Florida's Timber Inventory

Jay Engle : February 13, 2019

After attaining peak winds of 155 mph as a category 4 storm, Hurricane Michael approached the Florida Panhandle and made landfall near Mexico Beach, Florida on October 10, 2018. The storm moved inland and quickly weakened to a tropical storm over Georgia, but not before it claimed over 60 lives and caused nearly $15 billion in damage—over $5 billion in agriculture and timber losses alone.

According to data from the National Oceanic and Atmospheric Administration (NOAA), over 3.5 million acres of timberland were directly affected from Hurricane Michael. About half of these acres were impacted severely or catastrophically, meaning there was a 75% (severe damage) to 95% (catastrophic damage) total timber loss in these areas. The remaining acres were damaged moderately, sustaining a roughly 15% total damage.

In the wake of a natural disaster like Hurricane Michael, it is beneficial for forest industry participants operating in the affected area to analyze the total timberland damage, which will impact the entire supply chain for years to come. Landowners must assess current standing inventory and timber losses, harvesting crews and wood dealers must immediately begin scheduling and marketing salvage harvests, and mill facilities must be prepared to redefine their procurement zones based on the level of damage in their respective “backyards.”

Local Damage Analysis

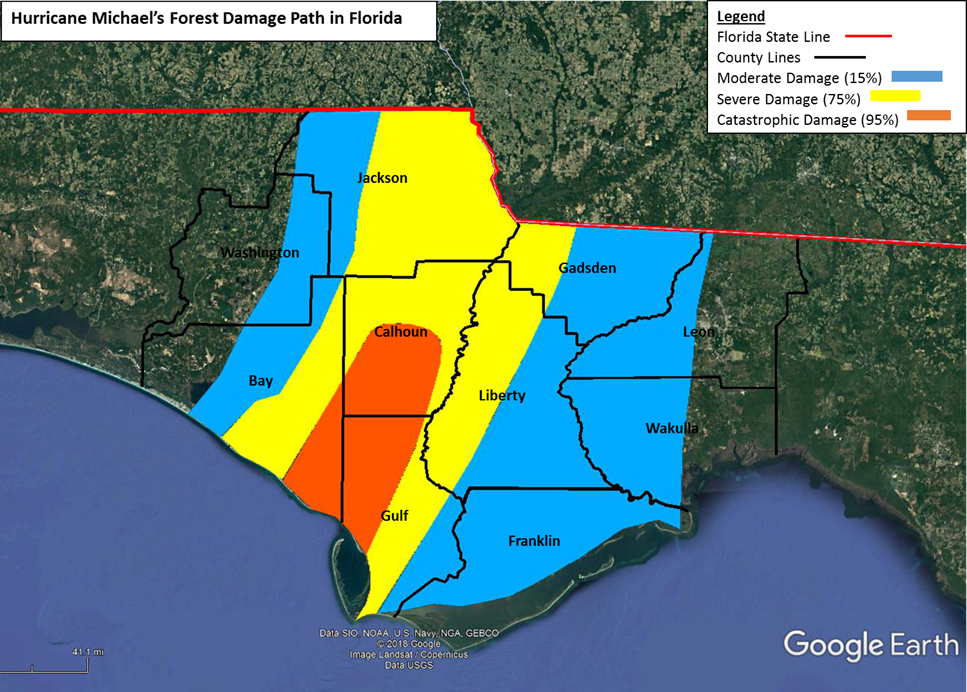

The colored study area in the map below shows the three damage categories in the panhandle of Florida where Hurricane Michael made landfall. We used Forest2Market’s Timber Supply Analysis 360 (TSA360) to derive the area of timberland in each affected county, and then used that information to calculate the timberland area as a percentage of the total county land area.

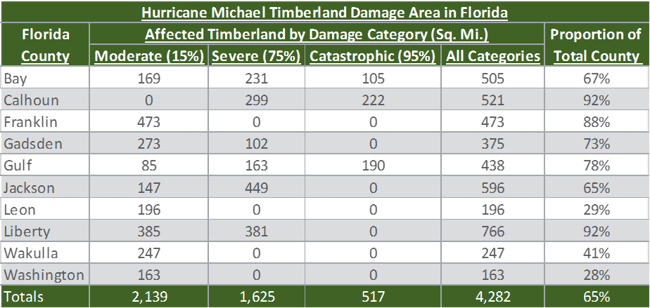

The area of the ten affected counties was derived from the map and the percentage of timberland was then applied as shown in the table below. (The underlying assumption was that timberland was evenly distributed across each county, which is likely not 100% accurate.)

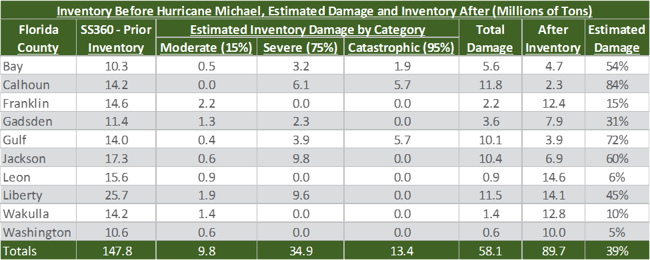

As evidenced above, the damage impact from Michael in these counties was enormous: nearly 4,300 square miles, or over 2.7 million acres. Translating this data to actual timberland damage yields equally shocking figures. Using TSA360 to estimate the damage by category, the table below illustrates the percentage of impacted timberland in each county, as well as the pre-hurricane timberland inventory.

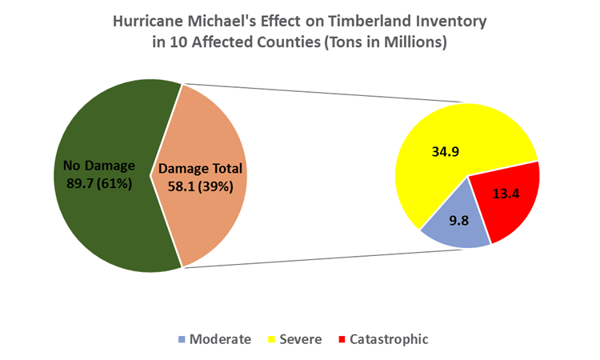

Timberland inventory damage at the county level ranged from a high of 84% in Calhoun County to a low of 5% in Washington County. Overall, 39% of the timberland inventory in the total study area was damaged.

Supply Chain Implications

This analysis shows that Hurricane Michael had a devastating impact—with both short- and long-term consequences—on the total timberland inventory in the 10-county study area. How do we then use this data to examine this impact on annual removals and future fiber supply?

Overall, the damaged timber inventory in the study area represents about a 12-year equivalent of current annual removals and over a 15-year equivalent in the more significantly damaged categories (severe and catastrophic). The implications for each of these categories will vary.

- The timberland acres in the catastrophic category will need to be salvaged, cleaned up and replanted, and these areas will produce very little timber volume for quite some time.

- The severely damaged areas will also need cleanup and re-establishment, and there will likely be some usable material to be removed following salvage efforts.

- The moderately damaged timberland acres will still have significant amounts of merchantable fiber. These areas will need to be evaluated on a tract by tract basis and some will be carried forward while others might be slated for early harvest depending on the total damage.

What will this mean for wood products companies and landowners that operate in the affected counties?

- Near term: Landowners must assess damage on a tract by tract basis and begin clean-up efforts and salvage harvests. Some of the damaged timber will be difficult to harvest (which will increase costs), however the regional fiber supply will increase and drive prices down. It’s imperative that landowners act quickly to maximize their forest investments; unsalvaged, damaged timber begins to decay relatively quickly, particularly in the hot and humid Florida climate. Landowners are forced to deal with a double whammy in this case: they must shoulder the financial burdens associated with cleanup, replanting, etc. while at the same time expecting lower stumpage prices for the near future based on the surplus of timber on the regional market.

- Mid term: Heavily impacted areas will need significant reforestation activity over the next five to ten years, producing large areas of young stands. Landowners will be responsible for managing these activities and bearing any associated costs. Given typical pine growth rates, it will be at least 15 years before these stands will be ready for their first thinning, which means these tracts of timber will not be commercially viable for some time.

Wood products companies must begin making supply chain and procurement zone adjustments now in order secure affordable fiber in the coming years. Depending on where a particular facility is located, the entire wood supply may be interrupted; companies in Calhoun county, for example, which lost 84% of its timberland inventory, will be forced to drastically expand their procurement zones. This will add significant procurement costs as affected organizations reach further and further for timber, and increased market competition that will drive prices higher.

- Long term: Heavily impacted areas will experience first thinnings in 15-20 years, thereby increasing the available regional supply of merchantable pulpwood. However, the impact of the initial loss of inventory combined with intensive harvesting in moderately damaged or undamaged acres will result in increased removals on those acres, an age/class imbalance in the timber supply and intensified competition for available timber. This will result in some localized strain on supply that will drive prices higher—and affect the current oversupply of sawlogs—for years and until the replanted timber reaches a mature state.

As evidenced above, the timberland inventory and the available timber supply in a region that is devastated by a natural disaster will face a number of near- and long-term impacts. There will be both immediate and prolonged shifts in procurement and harvesting activities, which will create increased price volatility that will likely last for years. Evaluations like this can be helpful in understanding the broader implications of one-off events or natural disasters that dramatically affect timberland inventory, and aid in formulating plans to address future fiber supply issues.

While this analysis was performed on a total damage basis, using Forest2Market’s tools available in SilvaStat360 and the TSA360 platform will help you forecast the impact of such an event in your wood basin and on your specific supply chain.