2 min read

Australia’s Declining Softwood Chip Exports: A ‘Canary in the Mine’ Moment

Tim Woods

:

August 6, 2019

Tim Woods

:

August 6, 2019

The latest softwood chip export data from Australia demonstrates that the resource is under significant pressure, and there are some other takeaways from the sector as well.

If there is a grade of paper or paperboard in which Australia has real global muscle, it is virgin Kraftliner, manufactured from the residues derived from the individual forests that comprise Australia’s softwood plantation estate. The simple story is that the nation’s softwood plantations (mainly Pinus Radiata) provided sufficient woodchips – in addition to saw and peeler logs – that became the feedstock for production of strong virgin liners for corrugated boxes.

Two large integrated kraft pulp mills produce Kraftliner from this resource. In addition to supplying local markets, Visy’s Tumut and Australian Paper’s Maryvale mills both engage in export of Kraftliner. Without exceeding capacity, everything the Australian mills can produce would easily be purchased on the global market.

Population growth in Australia (among other factors) has increased demand for sawn timber and for packaging. That is also a global story.

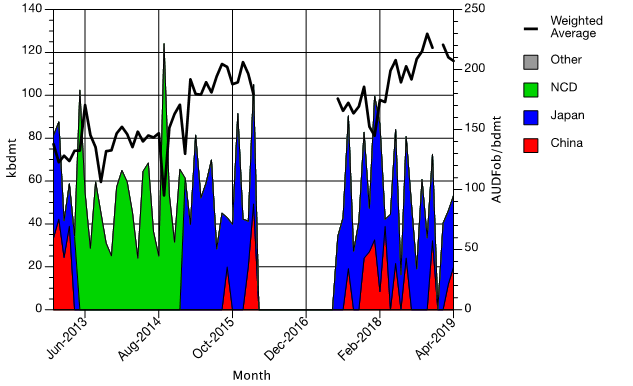

As the first chart shows, Australia’s softwood chip exports are on a slide. At an annualized 583.3 kbdmt (bone dried metric tons), the April 2019 exports are not insignificant, but they are more than 14% lower than the prior year. At an average FOB price of AUD $207.18/bdmt in April, export prices are good, although less so for sellers denominating their transactions in US dollars.

Australian Softwood Chip Exports by Country: Dec ’12 – Apr ‘19 (kbdmt & FOB AUD/bdmt)

Source: ABS and IndustryEdge research

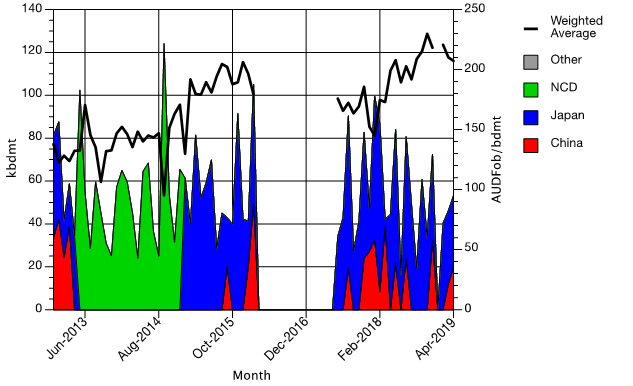

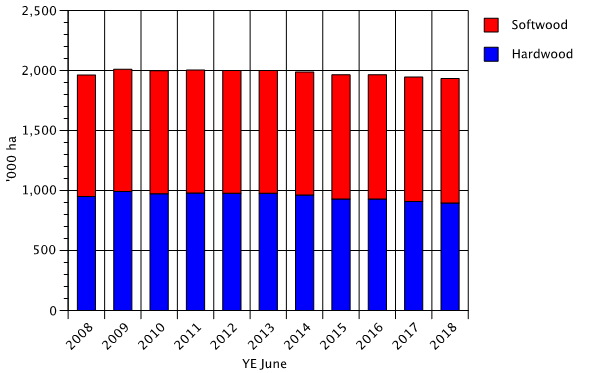

The headline export data might well be the canary in the mine on available softwood chip resources. In Australia, the softwood plantation estate land area has been static for twenty years at around one million hectares, and the second chart shows the details. There are substantial efforts underway to increase that estate, but any new plantations are literally decades from yielding more wood.

Australia’s Plantation Estate by Species: 2008 - 2018 (Hectares)

Source: ABARES

Growing the Australian Plantation Estate

The Australian forestry and wood products industry has called repeatedly for an increase in the national plantation estate. In 2018, that development worked its way through the ‘lobby train’ and plantation growth was included in the Federal Government’s National Forest Industry Plan 2018. The ‘billion trees’ initiative is yet to be given its full flourish, but that is underway.

At the May Federal election, the now re-elected Morrison Government announced the establishment of an AUD $500 million concessional loan arrangement to be managed by the Regional Investment Corporation. By its own assessment, the Government considers that may support 150,000 hectares of new plantations, with the target intended to be “…support for the purchase of the land (the largest cost).”

Future for Softwood Chip Exports

While the nation waits for its plantation base to grow, IndustryEdge’s expectation is that softwood chip exports will contract as the domestic demand pressures for softwood fiber grow. To be clear, there is not enough resource in Australia—let alone in a specific wood basket—to support a new softwood kraft pulp mill. It is doubtful there is sufficient resource to support investment in a net expansion.

So, over time, as local demand increases, exports of Kraftliner will inevitably decline. We observe this is already occurring. In the short-term, it will create few issues but over the longer term—once the exports are repatriated—how will additional supply be secured? If grown for saw logs, new softwood plantation resources will take around thirty years to mature and will provide no significant additional supply for at least a decade after they are planted.

The implication is significant for countries like Australia and New Zealand that are almost entirely self-sufficient for their fiber packaging needs. They will need new sources of fiber long before any new plantations come online.

Softwood chip exports are singing like a canary right now.

Tim Woods is Managing Director of IndustryEdge Pty Ltd, which provides data analysis, business intelligence, reporting and consulting for the forestry and paper industries in Australia and New Zealand.