4 min read

Can the Lake States Capitalize on Surge in NA Forest Industry Investment?

Pete Coutu

:

April 25, 2018

Pete Coutu

:

April 25, 2018

Despite the recent market volatility, economic optimism is higher than it’s been in over a decade and the forest products industry is well-positioned to grow as a result. GDP growth is positive, lumber prices are at all-time highs in many areas, OSB and panel facilities are running at high capacities, the housing and remodeling markets continue at a steady-to-increasing pace and, after some consolidation and restructuring to meet a changing market, the pulp and paper industry remains active.

As a result of this optimism, we are currently witnessing a significant amount of capital investment in the forest industry as it experiences a resurgence of sorts, and the lion’s share of this new activity is concentrated in the US South. Due to its dense stands of fast-growing pine timber and competitive costs of doing business, this region is the timber resource capital of the world at the moment. Much of the investment is focused on new and/or expanding sawmills, and this growth comes on the heels of 10+ years of investment in the pellet industry boom and its expansion into the South.

With all of this added investment and optimism, why aren’t other areas of the country—areas with traditionally strong forest products industries—experiencing the same kind of growth as the US South?

Forest2Market segments the North American forest products industry into three broad and distinct regions: US South, Western North America and Eastern North America (which includes the Lake States and Northeast sub-regions). We also drill down further into the micromarket level; the Lake States sub-region includes Michigan, Wisconsin and Minnesota.

While these three states have ample access to high-quality timber, the recent surge in forest industry growth has not made its way to the region. What’s limiting investment in the Lake States?

By examining the regional data in Forest2Market’s online business intelligence platform SilvaStat360, we can identify several potential issues:

- The growth-to-removal ratio (GRR) in the Lake States region is high.

As an indicator of the trajectory of available supply over time, the growth-to-removal ratio of a supply basin quantifies forest sustainability and when analyzed over a time range, can show whether forest sustainability is increasing or decreasing. A value of 1.0 suggests growth and removals are in balance; a value greater than 1.0 indicates that forest inventory growth is outpacing removals (greater sustainability), and a value lower than 1.0 means removals are outpacing growth (lower sustainability).

While GRR tends to be cyclical over time, current GRR in the Lake States region is 2.05, indicating that there is an extreme surplus of available timber growing on the stump. For the sake of comparison, GRR in the US South is 1.69; still on the high side of being balanced, but significantly lower than the Lake States. Inventory and removals in the Lake States represent about 20% of the US South’s.

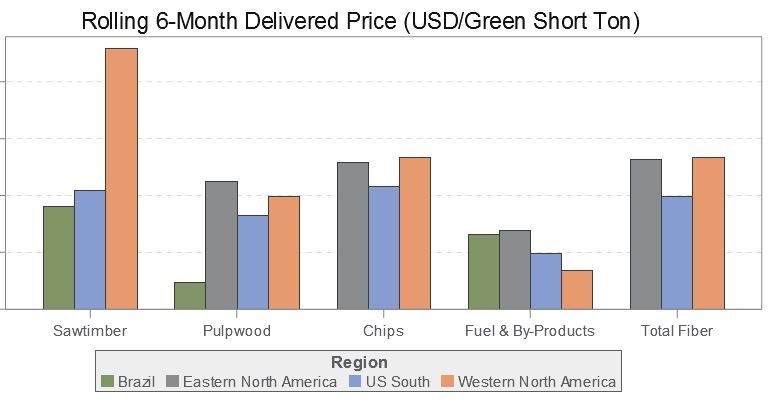

- Total fiber price in the Lake States is over 30% higher than in the US South.

Supply chain cost is influenced by a variety of factors. Higher costs in the Lake States can be traced back to uneven-aged timber management practices necessary to regenerate many of the species that grow there. Another major factor is the extreme seasonality of wood deliveries and transport in the region, which adds cost to wood raw materials. Variable harvesting windows and weather patterns cause mill facilities to increase inventory and, by extension, inventory holding costs.

- The Lake States has some softwood resource but is primarily a hardwood region.

Nearly 80 percent of the timber resource in the Lake States is comprised of hardwood fiber. While this is indeed a high-quality resource for the regional mills that utilize it—primarily pulp and paper manufacturers—it is a resource with limitations. Most new industry investment has focused on products developed around the use of softwood fiber, hence the growth throughout the US South.

Despite these challenges (and the fact that the region is competing for investment capital with a booming US South), the Lake States forest industry has a number of options to capitalize on this wave of economic optimism.

- Focus on the fundamentals.

With access to some of the highest-quality hardwood fiber in North America, the Lake States must take advantage of its native resources and focus on developing productive, profitable market solutions. With some of the highest supply chain costs in North America—partially due to long freight distances—focusing too heavily on larger mill facilities with large procurement zones is not an ideal solution. Rather, improving the supply chain efficiencies of smaller mills will help to limit hauling costs and increase profitability. While Forest2Market can help improve supply chain efficiency for any sized mill, encouraging the development of smaller mills limits the exposure to freight disadvantages.

- Maximize the value of your greatest resource: Hardwood.

The current investment in softwood resources in the US South is driven by a model of maximizing volume to some degree; pine plantations provide a fast-growing resource for mills throughout the region. The Lake States region simply can’t compete with this model, nor should it try. While the demand for housing has led to a surge in southern yellow pine lumber production, new home construction also requires a number of other wood products—many of which are ideally suited to the hardwood resources in the Lake States. Cabinets, veneer, and other specialty products are in demand and should be the focus.

- Find new markets for your greatest resource.

The low cost of natural gas has hurt demand for woody biomass, and this situation is unlikely to change in the near future. However, the hardwood and aspen resources in the Lake States make for excellent wooden pallet material for manufacturers seeking smaller, lower-grade wood. The trend towards ecommerce has resulted in a booming freight/transportation/logistics industry, and increasing globalization has created steady demand for freight resources like pallets and other shipping materials.

Another potential market is cross-laminated timber (CLT) which is starting to gain global popularity. In fact, LignaTerra and SmartLam both recently announced new CLT projects in Maine that will be operational within the next year. While these two projects will focus on manufacturing with softwood resources, hardwood projects are starting to develop as well.

Outlook

Capital is actively flowing into the wood products industry faster than it has in decades. There are significant sustainable timber resources across North America that will provide the necessary raw material for this expanding industry, including the Lake States. The key to attracting new industry growth in the Lake States will be to focus on developing facilities that benefit from the timber resource unique to each area. Hardwood may be the predominant regional resource, but it’s not the only resource. For example, there are pockets of high-quality Aspen and softwood throughout much of Wisconsin and the lower peninsula of Michigan.

New opportunities will involve fresh thinking and shrewd supply chain management, and now is the time for the region to capitalize on the industry growth and a development strategy that will support Lake States forestry through the coming decades.