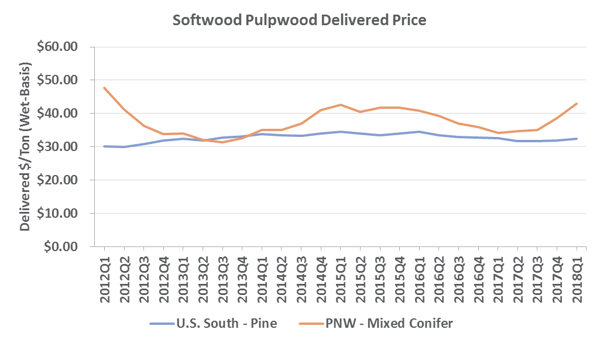

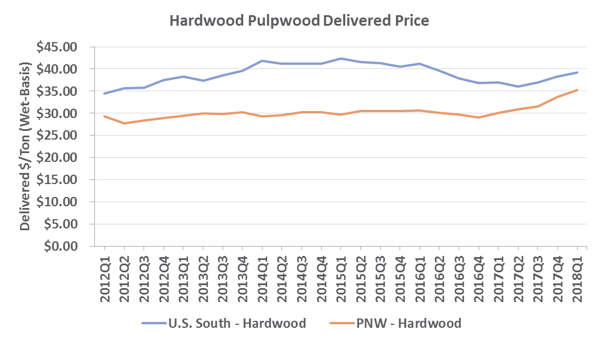

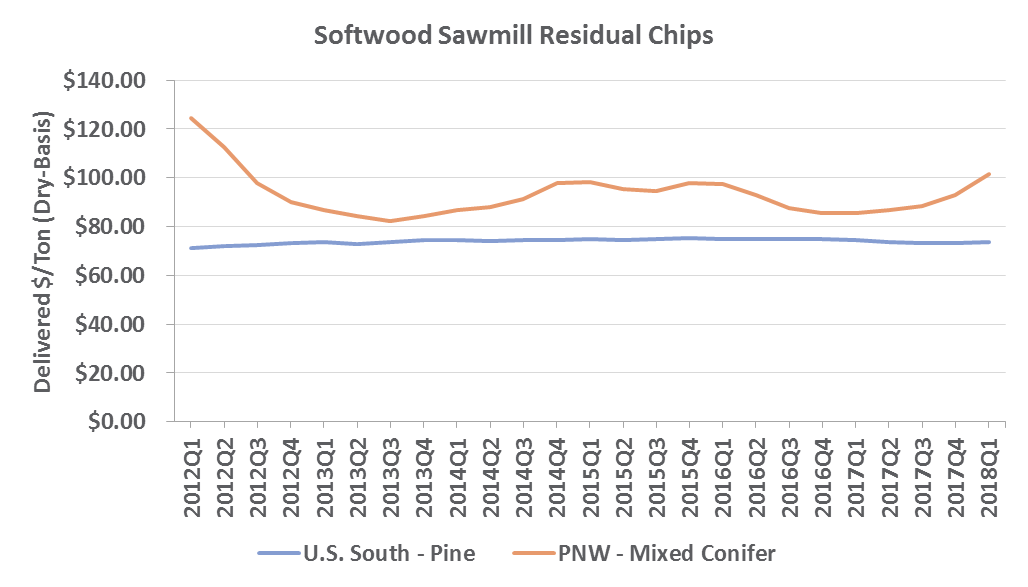

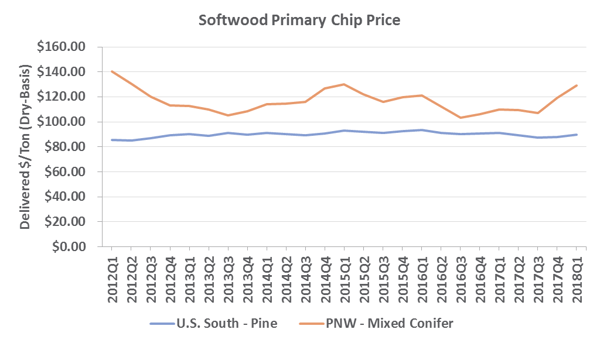

Over the past six years, chip and pulpwood prices in the Pacific Northwest (PNW) have demonstrated significant levels of volatility when compared to the relatively flat performance in the US South. Most notably, prices for these products have surged in the last year amid increased demand for virtually all timber products in the resource-constrained PNW.

Primary & Residual Chips

Softwood primary and sawmill residual chip costs remain markedly higher in the PNW than in the US South. As we recently noted, timber supplies are stressed in the region due to lack of management and harvesting on federal lands, increased domestic and export demand, and damaged/dying stands of timber caused by fire and pest destruction.

Several factors are contributing to higher chip costs in the PNW.

- The strong market for sawlogs and improvements in sawmill recovery has resulted in robust demand for smaller-diameter sawlogs (chip-n-saw) that would typically be delivered as pulpwood to chipmills. Some chipmills have struggled to maintain adequate pulpwood inventory to meet consuming mills’ needs, resulting in more demand for residual chips. Primary chip prices have increased as a result, as chip mills compete with sawmills for chip&saw logs.

- Recent increases in chip exports to overseas markets have put more pressure on domestic markets.

- Fiber shortages in BC have led to southern BC pulpmills increasing activity in the PNW market for chips and pulp logs.

- Recent chip consumption capacity announcements in the region will create additional competition for the existing chip supply.

Although the PNW has a vibrant solid wood industry, the US South currently has more active mills producing larger volumes of lumber, and capacity increases and greenfield mill projects are being added every quarter. This steady supply of sawmill chips has kept prices lower in the south, where softwood sawtimber and pulpwood prices have also remained low.

Outlook

As we continue through the summer months, when lumber production is typically strong, increased residual chip deliveries are expected and chip markets will remain dynamic. This will help ease some of the tension between fiber supply and the high demand for wood raw materials in the PNW market. Based on its abundant fiber supply and sawmill activity, the US South will not see much price volatility in the near term.

Softwood & Hardwood Pulpwood

The increase in chip and pulpwood prices is not surprising given the tremendous demand in the PNW; prices for these products have simply mirrored the escalating price of logs. Western log prices reached their highest sustained levels in recent months—domestic Douglas fir prices have averaged $880/MBF since the beginning of 2018. As a result, some increase in harvest activity has followed. This additional volume has contributed to pulp log supply, but delivered prices have not come down in response.

Softwood pulpwood prices have remained relatively flat in the US South over the last six years, where they experience minimal seasonality effects. However, hardwood pulpwood prices have trended upward in both regions over the course of the last year. Demand has increased and access to this resource can be limited, so a jump in volatility is not surprising.

Outlook

In the PNW, pulpwood prices will likely continue to increase incrementally as supply remains tight. Fiber consumption and the wood markets that drive it are very strong throughout the US South, which should create steady demand for pulpwood. As a result, softwood pulpwood prices will be flat and hardwood pulpwood prices will continue to increase incrementally in the near term. Pulpwood consuming mills in both regions would do well to closely monitor and analyze fiber and log costs through SilvaStat360 to uncover opportunities for managing costs.