3 min read

Declining Electricity Prices in the Northeast Hinder Biomass Market

Eric Kingsley

:

August 10, 2016

In 2015, New Hampshire set a record for biomass use: 2.6 million tons of low-grade wood was converted to electricity. In 2014, biomass accounted for roughly 22 percent of Maine’s total harvest volume. Depending on local markets, biomass represents between 20-30 percent of the harvest volume in the Northeast, which equates to a significant amount of electricity produced from renewable resources grown in local forests.

Biomass power plants are key outlets for low-grade wood, yet many are economically challenged in the region; some have closed altogether, while others hang on by a thread. Biomass electricity—generated either for the larger power grid or for internal use by forest industries—competes economically against other fuels. But with falling prices for natural gas (the most common generation fuel in the Northeast) and limited growth in the electricity market, biomass has struggled to remain competitive as a fuel source.

Biomass electric facilities produce two core products: 1) electricity, which competes directly with every other energy source on the grid, and 2) Renewable Energy Certificates (RECs), which allow a buyer (often a utility company) to claim the purchase of renewable or “green” energy for accountability purposes. Most states in the Northeast now have Renewable Portfolio Standards in place requiring that a percentage of qualified renewable energy be part of the overall electricity mix.

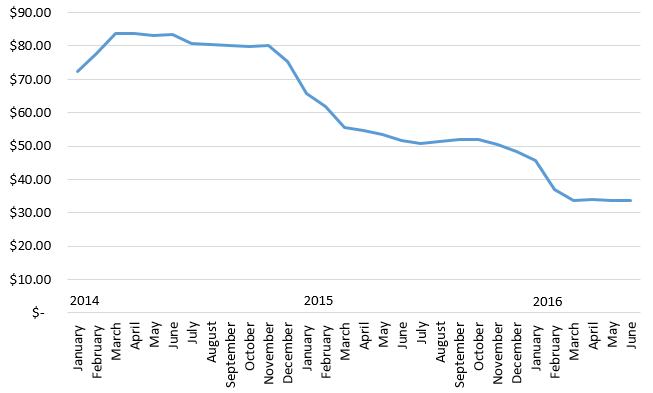

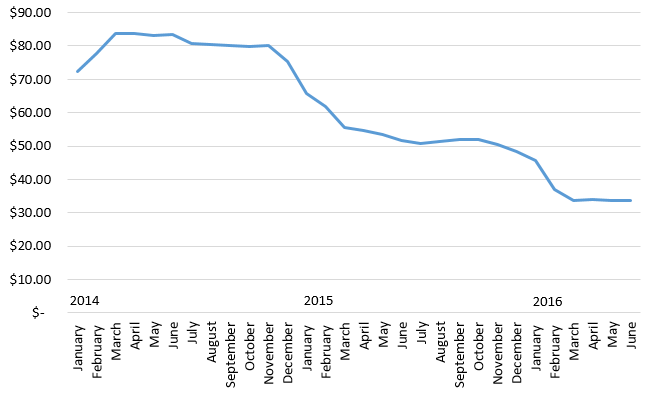

The sale price for both electricity and RECs are important to the operation of biomass facilities, and both are challenged in the current regional market. The table below shows the average on-peak wholesale electricity price in ISO-New England for the trailing twelve months (to eliminate seasonal swings in pricing). The trailing 12-month price has dropped from over $80 per megawatt hour (MWH) in the winter of 2014 to $33/MWH for the most recent months.

Average ISO New England On-Peak Electricity Price ($/MWH), Trailing 12 Months

Source: Innovative Natural Resource Solutions LLC

Source: Innovative Natural Resource Solutions LLC

Earlier this year, two Maine biomass generation facilities owned by Covanta Energy closed permanently. The falling price of electricity certainly didn’t help Covanta’s situation, but the two 25 MW plants—which each used about 300,000 tons of wood fuel annually—lost their ability to sell RECs into the Massachusetts market. Massachusetts utilities typically purchase RECS from all over New England, including wind, solar and, until recently, biomass. However, 2016 ushered in a new requirement that mandated biomass plants receiving state RECs achieve efficiency levels that are simply not possible for standalone units to attain using commercial technologies. (These requirements can be reached in unique cases, at some combined heat and power facilities, for instance). Given the regulatory change and subsequent disqualification from Massachusetts REC funding, Maine lost two important biomass markets.

Many of the other biomass facilities in the Northeast participate in regional REC markets, most importantly in Connecticut; biomass electric plants in Maine, New Hampshire, Vermont, Massachusetts and Connecticut all sell RECs in Connecticut. While the state is currently reviewing its REC market qualifications for biomass, any changes that limit or exclude biomass could send shockwaves through New England’s wood markets. Almost all of the operational biomass electric plants in the region rely upon Connecticut RECs to remain profitable.

According to information developed by the Professional Logging Contractors of Maine (PLC), when fully operational, Maine’s six biomass electric plants support 900 jobs (from the plant to the stump and beyond) and spend $115 million annually. Recognizing that the biomass industry is also an important part of the region’s forest industry, and acknowledging the challenging economic situation faced by biomass generators, Maine’s legislature recently passed a bill dedicating over $13 million to provide stop-gap funding for the above-market costs at some biomass generation facilities. The same legislation established a task force to evaluate ways to support the biomass industry in Maine in the long term.

As Maine continues to fund and explore the future operation of its biomass plants, other states in the Northeast face the same set of challenges. Standalone biomass plants are an important market for low-grade wood, and in many cases have become the only real market for some types of sawmill residues. In the forest industry—where unique markets exist for nearly every product and manufacturing process by-product—biomass markets are important for landowners, loggers and mills. These industry participants also need market-driven economic incentives to remain financially viable, which are becoming more elusive.

Absent significant changes in regional energy generation, maintaining the biomass electric market in the Northeast will require new thinking and innovation. Maine’s legislature is taking proactive steps to address some of the challenges for the sake of its forest products industry; we will have to wait and see whether other states in the Northeast follow suit for the sake of their own forest industries.