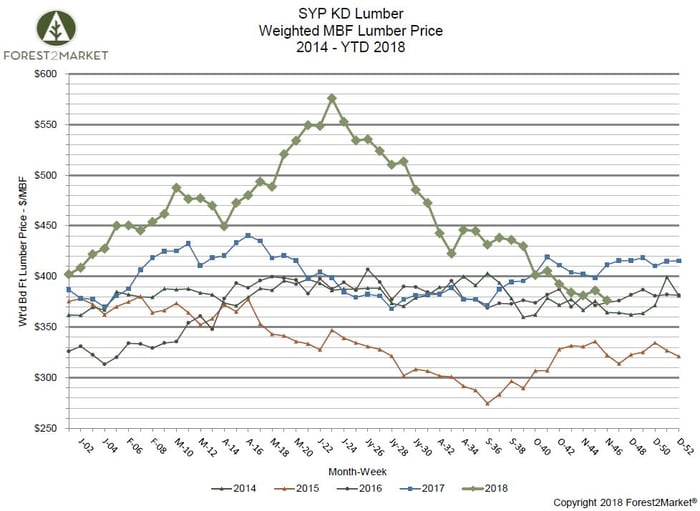

Southern yellow pine (SYP) lumber prices recently dropped to their lowest point of the year in week 46. Forest2Market’s composite southern yellow pine lumber price for the week ending November 16 (week 46) was $376/MBF, a 2.6% decrease from the previous week’s price of $386/MBF and an 8.5% decrease from the same week in 2017.

A closer look at some of the prices we have seen since the beginning of the year:

- 1Q2018 Average Price: $449/MBF

- 2Q2018 Average Price: $523/MBF

- 3Q2018 Average Price: $486/MBF

- YTD Average Price: $463/MBF

Log Supply vs. Lumber Price

SYP lumber prices have continued to plummet despite the potential for log supply disruptions in the wake of two major hurricanes that decimated portions of the US South. In fact, log supply has remained stable in some of the areas hardest hit by the hurricanes due to salvage harvests. As reported by state agencies, damage includes:

- Hurricane Florence caused over $70 million in significant damage to forest and timberland in North Carolina through wind and flooding.

- Over $1.3 billion in timber was lost in the Florida panhandle due to Hurricane Michael. Florida Agriculture Commissioner Adam Putnam said that along with the timber losses, pulp mills, sawmills and other production facilities were damaged in 11 of the top timber-producing counties in state.

- The Georgia Forestry Commission says that more than $762 million worth of timber was lost in Georgia because of Hurricane Michael.

- The Alabama Forestry Commission estimates a loss of $20 million in timber in Houston County due to Hurricane Michael.

Hurricane Michael left catastrophic timber damage in its wake near Blountstown, FL. Photo courtesy of the Florida Forest Service

Week 46 in 2017 marked a turning point for SYP lumber prices: a steady increasing trend that lasted through 1Q2018 before prices skyrocketed to historical highs in 2Q2018. As housing starts continue to disappoint and we put week 46 of 2018 behind us, it’s clear that supplies of SYP logs are sufficient to keep up with demand for finished lumber in the near term. With high log prices and a shortage of available fiber in the timber-constrained Pacific Northwest (PNW), a few market dynamics in the US South are worth watching: A significant increase in SYP exports and expanding sawmill capacity coupled with billions of dollars in regional timber losses. Will these developments apply enough pressure to move the log price needle higher in 2019?