1 min read

Forestry-Related Industry Performance At a Glance: August 2009

Suz-Anne Kinney

:

November 2, 2009

Suz-Anne Kinney

:

November 2, 2009

How did the forest products industries fare in August?

Forest products manufacturing broke off its previous months’ advances in August, retreating by 0.8 percent in the case of Wood Products and 0.2 percent for Paper.

Despite the broad-scale improvement, capacity utilization among Wood Products manufacturers fell 0.5 percent between July and August (21.2 percent below the year-earlier level), while Paper manufacturers remained unchanged from July to August (but 11.2 percent below a year earlier).

Shipments from Wood manufacturers were essentially unchanged (at -0.03 percent), while Paper shipments dropped 0.5 percent. Shipments for Wood Products and Paper are down 7.6 and 13.7 percent, respectively, on a year-over-year basis.

Wood Products inventories followed suit, dropping by 0.6 percent; Paper bucked the trend, expanding by 0.6 percent. The annual fall-off in the value of inventories stands at 11.5 (total manufacturing), 9.2 (Wood Products) and 10.7 percent (Paper).

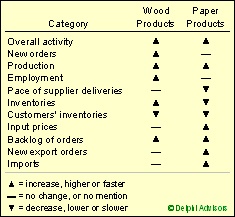

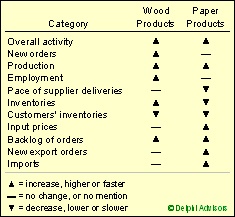

For the first time in what seems like forever, Wood Products firms finally reported what could be construed as good news in September (Table 1). That sector led the list of industries reporting overall growth (Paper Products was second) and growth in production; it ranked second in employment growth. About the only negative aspect for Wood Products was that the industry led the list with regards to growth in inventories. Domestic paper manufacturers are undoubtedly happy to see export orders continuing to expand, but that emotion will likely be tempered by the observation that their industry topped the list with respect to growth in imports.

Performance Overview of Wood and Paper Products

Source: Institute for Supply Management, September 2009

Exports of wood pulp, paper and paperboard dropped by 5.4 percent between June and July, while imports increased 6.4 percent. Whereas pulp sector exports exceeded year-earlier levels in June, July’s exports were 6.8 percent lower than in July 2008. Lumber exports were virtually unchanged between June and July, but imports declined by roughly 5.6 percent. Exports in July were 20.7 percent below July 2008 levels, while imports were off 31.6 percent. Based upon the most recent ISM manufacturing report and U.S. dollar weakness (p. 10), we expect to see exports of both paper and lumber pick up in the near term while imports either stagnate or continue declining.

Read more about the Forest2Market Economic Outlook.