2 min read

Forestry-related Industry Performance At a Glance: February 2010

Suz-Anne Kinney

:

March 1, 2010

Suz-Anne Kinney

:

March 1, 2010

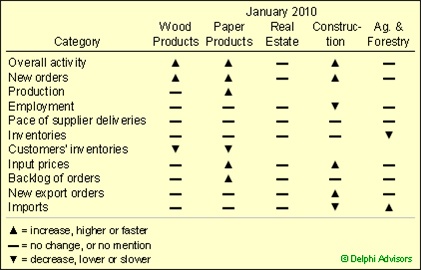

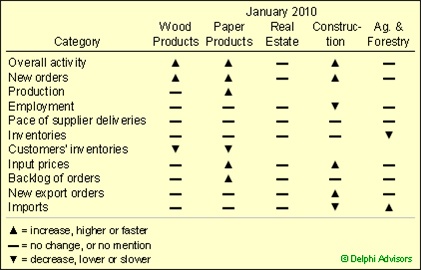

Both the Wood and Paper Products industries indicated a pick-up in overall activity during January, although details were rather sketchy (see table). Particularly important were rising new orders and falling customers’ inventories.

Performance overview for Forest-Related Industries during January 2010.

Data source: Institute for Supply Management

Of the service industries that have a relationship to the forest products industry, only construction posted a gain in overall activity. Real Estate was not mentioned at all in the ISM’s service sector report, which implies that the industry was essentially unchanged in January. One Agriculture, Forestry, Fishing and Hunting respondent indicated, “business is better, but not robust.”

Net exports of U.S.-made pulp, paper and paperboard rose slightly in November. They were also higher relative to November 2008, as well as year-to-date through November when compared to the same period in 2008.

Lumber exports from the United States retreated slightly in November (by five million board feet, or 4.9 percent), but imports fell off to a much greater degree (59 million board feet, or 7.7 percent). November’s exports were higher than year-earlier levels, while imports were well below. Both imports and exports were lower on a year-to-date basis in November 2009 than a year earlier, however.

In January, the U.S. dollar appreciated against two of the three currencies we track: by 2.1 percent against the euro, and 1.3 percent against the yen. But the greenback slipped for a second month (1.0 percent) against Canada’s “loonie.” On a trade-weighted index basis, the dollar appreciated 0.4 percent against a basket of 26 currencies and is 21 percent below its February 2002 peak.

Forest2Market employs experienced economists with long-time forest products supply chain experience. Our experts have studied how a multitude of factors interact to create markets for forest products and developed econometric models that provide a 24-month forward look at these interactions.

This summary of the performance of forest-related industries over the most recent period is part of the data upon which Forest2Market’s Economic Outlook is based. The Economic Outlook is produced monthly and provides a 24-month forward look at the economic factors that affect forest-related industries. Also available are 24-month forecasts of stumpage prices for local markets in the US South.