1 min read

Forestry-related Industry Performance At a Glance: January 2010

Suz-Anne Kinney

:

January 1, 2010

Suz-Anne Kinney

:

January 1, 2010

Given the low capacity utilization rates, falling inventories signal tepid current demand (and hence activity), but potentially greater activity in the future when inventories eventually must be replenished.

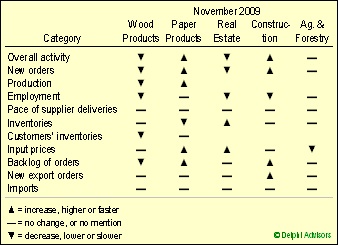

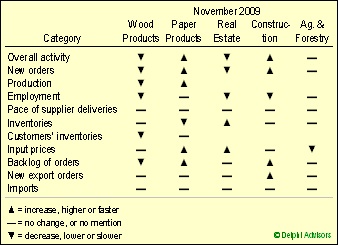

Wood Products is one of the industries still in decline, as it led the list of industries reporting contraction. Most aspects of that industry’s activity waned in December (Table 1). Paper Products, by contrast, was in the middle of the pack of industries reporting growth. The only aspects that might be interpreted as negative for Paper Products included higher input prices and a greater volume of imports.

Net exports of pulp, paper and paperboard increased in October as exports increased more quickly than did imports. Exports between August and October 2009 were higher than year-earlier levels, whereas imports were lower during each month between April and October 2009 than the corresponding months in 2008.

U.S. lumber exports shot higher in October, breaking above the 100 MMBF mark for the first time since July 2008. Imports also rose, but failed to exceed the recent high, which was set back in August.

Performance overview for Forest-Related Industries during December 2009.

Data source: Institute for Supply Management

In December, the U.S. dollar appreciated against two of the three currencies we track: by 2.2 percent against the euro and 0.8 percent against the yen. But the U.S. dollar slipped slightly (0.5 percent) against Canada’s dollar. On a trade-weighted index basis, the dollar appreciated 0.5 percent against a basket of 26 currencies, though it is 21 percent below its February 2002 peak.

This summary of the performance of forest-related industries over the most recent period is part of the data upon which Forest2Market’s Economic Outlook is based. The Economic Outlook is produced monthly and provides a 24-month forward look at the economic factors that affect forest-related industries. Also available are 24-month forecasts of stumpage prices for local markets in the U.S. South. For more information, call (704) 540-1440 or click here.