2 min read

Forestry-related Industry Performance At a Glance: March 2010

Suz-Anne Kinney

:

April 5, 2010

Suz-Anne Kinney

:

April 5, 2010

According to the Association of American Railroads’ (AAR) Rail Time Indicators report, the volume of U.S. rail traffic is still “off” from 2009’s levels – and even more substantially relative to 2008. However, lumber and wood products showed an increase in shipped volumes during January 2010, relative to January 2009.

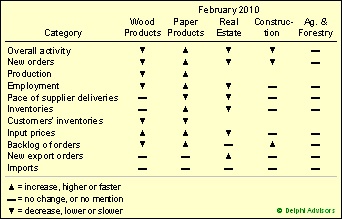

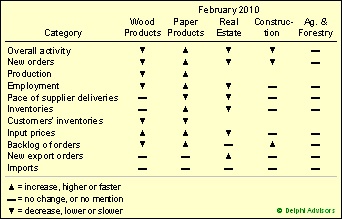

ISM’s report on service sector activity was more upbeat; it showed that part of the U.S. economy grew at the fastest pace in more than two years in February. While that may be true, the three industries most closely related to the forest products industry did not participate in the improvement (Table 1). The only mention of Agriculture, Forestry, Fishing & Hunting in the latest ISM report was a respondent’s comment saying, “Business is okay. Customers are doing a lot of price shopping.”

Table 1. Performance overview for Forest-Related Industries.

Data source: Institute for Supply Management

U.S. exports of wood pulp, paper and paperboard rose in December to the highest level since January 2008, while imports fell to a new cyclical low. Exports were 33.1 percent above, and imports 18.9 percent below, December 2008 levels.

Lumber exports retreated for a second month in December, and are now well below the trend that had been in place since December 2008. Nonetheless, December’s exports were 28.8 percent above year-earlier levels. With another drop-off in December, lumber imports appear to have reverted to a declining trend, after trending higher between January and August 2009. December’s imports were 7.8 percent below year-end 2008 levels.

In other paper-related trade news, the U.S. Department of Commerce (DOC) will impose tariffs of between 3.92 and 17.48 percent on imports of coated paper from China and Indonesia after determining that companies in those countries received unfair subsidies and harmed U.S. producers by dumping their products in this country.

That’s a look at the past. If you would like detailed information about the future of forest-related industries, subscribe to Forest2Market’s Economic Outlook, a 24-month forecast of performance in GDP, currency exchange rates, housing starts, oil prices and more.

Let Forest2Market do the groundwork; subscribe to the Economic Outlook and focus your resources on identifying and acting on the strategic advantages you’ll discover every month.