After remaining unchanged in July, the Industrial Production (IP) index rose by 0.4% (to 99.4%) in August. Performance of major market groups was as follows:

· Manufacturing advanced by 0.4%, reversing July’s retreat of 0.4% (revised lower from the original -0.1%).

· Wood Products was up 1.7%, more than compensating for July’s 0.7% decrease.

· Paper rose by 1.1%, extending July’s 0.2% increase.

· Construction slowed to +0.3%, from July’s +0.5%.

· Consumer Goods edged up by 0.3% after a 0.5% decline in July.

Capacity utilization of all industries increased 0.3% in August (to 77.8%); both Wood Products (1.7%) and Paper (1.1%) expanded. Capacity among all industries nudged 0.2% higher in August; Wood Products was unchanged while Paper shrank by 0.1%.

Manufacturing

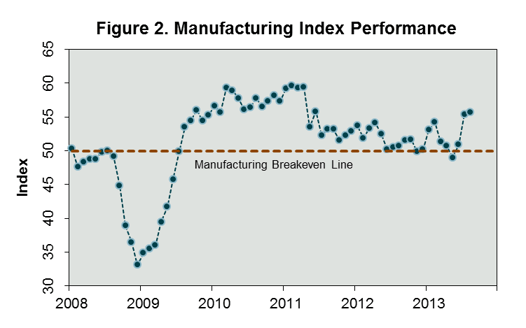

The most-closely followed nationwide index of manufacturing activity expanded to the fastest rate in two years during August (Figure 2). The Institute for Supply Management's (ISM) PMI rose to 55.7%, an increase of 0.3 percentage point from July's reading of 55.4% (50% is the breakpoint between contraction and expansion).

"Comments from the [respondent] panel range from slow to improving business conditions depending upon the industry," said Bradley Holcomb, chair of ISM's Manufacturing Business Survey Committee.

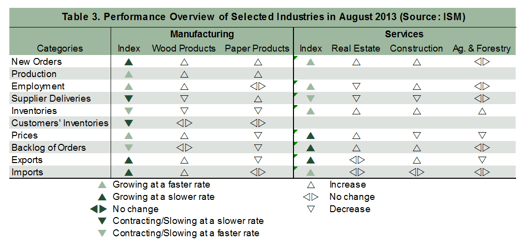

Details in the ISM report were generally favorable for the two manufacturing industries we track (Table 3). Domestic Wood Products manufacturers face some headwinds from higher input prices and expanded imports, though, while Paper Products manufacturers are experiencing declining export orders and order backlogs. Nonetheless, one Paper Products respondent opined that "material prices continue to be favorable; business is steady."

Non-Manufacturing

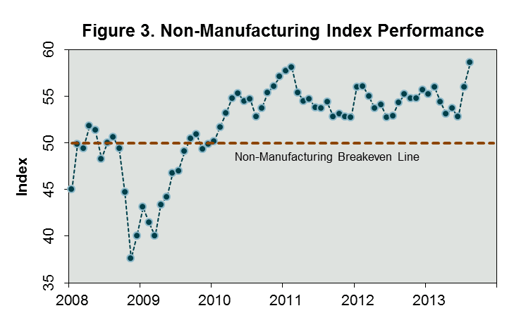

The service sector grew at the fastest pace on record in August (Figure 3). The non-manufacturing index registered 58.6%, 2.6 percentage points higher than July's 56.0%. "The majority of respondents' comments continue to be mostly positive about business conditions and the direction of the overall economy," said Anthony Nieves, chair of ISM's Non-Manufacturing Business Survey Committee.

Overall activity expanded among the service industries we follow. One Construction respondent observed that "we seem to have a flurry of activity in our pipeline." The positives and negatives among the individual industries appear reasonably well balanced. E.g., although new (including export) and backlogged orders generally picked up, so too did inventories.

Commodities used/produced by either the manufacturing or non-manufacturing industries we track and that were up in price included oil and oil-based products, fuel, lumber (including pine, spruce and treated), corrugated boxes and packaging, and paper. Natural gas was the only relevant commodity down in price.