From Forest2Market's Economic Outlook:

Industrial production at the total manufacturing level has marched upward at a fairly steady pace since the recession ended in June 2009, and in April it was nearly 20 percent higher than the recessionary trough. Capacity utilization was homing in on 75 percent – roughly one-third of the way between the levels generally accepted as indicating recession (i.e., less than 70) or overheating (i.e., greater than 85). Finally, although forest products manufacturing has not followed suit, total manufacturing capacity has been rising since March 2011.

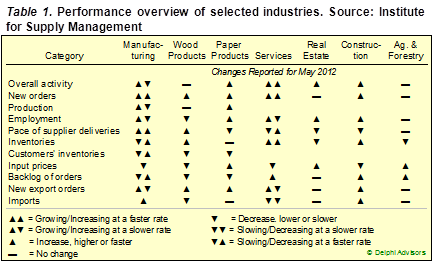

By the Institute for Supply Management’s (ISM) reckoning, manufacturing’s expansion continued in May (Table 1). Although the pace of growth slowed slightly, with PMI dropping to 53.5 percent from 54.8 in March (50 percent is the breakpoint between contraction and expansion), “[c]omments…generally reflect stable-to-strong orders, with sales showing steady improvement over the first five months of 2012,” concluded Bradley Holcomb, chair of ISM’s Manufacturing Business Survey Committee. The sub-indices netted out to no change for Wood Products, but we note the increase in new orders (including exports) and decreasing imports as positive signs for domestic manufacturers. Paper Products expanded as new orders (including exports), production and employment all rose.

The non-manufacturing sector grew at a slightly faster pace in May, reflected by a 0.2 percentage point rise (to 53.7 percent) in the NMI. “The majority of the respondents’ comments are positive and optimistic about business conditions and the direction of the economy,” concluded Anthony Nieves, chair of ISM’s Non-Manufacturing Business Survey Committee. Real Estate and Construction both reported expansion in overall activity, while Ag & Forestry was unchanged. “Q2 will be a strong quarter for us; the building market is starting to wake up,” claimed one Construction respondent.

ISM’s Spring 2012 Semiannual Economic Forecast Expectations report presents a stark contrast to the gloomier outlook discussed above; it reveals that U.S. purchasing and supply executives expect the remainder of 2012 to be positive for both the manufacturing and non-manufacturing sectors. “With 16 out of 18 industries within the manufacturing sector [including Paper Products] predicting growth in 2012 over 2011,” commented Bradley Holcomb, chair of ISM’s Manufacturing Business Survey Committee, “manufacturing continues to demonstrate its strength and resilience in the midst of global economic uncertainty and volatility.” Wood Products was one of the two industries not predicting growth during 2H2012. All 17 non-manufacturing industries, including the three we track, are predicting growth for the rest of the year.

Read about Forestry-Related Industry Performance in April 2012.

Suz-Anne Kinney

Suz-Anne Kinney