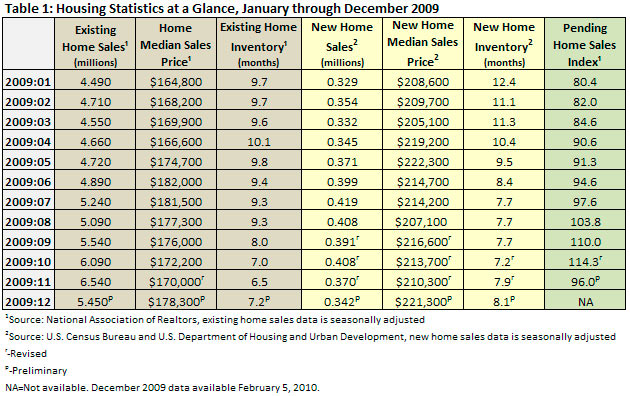

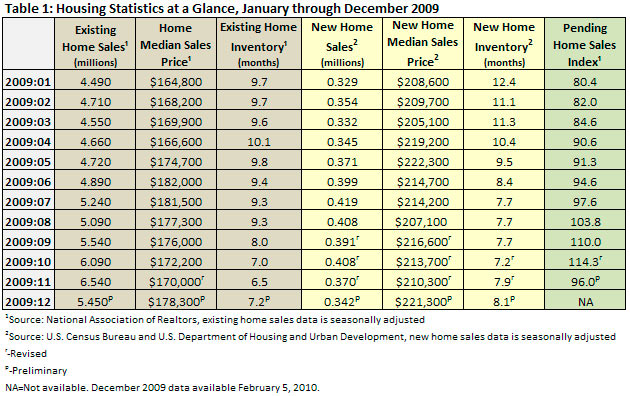

Sales of existing homes fell to 5.45 million units in December, down 16.7 percent from November (see Table 1), though this is still 15 percent above December 2008 levels. As we noted in this column last month, this turn was expected.

Lawrence Yun, chief economist at the National Association of Realtors, attributed the swing to the first-time homebuyer tax credit. “We’ll likely have another surge in the spring as homebuyers take advantage of the extended and expanded tax credit. By early summer the overall market should benefit from more balanced inventory, and sales are on track to rise again in 2010. However, the job market remains a concern and could dampen the housing recovery—job creation is key to a continued recovery in the second half of the year.”

Months of inventory of existing homes rose in December, up from 6.5 months to 7.2 months. This is 10.8 percent higher than November, but still an improvement of 23.4 percent from December 2008.

Sales of new homes declined in December as well, though November’s sales were revised upward from 355,000 to 370,000. After the revision, sales were down 7.6 percent from November to December, with just 342,000 units sold. This is 8.6 percent below December 2008’s level. Inventory lost ground as well. December’s inventory jumped 6.6 percent to 8.1 months. While disappointing, this figure is still 27.7 percent better than December 2008’s number.

Home prices were stronger in December. The median price for existing homes increased to $178,300, increasing $8,300 from the previous month. Year over year, prices increased 1.5 percent. The median price for new homes showed greater strength in December, increasing from a downwardly revised $210,300 in November to $221,300.

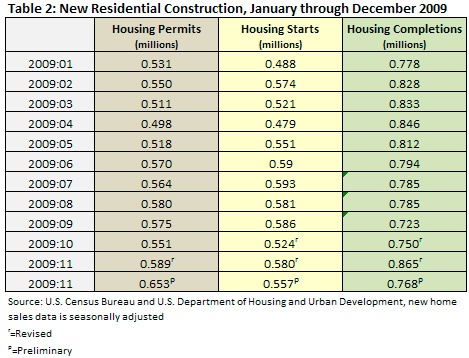

Housing permits increased in December, but starts and completions both fell (see Table 2). Housing permits increased from 589,000 in November to 653,000 in December, a 10.9 percent increase. Year over year, permits up 15,8 percent.

Housing starts fell from 580,000 in November to 557,000 in December, a decrease of 4 percent. This represents an increase of .2 percent over the December 2008 level. Completions decreased 11.2 percent in December, moving from 865,000 in November to 768,000. This represents a 25.3 percent year-over year decline since December 2008.

While most of the housing statistics and indicators suggest a recovery is underway, there are a couple of additional data points we’re keeping our eyes on: foreclosures and mortgage interest rates.

Our concerns over foreclosures and interest rates remain. that as soon as prices recover enough for the banks to move these units into the actual inventory of homes for sale, the glut will cause prices to decline again.

While we still expect mortgage rates to increase throughout 2010, the month over month trend from December to January was down, not up. According to Freddie Mac’s Primary Mortgage Market Survey, 30-year fixed interest rates have been hovering around the 5 percent mark pretty consistently over the last month. Bankrate quoted the overnight average for 30-year fixed mortgages for January 27 at 5.06 percent.

Suz-Anne Kinney

Suz-Anne Kinney