Forest2Market has recently applied a modest upward revision to our housing start forecast. The reasons for this revision are two-fold: First, we have concluded that 500,000 total units constitutes a “baseline” or “background” rate of building activity that occurs naturally in the U.S. economy. (We had previously speculated starts could fall and remain below that threshold.) The second reason relates to the legal issues surrounding the “foreclosure fraud” cases now in court. We think some homebuyers will exhibit a preference to purchase new homes with unencumbered titles.

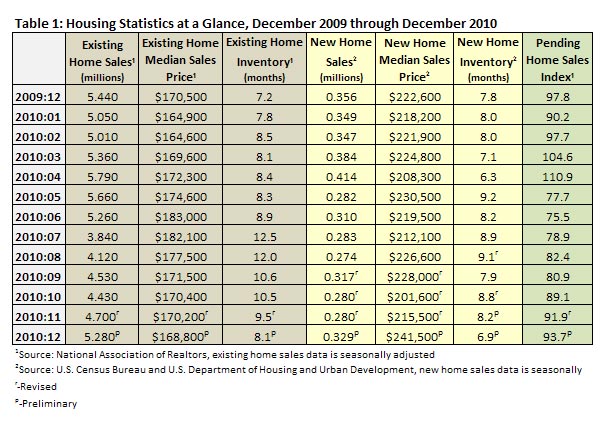

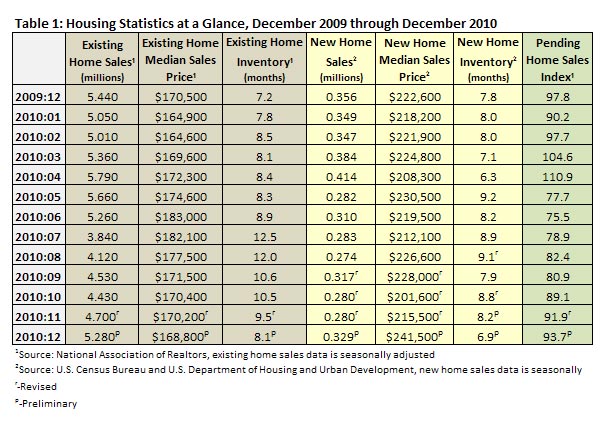

Movement may already be headed in that direction. New home sales jumped 17.5 percent in December, to an annualized rate of 329,000 units (Table 1). While significantly better than October and November, the number of new homes sold was down 7.6 percent year over year. Inventory fell from 8.4 months in November to 6.9 in December, a 17.9 percent improvement. Inventory is 11.5 percent lower than it was December 2009. Both median and average sales prices improved in December, with median price coming in at $241,500 and average price at $291,400.

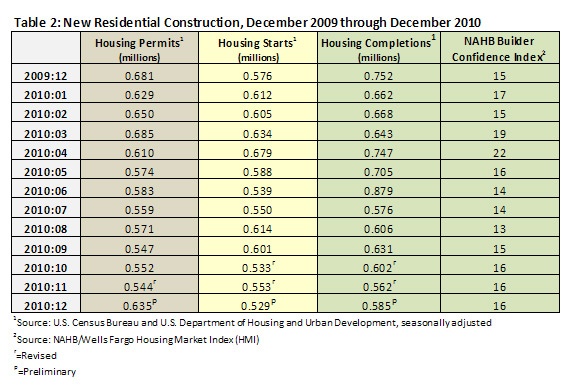

The number of new housing completions rose as well in December to an annual rate of 585,000 units, a 4.1 percent gain, according to the U.S. Census Bureau and the Dept. of Housing and Urban Development (Table 2). While housing starts fell 4.3 percent to 529,000, permits jumped 16.7 percent to 635,000. Across the board, new residential construction numbers were lower when compared to December 2009.

Pending home sales were stronger, as they have been five out of the last six months (Table 1). In December, the Pending Home Sales Index was 2 percent higher. Laurence Yun, the chief economist at the National Association of Realtors attributes the improvement to “ modest gains in the labor market and the improving economy,” which are “creating a more favorable backdrop for buyers.”

Existing home sales increased 12.3 percent in December to an annual rate of 5.28 million units (Table 1). This is just 2.9 percent lower than December 2009. Yun observed: “The pattern over the past six months is clearly showing a recovery. The December pace is near the volume we’re expecting for 2011, so the market is getting much closer to an adequate, sustainable level.” Existing home inventory fell to an 8.1 month supply, down from 9.5 months in November. Median existing home prices fell $1,400 to $168,800.

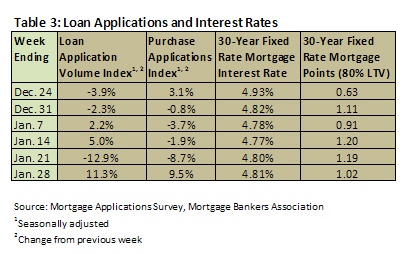

Except for the week of the Martin Luther King holiday (the week ending January 21), mortgage application volume increased throughout most of January (Table 3). Interest rates demonstrate continued affordability.

Despite better sales numbers and prospects, the buzz over the last month has primarily focused on home prices. We agree that the major story of 2011 is more likely to be a case of home prices falling than housing start activity taking another large dive.

The length of the housing downturn (which started a year before the recession and has yet to really recover) means there are enough potential buyers that – if presented with lower prices and low mortgage rates when compared to historical averages – housing start activity itself could improve slightly. Despite our upwardly revised forecast, we do not expect starts to break above 900,000 units on a sustained basis until the overhang of shadow inventory is substantially pared down. Longer term, we think population growth will eventually overtake the factors suppressing housing demand and lead to a more robust escalation in residential construction.

Suz-Anne Kinney

Suz-Anne Kinney