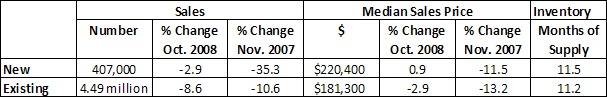

In light of the current economic situation, it’s clear we will continue to see the housing market struggle throughout 2009 and perhaps into 2010. The inventory statistic illustrates the scope of the problem. The months of inventory on the market climbed to over 11 months (11.5 for new homes and 11.2 for existing ones) in November. To put this number in context, the last time inventory was this high was during the recession of the early 1980s. With an increasing number of foreclosures set to hit the market during 2009 (an estimated 2 million homes), this number will certainly get worse before it gets better. The key to a turnaround in the housing industry is the reduction of inventory from this 11 month range back to the 4-6 month range, a number that is consistent with a healthy market in most areas (inventory remained relatively stable at this 4-6 month range between 1992 and 2006). Once inventory bottoms at around this level, housing starts will follow suit, an event that is necessary for the recovery of the timber and forest products industries. What work needs to be done to accomplish this reduction in inventory?

Affordability

Is housing affordable? Two key measures of affordability show that homes are much more affordable at the end of 2008, though still somewhat overpriced:

- Price-to-rent ratio, the ratio of the National Case-Shiller Home Price Index to Owner Equivalent Rent, a statistic tracked by the Bureau of Labor Statistics. For comparison, between 1991 and 2000, this ratio remained in the "equilibrium" 1.0-1.1 range, after which it began to climb, hitting its peak in 2006 of over 1.7. By the third quarter of 2008, the ratio dropped to 1.3, indicating that 60-70 percent of the necessary correction in home prices had already occurred. The fourth quarter has provided additional downward movement in this ratio, inching us closer to the 1.0 target.

- Price-to-income ratio, the ratio of median home prices to median family income. Between 1981 and 2000, the average or “equilibrium” ratio was 2.86. This measure hit its high of 4.1 in October 2005 but has dropped considerably since—the second quarter of 2008 ended with a ratio of approximately 3.35. Credit Suisse, an institution that publishes regular reports on the housing industry, estimates that it will be January 2010 before the equilibrium level is reached once again. Because the third and fourth quarters of 2008 have seen significant price corrections, however, affordable housing could be closer than they predict.

Though prices are nearing the bottom, fear of further depreciation in home values will continue keeping buyers at bay. One reason is the effective or “real” mortgage interest rate, a measure that considers both the 30-year fixed mortgage rate and year-over-year percentage change in median sales price. When the interest rate is 6 percent and prices are appreciating at 3 percent per year, for instance, the “real” interest rate is 3 percent. In November, however, interest rates averaged 6.1 percent and housing prices fell 13.2 percent from November 2007’s price. If you subtract the –13.2 percent change in house prices from the 6.1 percent interest, the “ real” interest rate in November 2008 was 19.3 percent. Buying a house used to be the best investment a family could make. Until prices stabilize, good investments—whether in real estate or anywhere else—will be hard to come by.

Two additional but related factors will keep inventory elevated and slow progress toward recovery—foreclosures and job losses. To speed the recovery, work will need to be done in these quarters as well. Foreclosures in the third quarter of 2008 hit 1.35 million, according to the Mortgage Bankers Association, a 76 percent increase from third quarter of 2007. At this rate, the number of homes going into foreclosure in 2008 will total 2.2 million. Because of the surge of job losses in the fourth quarter, the foreclosure crisis will continue to get worse. Initial jobless claims hit a 26-year high in the week ending December 20. Because of the state of the economy, Credit Suisse recently revised its predictions for foreclosures; they now believe that 8.1 million foreclosures will occur between 2009 and 2012, adding 2 million existing homes to inventory per year. If the recession is deep, they predict the number could grow to 10.2 million.

Proposals for Reversing the Course of the Housing Numbers

The outlook for housing is bleak. Reversing the trend will require focusing on decreasing job losses and foreclosures and encouraging new buyers. Failure to address both the supply and demand sides will produce little in the way of movement. Here are some of the proposals currently being floated to accomplish this work.

- Sheila Bair, the Chair of the Federal Deposit Insurance Corporation, has been fighting for foreclosure relief, arguing that $24 billion of the $700 billion in bailout funds should go to guaranteeing modified home loans through 2009. While the White House and Treasury Department rejected the proposal, Bair was on Capitol Hill in December making her argument to Congress. Though a moderate Republican, Bair’s opinions are likely to carry more weight with the Obama administration.

- Two of the key rates adjustable rate mortgages are indexed to, the 1-year Treasury Bill or 1-year LIBOR, are extremely low. ARMs that reset in the near future will be just as likely to drop. The resulting lower payments could prevent some foreclosures in the near term.

- The U.S. Treasury Department is developing a new plan that could lower mortgages rates to 4.5% in an attempt to bring new buyers into the housing market. Some predict that we will see mortgage rates below 5 percent, perhaps approaching 4 percent, in 2009.

- The new administration’s job creation program is projected to add 3 million new jobs to the economy over the next two years, increasing the number of new buyers on the market.

- The National Association of Home Builders (NAHB) has formed a coalition of industry participants in an effort they are calling “Fix Housing First.” The initiative seeks to build on the current $7,500 tax credit for first time homebuyers that was signed into law earlier this year, extending the time frame, expanding the credit to 10 percent of the home price (maximum $22,000), eliminating the pay back provision, and providing qualified buyers with a 30-year fixed rate mortgage at 2.99-3.99 percent (depending upon the date of closing).

Suz-Anne Kinney

Suz-Anne Kinney