For existing sales, 49 percent of homes in April were sold to first-time buyers, repeat buyers purchased and 36 percent investors bought 15 percent.

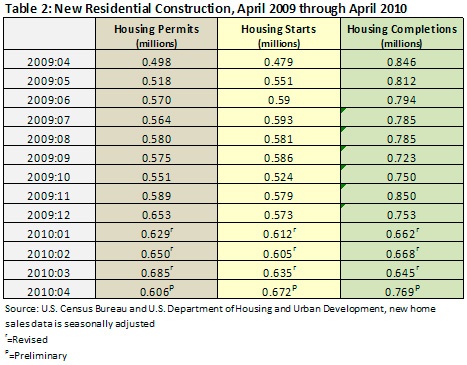

Permits for new housing units fell 11.5 percent in April, but housing starts rose 5.8 percent. Permits have grown 15.9 percent over the last 12 months, and starts have risen 40.9 percent. Completions also rose in April, up 19.2 percent from March (Table 2).

Standard & Poor’s Case-Shiller Home Price Index fell by 3.2 percent in 1Q2010, but remains 2.0 percent higher than 1Q2009. The 10-City and 20-City Indexes gained 3.1 percent and 2.3 percent respectively. Prices in eight cities—Atlanta, Charlotte, Chicago, Detroit, Las Vegas, New York, Portland and Tampa—posted new index lows, however. Boston prices were flat quarter over quarter, and Cleveland, San Diego and San Francisco saw the largest gains, 1.8 percent, 1.5 percent and 1.5 percent respectively.

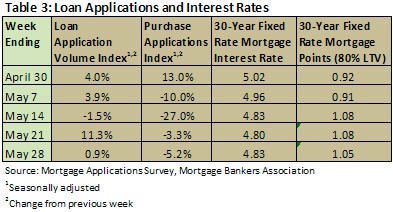

Weekly changes in the Mortgage Applications Survey conducted by the Mortgage Bankers Association (MBA) are summarized in Table 3.

Freddie Mac’s Primary Mortgage Market Survey shows a drop in 30-year fixed rate as well, from 5.06 percent for the week ending 4/29 to 4.78 percent for the week ending 5/27. Points remained static at 0.7.

Suz-Anne Kinney

Suz-Anne Kinney