Despite a litany of bad news for the housing market over the first half of 2011, several reports out at the end of June point to better performance ahead.

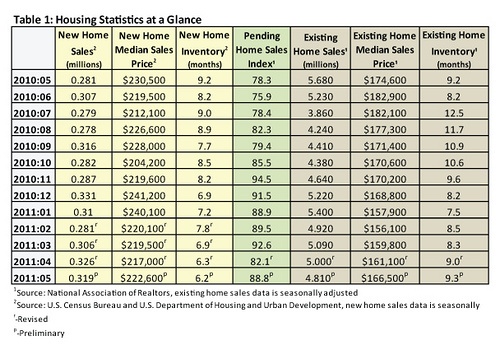

The first of these is the National Association of Realtors (NAR) Pending Home Sales Index (PHSI) for the month of May, which is based on contract signings. The PHSI improved by 8.8 percent over April’s number; year over year, the index is up 13.4 percent (Table 1). This was the first time the PHSI was above year ago levels since the height of the home buyer tax credit in April 2010. (Closings generally occur 1-2 months after contracts are signed.)

Lawrence Yun, chief economist for the NAR said the improvement bodes well for home prices. “Absorption of inventory is the key to price improvement, and this solid gain in contract signings implies that home values in many localities are or will soon be stabilizing as inventories get absorbed at a faster pace.”

The S&P Case Shiller Home Price Index for April suggests that Yun may be right and that prices may be beginning to stabilize, at least for now. The level of stability depends on whether one looks at the actual number for April (prices rose by 0.7 percent after 8 months of declines) or at the seasonally adjusted number (prices fell by 0.1 percent). According to the report, prices rose in 13 of the 20 markets that Case Shiller tracks. Table 1 also shows that new and existing median home prices increased, both by more than $5,000.

Some of the price stabilization can be attributed to the beginning of the spring and summer buying season. The rest is likely the result of the falling number of foreclosures on the market. Joseph LaVorgna of Global Markets Research, for instance, noted in a CNN Money report that the volume of distressed properties sold has declined by 16% this year, while the number of non-distressed sales has increased by 11 percent.

May home sales numbers show that these positive factors are not yet having an effect on the market. New home sales for May came in at 319,000 units, which is a 13.5 percent gain over the May 2010 estimate, but a 2.1 decrease from April. Inventory stands at 6.2 months. Existing home sales slipped a bit in May to 4.81 million on an annualized basis (Table 1). Months of inventory increased to 9.3 months. The NAR’s Yun commented that temporary factors held back the market in May. “Spiking gas prices along with widespread severe weather hurt house shopping in April, leading to soft closings in May.” He went on to state that he thought “the pace of sales activity the second half of the year is expected to be stronger than the first half….”

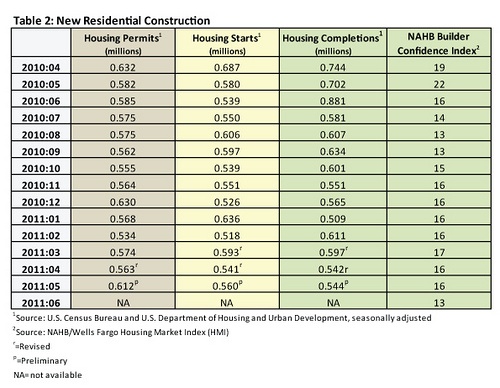

Residential construction in May underscores the unevenness of the housing market. While builder confidence was down 3 points, May starts were at the seasonally adjusted annual rate of 560,000 (Table 2). This is 3.5 percent above April’s revised level but 3.4 percent below the May 2010 rate. Permits rose 8.7 percent to an adjusted annual rate of 612,000; this is 5.2 percent above the May 2010 number. Completions were up a meager 0.4 percent, a whopping 22.5 percent below the May 2010 rate.

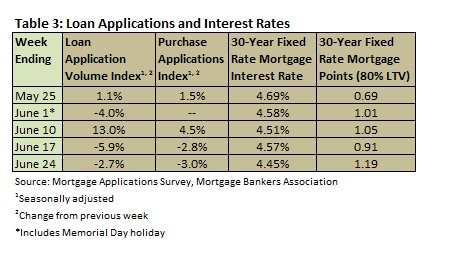

Still, mortgage rates are incredibly low (Table 3) with interest rates on a 30-year fixed mortgage in June averaging 4.53 percent. The week ending June 24 reached a low of 4.46 percent.

Despite the fact that high unemployment, tougher lending standards and higher down payment requirements continue to be obstacles to the full recovery of the housing market, a recent New York Times/CBS News poll found that 9 out of 10 Americans still believe homeownership is an integral part of the American dream. In addition, they oppose any efforts to make owning a home more difficult. The poll found, for instance, that almost no one supported the discontinuation of the mortgage tax deduction that lawmakers have been floating as a mechanism for generating revenue to offset the deficit. This, along with the backlog of new household formations, bodes well for 2013 and beyond.

Comments

Nice Residential Construction photos | Constructio

07-19-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

Loan Applications And Interest Rates | Dream Home

07-23-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

07-29-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

Loan Applications and Interest Rates

08-01-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

08-18-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

Cool Mortgage Interest Rates images | Graduated Pa

08-20-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

Cool Loans images | gotoeconomy

08-24-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

08-24-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… Tags: Loans, Nice, photos << Cool Investing images [...]

Comments

09-08-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… Loans Leave a Reply ? Already the latest post! Useful Advice Choosing The Best Low Interest Rate Personal Loan [...]

Comments

Cool Loans images | EmaiLoan.com

09-19-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

Cool Loans images | LoansBelow.com

09-20-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

Loan Applications and Interest Rates | I Share Fin

09-25-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… No Comments » Tags: Applications, Interest, loan, Rates [...]

Comments

Loan Applications and Interest Rates | yoursite

09-26-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

Loans | finance for a livelier life

11-28-2011

[...] blog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Comments

Lastest Mortgage Loan Rate News | mortgages-lender

04-26-2012

[...] weblog.forest2market.com/2011/07/01/housing-market-update-j… [...]

Suz-Anne Kinney

Suz-Anne Kinney