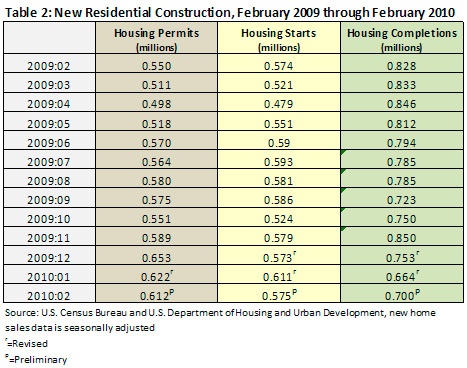

Housing starts fell as well, dropping 5.9 percent to an annual adjusted rate of 575,000. Permits, a leading indicator of housing activity, were down 1.6 percent (Table 2). According to the National Association of Home Builders, U.S. home-builder confidence fell from 17 to 15 in March, the fourth drop in six months.

While February data on home prices was mixed, most agree that the outlook is troublesome. According to Standard & Poor’s Case-Shiller Home Price Index, prices rose 0.3 percent on a seasonally adjusted basis but fell 0.4 percent on an unadjusted basis in January. The modest increase was the eighth consecutive monthly increase.

Despite this, David M. Blitzer, the chair of the index committee at S&P had this to say: “While we continue to see improvements in year over year data for all 20 cities [covered by the index], the rebound in housing prices seen last fall is fading....[W]e can’t say we’re out of the woods yet.” Robert Shiller, the index’s co-creator discussed the market on Bloomberg television: “ We had a real sharp recovery starting a year ago, and it’s still going up on a seasonally adjusted basis, but it’s gotten weaker....There is a real concern about a possible double dip in the housing market. What’s the probability? I don’t know, 50/50, which is actually very high because we don’t have double dips. The only post-war example is the ‘81/‘82 recession. There’s no other example.”

Some of the weakness in the housing numbers can be attributed to nasty weather in both the South and the Northeast, which kept many potential homebuyers trapped inside and prevented ground breakings for new construction.

The weather could also account for the limited number of people taking advantage of the home buyer tax credits. Signs are emerging that this trend is reversing, however. Now that the weather has improved, buyers are coming to life. The Weekly Mortgage Applications Survey conducted by the Mortgage Bankers Association reported that application volume increased 1.3 percent during the week ending March 26. Michael Fratantoni, MBA’s VP of research and economics, interpreted the data this way: “Purchase applications have increased over the past month and are now at their highest level since last October when many homebuyers were rushing to get loans closed before the expected expiration of the homebuyer tax credit. We may be seeing a similar pattern now, as the extended version of the tax credit ends next month.”

News on the mortgage interest rate front is also mixed this month. The MBA reports that rates are inching upwards — 3 basis points from 5.01 to 5.04 for 30-year loans. Concerns still exist that as the Federal Reserve’s program for purchasing mortgage-backed securities ends — as it did last Thursday — interest rates will begin climbing. New evidence suggests that this may not be as bad as many feared.

First, there seems to be more interest in purchasing these securities than many thought. Lawrence Yun, chief economist at the National Association of Realtors, said “Just as the Fed is stepping out, private investors appear to be stepping in. As long as there are buyers on Wall Street for mortgages, it should have no impact on consumers. Having said that, it’s possible that the mortgage rate could be higher later in the year, but that would be due to macroeconomic forces unrelated to the Fed purchase program. Second, policy makers made it very clear months ago that the program would end on March 31, and this has provided the market with plenty of time to adjust. Finally, since home sales have retreated off last fall’s rebound, the supply of the securities is not increasing. Again, Fratantoni from the MBA: “Home sales really are running at quite a slow pace, and we haven’t seen much of a spring buying season yet, so there haven’t been a lot of mortgages originated or security’s issued.”

Suz-Anne Kinney

Suz-Anne Kinney