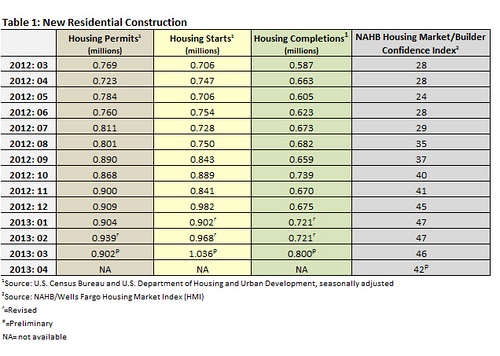

For the first time since the 2008 financial crisis, housing starts surpassed the one million mark in March, a seven percent increase from the previous month and 46.7 percent higher than one year ago. Performance, however, was mixed. Single-family home starts were down 4.8 percent, while multi-family starts were up a whopping 26.9 percent.

Ongoing foreclosure procedures and the processing of delinquent properties have forced many families into renting, which explains the significant increase in multi-family starts. Despite the discrepant numbers, analysts note single-family new home construction continues a gradual recovery, as the current levels were last seen in May 2008.

Amidst this good news were some indicators of a slight softening in new construction. The number of new housing permits declined, indicating the rate of future construction may decrease in the month ahead. Builder confidence also fell due to ongoing increases in the cost of building materials and limited credit to secure those materials. Limited availability of both skilled labor and developed lots also contributed to the dip in builder confidence.

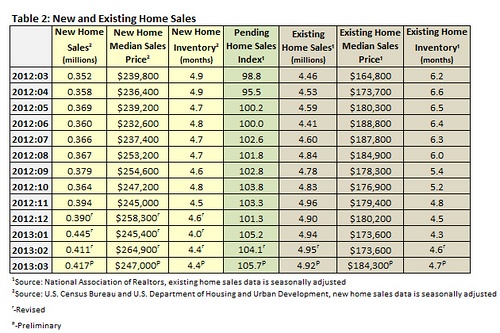

Supply was also limited and, coupled with steady demand, constrained the housing market. Buyers, encouraged by both low home prices and low mortgage interest rates, turned their attention to new construction when unable to find a home on the resale market. From February to March, sales of existing homes dropped from 4.95 to 4.92 million, while new home sales increased 1.5 percent from 411,000 to 417,000.

According to Lawrence Yun, chief economist for the National Association of Realtors, "We need a housing supply of over 6 months to have a generally balanced market between home buyers and sellers, but it's unlikely we'll get there without greater increases in housing construction." The current existing home supply sits at 4.7 months, relatively unchanged from 4.6 one month ago.

Inventory constraints also pressured home prices. Reporting data through the end of February, the S&P/Case-Shiller Home Price Indices revealed average home prices increased 9.3% for the 20-city composite. The 10-city composite showed an increase of 8.6%. From January to February 2013, the 20-city composite increased by 0.3% while the 10-city composite rose 0.4%.

However, other analysts suggest the Case-Shiller composites overstate the rise in prices. Stan Humphries, chief economist at real estate company Zillow, suggested, “The appreciation rates we’re currently seeing in the Case-Shiller composite are not broadly reflective of what’s happening in the national housing market right now. The Case-Shiller series is overly skewed to quickly rebounding markets—particularly in the Southwest and on the West Coast—and is being boosted by a shift in transactions away from foreclosure re-sales.”[1]

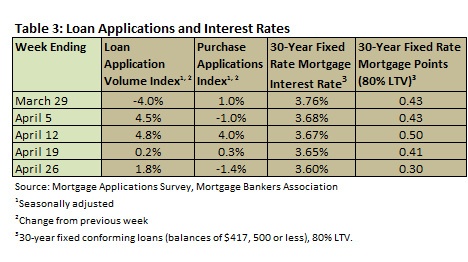

As prices begin to rise, mortgage rates continue to fall. By the end of April, fixed mortgage rates had declined for the sixth consecutive week and remained near historic lows, with interest rates decreasing to their lowest levels since December 2012. More buyers are expected to flock to the market as interest rates remain low and home values increase.