Lawrence Yun, chief economist with the NAR, had this to say about the state of the market: “ The rise in buyer contact activity may signal the early stages of a second surge of home sales this spring. The healthy gain hints home prices are continuing to flatten. We need a second surge to meaningfully draw down inventory and definitively stabilize home values.”

While weather was the primary influence pulling the market down in February, the homebuyer’s tax credit takes center stage in March. To be eligible for the credits, buyers must have signed a contract by the end of April and close the sale by June 30. A second extension of the homebuyer tax credit is unlikely. An NAR spokesperson said, “It’s time for the housing market to stand on its own two feet.” The National Association of Home Builders is not actively seeking an extension either.

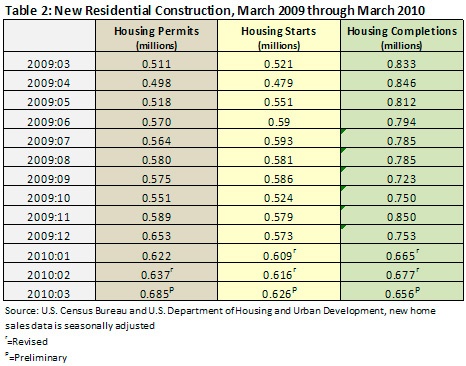

Housing starts improved in March; they were up 1.6 percent on a month-over-month basis and 20.2 percent on a year-over-year basis. Permits grew at a rate of 7.5 percent from February. Year over year, they increased 34.1 percent (Table 2). Completions were off this month.

Data on home prices continues to be mixed. The most significant piece of news here is that the Standard & Poor’s Case-Shiller Index showed its first year-over-year increase in more than three years. Month over month, the index continued to decline, making it five straight months the index has been headed in the wrong direction. Charlotte, Tampa, Portland and Seattle all saw declining prices, as did New York and Las Vegas.

The Weekly Mortgage Applications Survey conducted by the MBA show that the week ending April 16 was the only week in April in which the number of mortgage applications increased. The negative numbers were likely due to the rapidly closing window of opportunity for receiving homebuyer tax credits.

- Week ending April 2: -11.0 percent (mortgage rates increased, a result of the Federal Reserve completing their purchase of mortgage-backed securities)

- Week ending April 9: -9.6 percent (a result of an increase in FHA mortgage insurance premiums)

- Week ending April 16: +13.6 percent (treasury rates fell, causing a drop in mortgage rates)

- Week ending April 23: -2.9 percent

The MBA also published the results of a study, “What Happens to Household Formation in a Recession.” The report indicates that 1.2 million households were lost in the U.S. between 2005 and 2008, despite an increase in population of 3.4 million people. 2009 will have added to these totals. Ultimately, only job creation will remedy this situation. At some point, record levels of overcrowding in homes and apartment—overcrowding increased five-fold during the recession according to the study—will need to be reversed. This report is available at www.housingamerica.org.

Mortgage interest rates continue to hold relatively steady. The MBA reports that rates are inching upwards; for the week ending April 23, rates increased 4 basis points from 5.04 to 5.08 with 0.91 points (down from 0.98) for 30-year fixed loans with 80 percent loan to value ratios. Freddie Mac’s Primary Mortgage Market Survey for the week of April 22 showed 30-year rates stayed the same as they were the previous week: 5.07 percent. While rates are still low, last year at this time the 30-year rate averaged 4.80 percent.

Suz-Anne Kinney

Suz-Anne Kinney