Home Prices

The S&P/CaseShiller Home Price Index reported home prices rose at a record rate in April as both the 10-City and 20-City Composites posted the highest monthly gains in the history of the index. From March to April, prices in the 20-City Composite rose 2.5 percent for the fourth consecutive month of year-over-year returns. Prices in the 10-City Composite rose 2.6 percent. Between May 2012 and April 2013, the 20-City Composite saw average home prices increase by 12.1 percent, while home prices in the 10-City Composite rose at a rate of 11.6 percent.

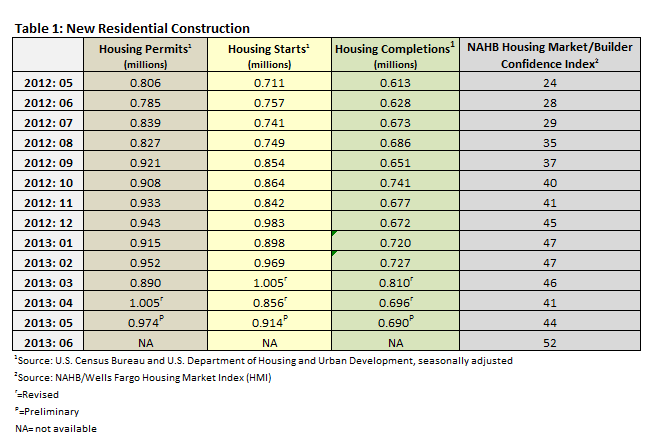

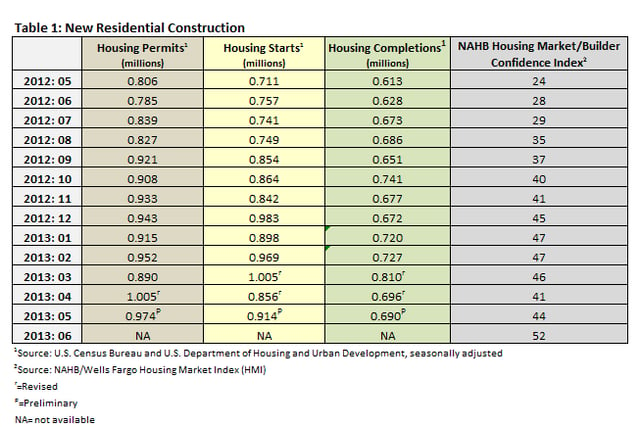

Building Permits

While the record-setting rise in home prices garnered most of the attention, an upwardly revised number of housing permits pushed April permits past the one million mark. May permits also remained strong at 974,000. New housing permits are considered a strong leading indicator of future market performance.

Housing Starts & Completions

Housing starts recovered from the significant drop posted in April to reach a healthy 914,000 privately-owned starts in May. Housing completions declined for the second straight month, though only slightly, dropping from 696,000 in April to 690,000 last month.

Builder Confidence

Despite an ongoing shortage of qualified, skilled laborers, rising prices, steady buyer demand and low inventories have contributed to increasing optimism among builders. Up from the 44 recorded in May, builder confidence rose to an impressive 52 in June. The eight-point jump marked the highest month-to-month increase recorded in over a decade and led to the highest rating seen in seven years. Confidence ratings above 50 indicate builders consider current conditions as good for sales.

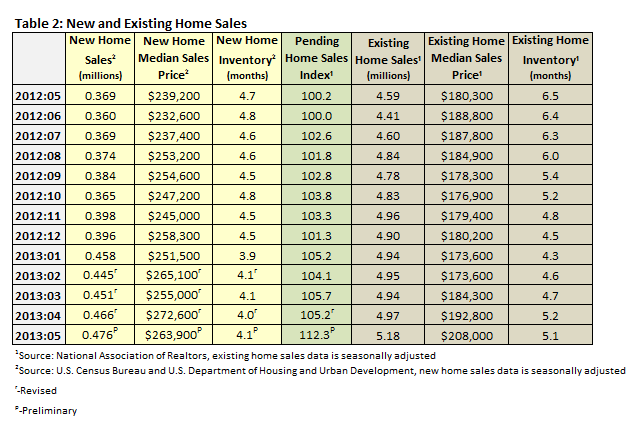

Home Sales

Sales of new single-family homes also improved, reaching numbers last seen in July 2008 as they gained momentum for the third straight month. New home sales increased 2.1 percent to a seasonally-adjusted annual rate of 476,000, up 29 percent compared to May 2012 when new home sales numbered just 369,000. Still, new home sales remain well below the 700,000 annual mark most economists consider healthy.

Existing home sales also recorded numbers not seen for quite some time. The National Association of Realtors (NAR) reported sales of previously owned homes numbered 5.18 million in May. Sales of existing homes had not topped the 5 million mark since November 2009, when the home buyer tax credit was nearing expiration.

Despite the record-setting rises in home prices recorded in April, the median price of a new home fell from $272,600 to $263,900 in May according to the Census Bureau. Meanwhile, the NAR reported that the median price of an existing home rose for the third consecutive month, reaching above the $200,000 mark to settle at $208,000.

Tight inventories have no doubt contributed to the price increases. A five-month supply of existing homes and a four-month inventory of new homes remain below the six-month supply considered balanced between supply and demand.

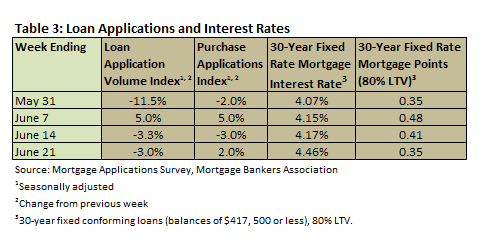

Mortgage Rates

Following Chairman Ben Bernanke’s announcement that the Federal Reserve will scale back bond purchases as the economy continues to strengthen, long-term borrowing rates continued along an upward trajectory. Mortgage interest rates continued to rise for the seventh consecutive week, reaching 4.46% for a 30-year fixed rate mortgage, a level not seen since August 2011.

The steady increase in interest rates has led to talk of waning demand for new and existing homes in the near future. Higher mortgage rates could slow the housing market's current momentum; yet because interest rates remain low when compared to historical levels, most analysts do not think increasing rates will negatively influence the housing recovery.

The effects of higher home prices and rising interest rates are expected to continue to play out over the summer.