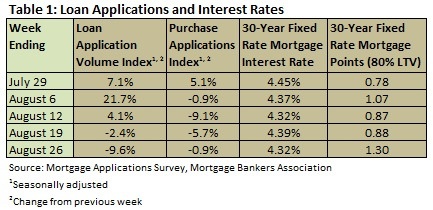

Performance across virtually all aspects of the housing market weakened in July. The one bright spot was mortgage interest rates, which remain below 4.5 percent (Table 1). These low interest rates are key to a new program—currently being considered by the Obama Administration—designed to reduce the number of foreclosures on the market and boost housing market activity without spending any additional Troubled Asset Relief Funds or other US taxpayer dollars.

This new plan, which is just one of the housing proposals making its rounds in the White House, will allow 37 million US homeowners with government-backed mortgages to refinance them at current interest rates. The plan will assist homeowners who have been unable to refinance their mortgages because they are either underwater (they owe more on their homes than their homes are now worth) or because they have been unable to meet the stricter lending requirements that are today's norm.

The upsurge in refinancing would immediately lower mortgage bills for millions of Americans – one estimate pegs the savings at $85 billion per year – freeing up cash that could be spent in other areas of the economy. By doing so, the program would extend the benefits of the Federal Reserve’s "keep interest rates low" economic policy beyond Wall Street and into Main Street.

This approach has risen to the top of the heap of housing proposals because it requires no additional taxpayer dollars be spent. And, since the federal government already backs these mortgages, there is little risk involved. Although Fannie Mae and Freddie Mac would lose a few points in mortgage interest, they will also have fewer bad loans on their books as the number of defaults and foreclosures will decline. Even more important, the program is reported to not require Congressional action.

One voice in favor of such a move is Frank E. Nothaft, the chief economist at Freddie Mac: “It almost seems to me you want to have some type of announcement or policy, program, or something from the federal government that provides that clear signal that we are here supporting the housing market and this is indeed a good time to really consider buying.”

Another interesting proposal being vetted in the White House, one that is probably closer to implementation, is a home rental program. Under this program, government entities like Fannie and Freddie would convert houses that are undergoing foreclosure into rental properties. This program will support higher housing prices by prevent even more lower-priced foreclosed homes from flooding the market.

One look at the housing construction and sales numbers for July illuminates the urgent need for additional ideas to support the housing market.

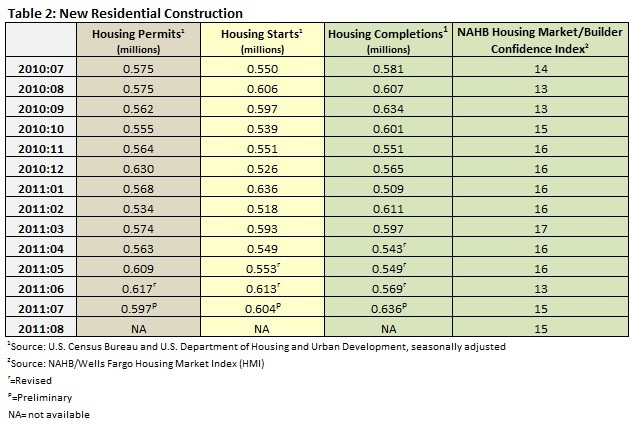

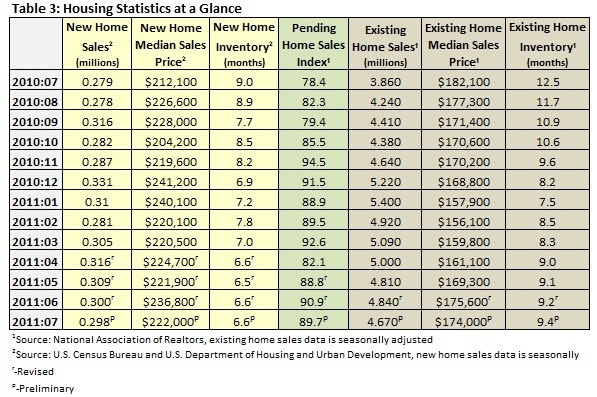

Residential construction lost some steam in July (Table 2). July starts were down 1.5 percent month over month (9.8 percent above July 2010’s level). Permits were down 3.2 percent (9.8 percent above July 2010’s level). Completions increased by 11.8 percent (9.5 percent above July 2010’s level). Completions of single-family homes came in at 470,000 on an annualized basis; this may not be good news, as sales of new homes were at 298,000 on an annualized basis (Table 3).

Builder confidence reflected this malaise. While this remained at 15 for the second straight month (Table 2), Bob Nielsen, chairman of the National Association of Home Builders (NAHB) highlighted some interesting (though far from optimistic) trends: “Builders continue to confront the same major challenges they have seen over the past year, including competition from the large inventory of distressed homes on the market, inaccurate appraisal values, and issues with their buyers not being able to see an existing home or qualify for favorable mortgage rates because of overly tight underwriting requirements.”

Interestingly, analysts at the National Realtors Association (NAR) saw nearly identical trends developing in the July existing home sales numbers (Table 3). Lawrence Yun, NAR chief economist, had the following to say about lending requirements: “Affordability conditions this year have been the most favorable on record dating back to 1970, but many buyers are being held back because banks are offering financing to only the most highly qualified borrowers, ignoring a large share of otherwise creditworthy buyers. Those potential buyers represent the difference between an uneven recovery and a much more robust housing market that could stimulate additional economic activity and create jobs.”

NAR President Ron Phipps added: “For both mortgage credit and home appraisals, there’s been a parallel pendulum swing from very loose standards which led to the housing boom, to unnecessarily restrictive practices as an overreaction to the housing correction. Beyond the tight credit problems, all appraisals must be done by valuators with local expertise and using reasonable comparisons—it doesn’t make sense to consistently see so many valuations coming in below negotiated prices, often below replacement construction costs. Banks frequently request numerous sales comparisons, well beyond the customary three comps used in the past, with little consideration that some of those properties may be discounted foreclosures used to valuate a traditional home in good condition. To a great extent, banks are exerting influence on appraised valuations with negative impacts for both home sales and prices.”

Comments

09-05-2011

Fannie Mae and Freddie Mac purchase over 70% of residential mortgage loans. This begs the question, “Who established the current unreasonable underwriting guidelines squeezing the “otherwise creditworthy” homebuyers out of the market? Surely not “the banks.”

Suz-Anne Kinney

Suz-Anne Kinney