Even as housing numbers show signs of a slow but ongoing recovery, foreclosures continue to overshadow positive developments. In early October, all fifty state Attorney Generals, headed by Iowa State Attorney General Tom Miller, launched an investigation into fraudulent foreclosure proceedings. The action was preceded by JPMorgan, GMAC and Bank of America suspending some or all foreclosure proceedings due to inaccurately processed paperwork.

At least some of the problem appears to come from the attorneys’ offices that handled the outsourced paperwork. Indications are that the employees were so swamped with foreclosures that they began signing off on affidavits without verifying their accuracy and backdating forms, among other alleged misconduct. Between the potential criminal allegations and suspended foreclosure proceedings, the long-term effects of this investigation could be anything from a blip in the long-term housing recovery to the potential to force bank closings.

With financial institutions already on the defensive, mortgage lenders are sure to be less than pleased at a recently published study in the American Sociological Review that studied predatory lending behavior during the height of the housing boom. Professor Douglas Massey and PhD candidate Jacob Rugh, of Princeton University, the study’s authors, analyzed demographics of those who received different types of mortgages from 1993 to 2000 in 100 of the largest MSAs. The study found that despite similar credit profiles and down payments, minorities were far more likely to be given a subprime mortgage than their white counterparts. “As a result, from 1993 to 2000, the share of subprime mortgages going to households in minority neighborhoods rose from 2 to 18 percent,” said Massey and Rugh.

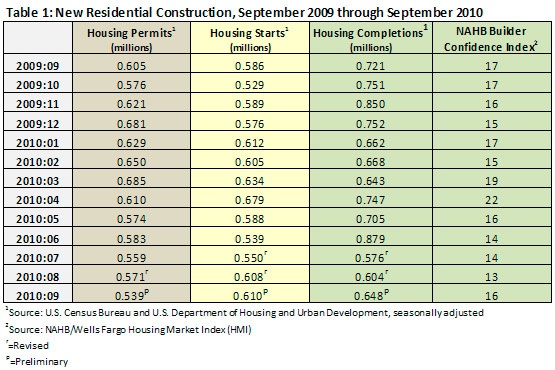

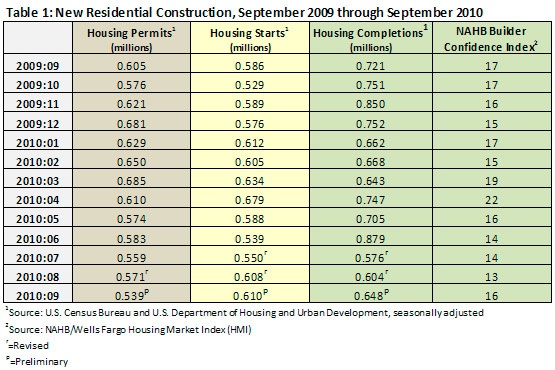

Aside from these disclosures, the housing numbers overall are still showing signs of healing. The most interesting indicator is the National Home Builder Confidence Index, which shows the first increase in builder confidence in five months. The index is now back to its June 2010 level (Table 1). While housing permits declined, housing starts and completions both increased, if only slightly.

To better explain the recent change in builder confidence, Bob Jones, Chairman of the National Association of Home Builders, said, “Builders are starting to see some flickers of interest among potential buyers and are hopeful that this interest will translate to more sales in the coming months.”

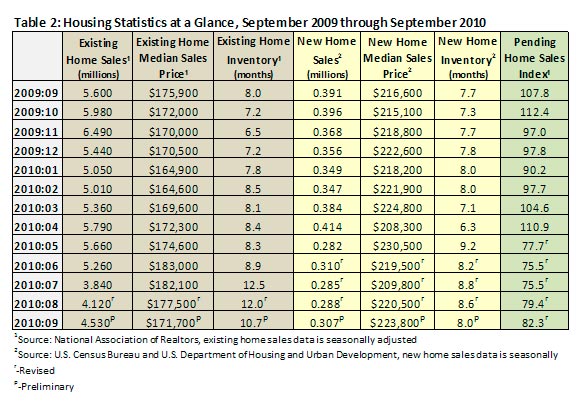

New and existing home inventories saw a marked decline in September, 1.3 and 0.6 months respectively, the result of an increase in new and existing home sales over the last two months (Table 2). The pending home sales index also saw an increase for the second month in a row. However, for the third month in a row, existing home median sales price saw a noticeable dip with an additional 3.2% decline.

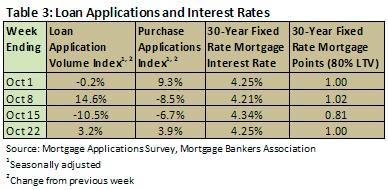

With 30-year fixed rate mortgage interest rates remaining at record lows currently hovering around 4.25% (Table 3) and median home prices staying at depressed levels, there is good reason to believe that new and existing home inventories will continue to drop over the coming months.

Lawrence Yun, National Association of Realtors chief economics, puts the recent events in the housing market into perspective, “A housing recovery is taking place but will be choppy at times depending on the duration and impact of a foreclosure moratorium. But the overall direction should be a gradual rising trend in home sales with buyers responding to historically low mortgage interest rates and very favorable affordability conditions.”

Suz-Anne Kinney

Suz-Anne Kinney