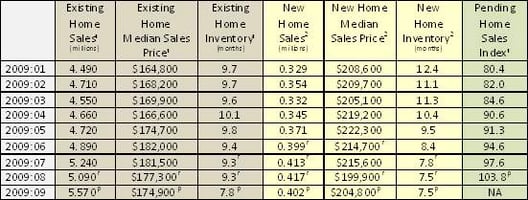

Median home prices for existing residences continued to decline, falling 8.5 percent to $174,900 in September . Months of inventory fell from 9.3 months to 7.8, a 16.1 percent change for the better. Compared to this month last year, inventory has improved by 22.8 percent. Lawrence Yun, chief economist for the NAR said, “The current housing supply is the lowest we’ve seen in two and a half years. If we could continue to absorb inventory at this pace, home prices would return to normal, modest appreciation patterns next year.”

Sales of new homes did not follow suit, declining 3.6 percent from August to September, down to 402,000. Inventory remained flat at 7.5 months of supply to 7.3 months, a 31.2 percent improvement over this time last year. Prices for new homes improved in September, increasing 2.5 percent to $204,800.

Table 1: Housing Statistics at a Glance, February through September 2009

1Source: National Association of Realtors

2Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development

r=Revised

p=Preliminary

NA=Not available at time of publication, due out on November 2, 2009

The Case-Shiller index confirmed the upward trend in home prices. The index increased 1.2 percent in August following a 1.3 percent increase in July. David M. Blitzer, Chair of the Index Committee at Standard & Poor’s commented: “Broadly speaking, the rate of annual decline in home price values continues to improve. While many of the markets remain down versus this time last year, the relative rate of decline has shown some real improvement.”< /font>

While the $8,000 tax credit for new home buyers is scheduled to end on November 30, Congress is currently working to extend the credit. In addition, a proposal for a $6,500 credit for other buyers is also under consideration. The first of these would be good for the market, as new buyers reduce inventory. The second credit might have negative effects, however, as current homeowners would have to put their current homes on the market and add to inventory in order to take advantage of the credit.

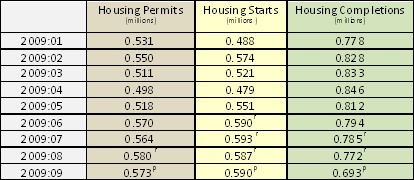

Housing starts rose a half of one percent in September. Permits were down 1.2 percent from August, however, and completions were off 10.2 percent (Table 2).

Table 2: New Residential Construction, February through September 2009

Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development

r=Revised

p=Preliminary

Suz-Anne Kinney

Suz-Anne Kinney