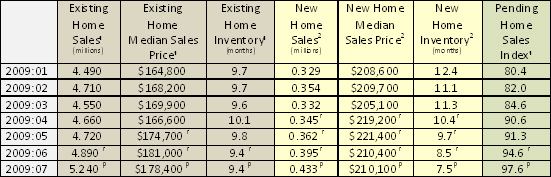

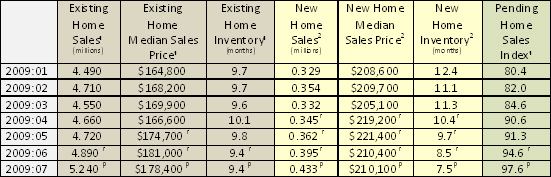

Statistics for the sale of both existing and new homes in July showed marked improvement (see Table 1).

Existing home sales accomplished the following milestones during the month; they:

- Increased for four consecutive months—the last time we saw four consecutive months of gains was in June 2004.

- Were higher than they were in July 2008—the last time year-over-year results were higher since November 2005.

- Saw the highest gain on record since 1999.

Existing home sales rose to 5.24 million in July, up 7.2 percent from June and up 5 percent from July 2008. A combination of first time buyers taking advantage of the last months of the $8,000 tax credit and improved affordability were responsible for the rise, according to the National Association of Realtor’s chief economist, Lawrence Yun. Falling interest rates may also have had an effect: 30-year, conventional, fixed-rate mortgages fell from 5.42 percent in June to 5.22 percent in July. Interest rates were at 6.43 in July 2008.

Despite the big jump in sales of existing homes in July, months of supply remained steady at June levels—9.4 months. Foreclosures hitting the market are partially responsible for this. Also contributing to the total is that homeowners who were holding their properties off the market until the market improved are starting to put their homes up for sale.

New home sales also saw big gains, rising 9.6 percent over June. While sales of new homes were still down 13.4 percent from July 2008, inventory improved by a full month, and now stands at 7.5 months.

Prices for both existing and new homes remained relatively stable, as Table 1 indicates. In addition, the Case-Shiller Home Price index in June (the last month for which data is available) showed improvement in 18 of the 20 cities they track. Overall, the index was up 1.4 percent. Case-Shiller’s Quarterly Index posted its first increase in three years for the second quarter.

Stabilizing home prices are having two—opposite—effects on the market: 1) buyers who were sitting on the sidelines because they expected prices would drop further (and lessen the value of their newly acquired assets) are now ready to act, and 2) sellers who have not put their homes up for sale because prices were too low will gradually flood the market, thereby increasing inventory.

The Pending Home Sales Index also set records; the index:

Rose for the sixth straight month, a first since the index’s inception in 2001.

Is at its highest level since June 2007, when it was 100.7.

Table 1: Housing Statistics at a Glance, January through July 2009

1Source: National Association of Realtors

2Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development

r=Revised

p=Preliminary

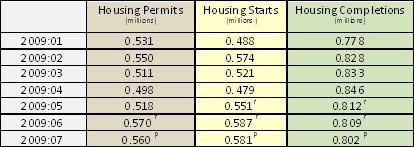

While improving existing and new home sales will eventually influence new residential construction numbers, these numbers dropped slightly in July. Permits decreased by 1.8 percent, starts decreased by 1 percent, and completions were off 0.9 percent (Table 2).

Table 2: New Residential Construction, January through July 2009

Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development

r=Revised

p=Preliminary

Suz-Anne Kinney

Suz-Anne Kinney