1 min read

Industry At a Glance: From Forest2Market’s August 2010 Economic Outlook

Suz-Anne Kinney

:

September 6, 2010

Suz-Anne Kinney

:

September 6, 2010

New numbers suggest growth in the second quarter was sluggish. After two revisions, GDP for 2Q2010 is now being estimated at 1.9 percent.

Although output of the manufacturing and service sectors continues to grow, forward-looking metrics (especially for manufacturing) suggest a slowdown may be in the offing. Excess capacity and lack of credit will constrict opportunities for business expansion. As with consumer spending, foreclosures and high unemployment will prevent housing from contributing significantly to GDP for some time.

A second monthly slowdown in new factory orders is heightening concern that manufacturing (and perhaps the broader economy) is cooling. New orders for manufactured goods decreased $5.1 billion (1.2 percent) to $406.4 billion in June. Excluding transportation, new orders decreased 1.1 percent. Durable goods orders dropped by 1.2 percent (to $190.4 billion)—led by transportation equipment—while nondurable goods fell by 1.3 percent (to $216.1 billion).

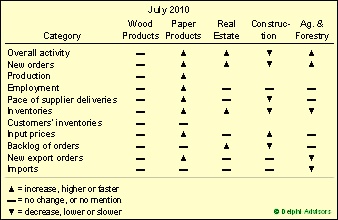

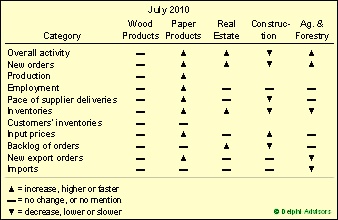

Most metrics of performance for paper manufacturing were positive in July (see table) but, strangely, Wood Products was not mentioned once in the report. Personal communication with ISM staff confirmed that Wood Products scored an index of 50 (i.e., no change) in all categories – a very unusual occurrence.

Table 1. Performance overview for Forest-Related Industries.

Data source: Institute for Supply Management

The service sector grew a bit faster in July than it had in June; the non-manufacturing index rose 0.5 percentage point (to 54.3 percent). Changes were rather spotty for the individual service industries we track. Real Estate, Rental & Leasing led the list of industries reporting overall growth, while Construction led the list of contracting industries.

Input prices rose at a slightly faster pace for manufacturing industries and a slightly slower pace for the service sector. Relevant commodities whose prices increased in July include : coated groundwood, corrugated containers/products, and both #2 diesel and gasoline. No relevant commodities were down in price. Coated freesheet and coated groundwood were listed as being in short supply.

If you would like a detailed forecast for forest-related industries, subscribe to Forest2Market's Economic Outlook, a 24-month forecast of performance in GDP, currency exchange rates, housing starts, oil prices and more.

Let Forest2Market do the groundwork; subscribe to the Economic Outlook and focus your resources on identifying and acting on the strategic advantages you’ll discover there every month. For more information, call (704) 540-1440 or click here.