2 min read

Industry At a Glance: From Forest2Market’s December 2010 Economic Outlook

Suz-Anne Kinney

:

January 3, 2011

Suz-Anne Kinney

:

January 3, 2011

The final manufacturing statistics are in for October. New orders, the forward-looking portion of the Census Bureau’s report on shipments, inventories and orders provided little in the way of encouragement for manufacturing. New orders decreased $3.4 billion (0.9 percent) to $420.3 billion in October. Excluding transportation, new orders decreased 0.2 percent. Orders for durable goods decreased 3.4 percent (led lower by transportation equipment) while nondurable goods orders increased 1.5 percent billion.

“I don’t think we’re in for a prolonged downtrend in new orders but this [report] is a reflection of the weakness we saw in demand over the summer,” Scott Anderson, a senior economist at Wells Fargo Securities Inc. in Minneapolis, said. “We had a buildup of inventories over the summer and that’s having a consequence.”

Norbert Ore, chair of ISM’s Manufacturing Business Survey Committee, had this to say about the preliminary numbers for November: “The manufacturing sector grew during November, with both new orders and production continuing to expand. November’s rate of growth is the second fastest in the last six months [but well off the pace seen between March and May]. Exports and imports continue to support expansion in the sector. Prices moderated slightly during the month, but comments from the respondents express concerns with regard to pricing pressures. The list of commodities in short supply increased, though short supply items are not yet posing significant problems. Manufacturing continues to benefit from the recovery in autos, but those industries reliant upon housing continue to struggle.”

The pace of growth of the non-manufacturing sector picked up in November, however, thanks to a 0.7 percentage point increase (to 55.0 percent) in its NMI/PMI.

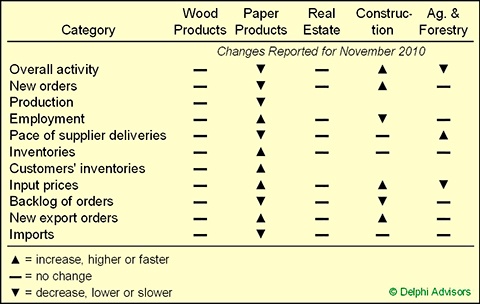

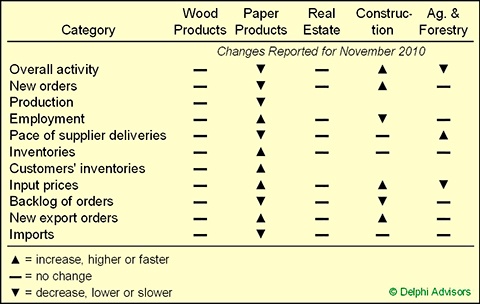

Wood Products reported no change in November, while the only real bright spots for Paper Products involved rising new export orders and slowing imports (see Table). Construction was the only industry among those we track to share in the service-sector expansion. Like Wood Products, Real Estate was unchanged for a second month; Ag & Forestry contracted.

Table: Performance overview for Forest-Related Industries.

Data source: Institute for Supply Management

Input prices of both manufacturers and service industries rose at a slower pace, which is surprising in light of the lengthening lists of commodities reportedly up in price. E.g., caustic soda, chemicals, corrugated containers, fuel and paper were among the commodities up in price. The only relevant commodity down in price was paper rolls. Coated freesheet and coated groundwood were described as in short supply.

Rail traffic has been a bright spot of economic activity since December 2009. Rail traffic during the week ending December 4 was up compared to both prior-year levels and cumulatively over the prior 48 weeks. The Association of American Railroads (AAR) reported Lumber and Wood Products as well as Pulp, Paper, and Allied Products shipments were both higher for the most recent week while Primary Forest Products fell. On a cumulative prior-48 week basis all three categories were up according to AAR. That bright spot appears to be dimming; however, as the year-over-year rate of increase for all intermodal shipments has been slowing since mid-year.