2 min read

Industry At a Glance: From Forest2Market’s October 2010 Economic Outlook

Suz-Anne Kinney

:

November 2, 2010

Suz-Anne Kinney

:

November 2, 2010

The Business Cycle Dating Committee at the National Bureau of Economic Research (NBER) has declared the recession over. According to the committee, the recession lasted 18 months, from December 2007 to June 2009.

The $64,000 question remains: where do we go from here? There are two camps of thought on this question. One believes we’re in for a prolonged period of sluggish growth over the next few years. Another believes we’ll be in a second (or double-dip) recession by the end of next year.

All agree that the recovery to date has been less than stellar. David Rosenberg, chief economist at Gluskin Sheff has labeled the recovery “The Great Disappointment,” citing the following economic indicators:

- While GDP has recouped 69 percent of its loss since hitting a low in June 2009, employment has recouped only 9 percent of its losses since hitting a low in December 2009.

- Household net worth has recovered only 28 percent since its low in the first quarter of 2009.

- Wages and salaries have rebounded only 36 percent from their March 2009 lows.

- Housing starts have recouped only 7 percent of their losses since their April 2009 low.

- Home prices have recovered only 13 percent from their low in April 2009.

- Consumer sentiment has regained only 27 percent of its losses since hitting a low in November 2008.

- New and existing home sales are at all-time lows. They have never recovered.

As to the future, the view of the “slow growth” camp was summarized in a Bloomberg.org article: “the sectors of the economy that traditionally drive it into recession are already so depressed it’s difficult to see them getting a lot worse.” Also making this possibility less likely is the fact that historically, back-to-back recessions are rare. The view of the smaller “double-dip” camp is based on anemic growth in GDP since the fourth quarter of 2009, which included a significant downward revision to second quarter 2010 growth and growth of just 2 percent in third quarter 2010. The outlook, therefore, appears to be between fairly bad to worse.

Manufacturing and Service Sector Performance in September

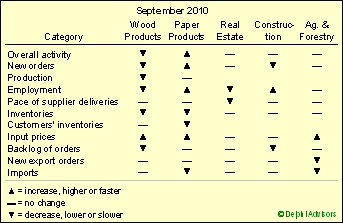

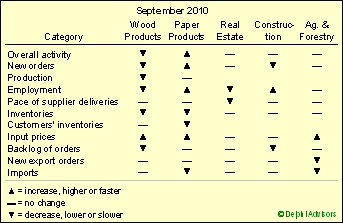

ISM’s manufacturing report points to “an economy that is growing but not growing very rapidly,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. After exhibiting no changes for two months, Wood Products reported some movement in September; unfortunately, most of the changes that did occur were disappointing (Table 1). Paper manufacturing, on the other hand, lengthened its string of positive changes.

Table 1. Performance overview for Forest-Related Industries.

Data source: Institute for Supply Management

Growth in the service sector picked up speed in September, nearly offsetting the PMI decline; the non-manufacturing index rose by 1.7 percentage points (to 53.2 percent). None of the service industries we track showed much change. One Construction respondent indicated that the “general state of the business has not changed in the last three months. The market is still soft for new sales due to financing requirements.”

“This is slow and steady growth,” remarked Anthony Nieves, chair of ISM’s non-manufacturing survey. “There’s still this cautiousness about whether or not things are turning the corner but people want to remain optimistic.”

Input prices paid by manufacturing industries jumped at a significantly faster pace (9 percentage points), but the rate of increase slowed slightly (-0.2 percentage point) for the service sector. Relevant commodities whose prices increased in August included corrugated containers, diesel fuel and paper. No relevant commodities were down in price. Coated groundwood and coated freesheet were commodities listed in short supply.

Exports have been trending upward as well, with many ports seeing increases in the export rates for both wood and paper products. This can be attributed both to a weakening dollar and high demand from China. (Despite efforts to curb growth, the Chinese government recently announced that their economy grew at a rate of 9.6 percent over the last quarter.)

Let Forest2Market do the groundwork; subscribe to the Economic Outlook and focus your resources on identifying and acting on the strategic advantages you’ll discover there every month. For more information, call (704) 540-1440 or click here.