While southern yellow pine (SYP) exports to China are on track to increase 65 percent over 2016 numbers, the US South isn’t the only region that is experiencing significant export growth driven by China’s demand for timber.

Per recent information published in the Nikkei Asian Review, China recently updated its building codes to include traditional Japanese wood-frame home construction methods, which is also creating demand for Japanese timber imports. This building style incorporates sugi cedar, hinoki cypress and karamatsu larch—three species that are common in Japan—for use as beams, pillars and other structural components used by home builders.

The building code change and preference for Japanese wood has added to the demand for Japanese wood resources; preliminary export values of Japanese timber products in 2017 hit their highest level in over four decades.

Japanese Wood Fiber Exports

Hiroshima-based timber producer Chugoku Mokuzai says that exports of sugi and hinoki timber are growing for markets like China, Taiwan, South Korea and even the US. For Japanese producers—struggling with a shrinking labor force of loggers and a decline in domestic demand—growing exports may be the future of the industry.

2017 figures will likely reach nearly 32 billion yen ($288 million), up more than 30 percent from 2016. Exports from January through November 2017 jumped 37 percent from the previous year to 29.2 billion yen; total 2016 exports of 23.8 billion yen were already eclipsed by the end of September.

The preliminary 2017 export total would equal roughly one-tenth of Japan's wood production by value last year. Logs comprised the greatest proportion at 42 percent of exported products, with sawn timber making up 17 percent.

- China was the largest import destination for Japanese wood resources by value, taking in roughly 40 percent.

- China was the largest purchaser of Japanese logs, and Philippines was a major purchaser of lumber.

Japanese cedar logs bound for China. SOURCE: Nikkei Asian Review

Per a sawmill operator in northeastern Japan, the new growth comes as "Japanese timber is relatively inexpensive at a time when prices worldwide are spiking." Japanese wood products are significantly cheaper than those from New Zealand, a fierce competitor in certain wood products sectors in the region.

Japanese timber prices have also remained steady amid a stable balance of supply and demand, while prices of wood from North America and the southern Pacific have been on the rise due in part to expanding demand. Lumber prices remain near historical highs throughout North America as Canadian producers are battling a shortage of accessible timber on the stump and new duties imposed on imports of softwood lumber into the US.

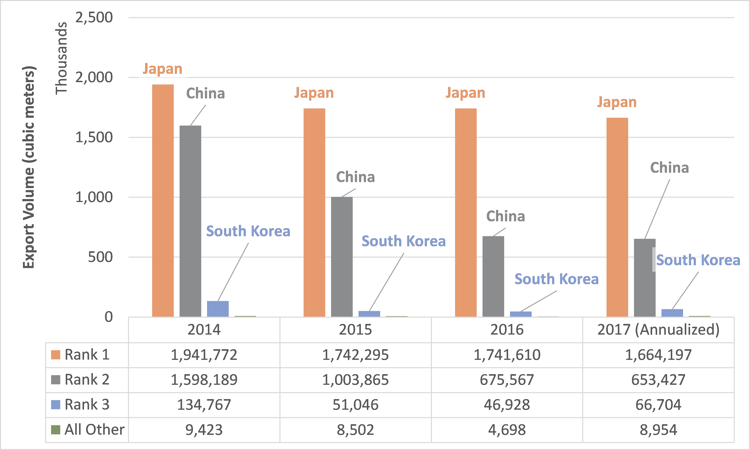

The result of this price increase can be seen in the chart below. While the US is a major exporter of logs to Asian destinations (Japan alone imported 1.6 million cubic meters of Douglas fir logs from the US Pacific Northwest in 2017), those exports have trended down over the last four years as prices have remained high and/or increased sharply. Prices in October 2017 crested the $770/MBF mark after consistently remaining above the $700 level since early 2Q2017. December brought a continued surge: the weighted average price for delivered domestic Douglas fir logs was $833/MBF, and the weighted average price for export logs was $858/MBF.

Douglas Fir Exports to Asian Destinations

Per a separate article in the Nikkei Asian Review, "What's most important is consumption of plywood and other materials, not log exports," said Atushiro Inoue, head of the Japan Plywood Manufacturers' Association. The success of Japan's exporters is based on providing processed, high-value products that meet overseas demand at a competitive price.

As Japanese producers continue to look for additional high-demand export opportunities, China’s growing housing economy and recent predilection for Japanese building styles and materials should create sustained demand. Last fall, China’s GDP growth forecast was 6.8 percent, which is still strong by global standards. This kind of growth will likely keep Japanese exporters busy in the near term.