"How big should I let my trees grow?""Should I let my trees grow for a longer period of time, so I can get a big price." "How long will it take them to reach sawtimber size?" "Will the market for sawtimber be strong when I am ready to sell?" These questions continue to vex timberland owners.

For the past 11 years, we at Forest2Market have been helping landowners answer these tough questions. Over the first 7 of these years, it was a sure bet that if you let your trees grow into sawtimber, you would receive a higher price for them. Furthermore, if you let them grow into large sawtimber, you would receive an even higher price.

In fact, to help landowners understand this relationship, we started measuring price in pounds per linear foot (PLF). Pounds per linear foot is exactly what it sounds like. It is a measure of how many pounds there are in one foot of tree. (For detail into how we make this calculation, see Daniel Stuber's post on PLF.) So, a big tree with a large diameter will have more pounds per foot than a skinny tree. Since a sawmill can cut a wide board (2x12) from a big tree, these big trees traditionally commanded larger prices than; say, trees from which they could cut just a 2x4.

From 2000-2007, the market data clearly suggested that larger trees (i.e. sawtimber) commanded a higher price per PLF than smaller trees such as chip-n-saw. As a result, it was easy to advise landowners to grow big trees that commanded both a higher price per ton, but also a higher price per PLF.

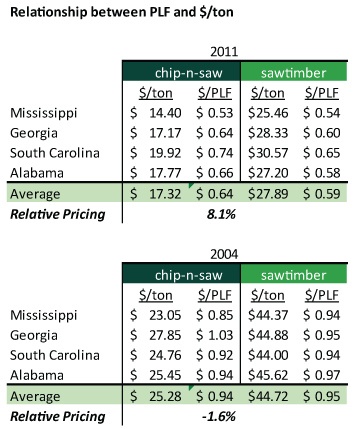

In 2008, however, the tried and true relationship between the size of the tree and price per PLF started to change. Using the relative measure of PLF, the data now shows that small sawtimber trees (chip-n-saw) are commanding a premium over large sawtimber trees. The charts below demonstrates my point.

In 2004 (the good old days when timber prices were high), the price per PLF (again, a relative measure) for chip-n-saw was 1.6% below that of sawtimber. This meant that landowners received a premium (on an equivalent basis) for growing larger sawtimber trees. There was a clear financial disincentive to grow smaller chip-n-saw trees.

If we take data for 2011, this trend has reversed quite radically. For example, the current data says smaller chip-n-saw trees command an 8% premium over larger sawtimber trees.

Could this just be a function of the depressed sawtimber markets due to the poor economy and deplorable housing start numbers? Maybe, but consider the following factors.

- Over the last decade, most of the southern plywood plants – those that traditionally bought large trees – have closed. This is a structural change in the market, not a short term trend.

- All the technology in the lumber and building products manufacturing is geared toward using smaller trees. Again, the growth in the OSB, MDF, LVL and oriented strand lumber markets is a structural change, not a short-term one.

- Third, the new demand for woodfiber is coming from wood pellet manufacturers and utilities. In both cases, they are using small trees (or even a lower grade product).

- Recent reports from Forest2Market’s Mill2Market Lumber Pricing Service showed that 2x4s sold for more than 2x12s. So, sawmills are getting paid more to cut 2x4s than they are for a “premium” 2x12. And since 2x4s can be cut from small chip-n-saw logs, sawmills have no incentive to buy or pay a premium for large logs.

Is this a permanent trend or just an aberration due to current market conditions? I am not entirely sure, but the evidence suggests there are many reasons why landowners should take another look at their timber holding periods in light of the structural changes happening in the market.

Comments

09-06-2011

Pete, your logic and numbers are excellent. But this is a major paradigm shift for most of us who have been in the business for years and most landowners are going to have a difficult time understanding this one. You’re probably going to have to do this again in simple steps to get the paradigm shift across using real world examples. Also, I noticed North Carolina is not in the chart - how does that market compare?

Comments

Southern Yellow Pine Lumber Prices: A Trend toward

09-14-2011

[...] in the market. (To read about the effect this has had on timber markets, read Pete Stewart’s blog Sawtimber vs. Chip-n-Saw) Meanwhile, beginning in the fall of 2010, 2×8’s became the lowest value dimension in the [...]

Comments

Plywood Plants Close – More Evidence Structural Ch

09-16-2011

[...] Plywood Plants Close – More Evidence Structural Changes Will Force Landowners to Grow Smaller Logs Posted on September 16, 2011 by Pete Stewart A few weeks ago, I blogged about the structural changes in the sawlog market that should lead landowners to rethink how big they should let their trees grow. [...]

Comments

Silvicultural Practices and the Adoption of New Te

09-21-2011

[...] signs that log prices are starting to favor chip-n-saw size logs (see Pete Stewart’s posts: sawtimber vs. chip-n-saw and plywood mill closures), the mills that have made the conversion will be prepared if landowners [...]

Comments

01-06-2012

This is quite a dilemma to have as the market can be unpredictable when you least expect it. Having information of this type is a great way for landowners and even lay people to have an idea of the ins and outs of this industry. Especially today, people can be torn between profit and doing the right thing, so, thanks for an informative post.

Pete Stewart

Pete Stewart