In economic models, the marriage of art and science is evidenced by events that are difficult to predict and, as a result, not easily accounted for in forecasts. The 571 inches of rain that fell across the South in 2013 (the second largest rainfall in the region over the last decade) is a prime example.

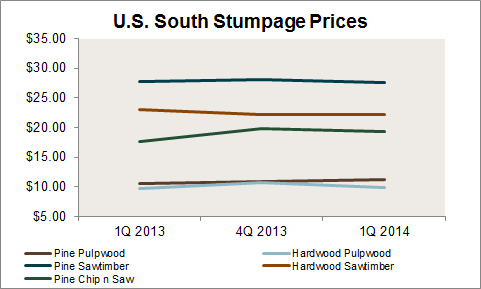

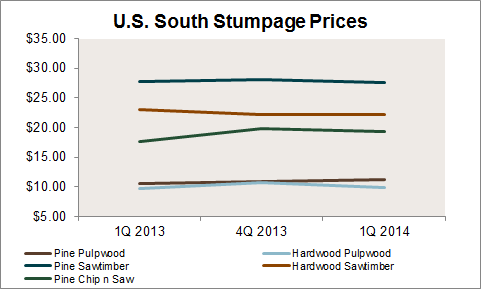

Short-term changes in stumpage prices – the prices paid to timberland owners for timber standing on the stump – are generally related to weather events that cause a supply interruption. Forest2Market’s data supports a correlation between increases in rainfall and increases in wood raw material costs.

The 571 inches of rain that fell across the South represented a 22.2 percent increase from 2012 to 2013. Above-normal rainfall equated to wet operating conditions that impeded logging, in turn restricting supply and driving stumpage prices up.

This effect wore on through the late winter and early spring, lessening price decreases when salvage operations after a February ice storm added supply to the market. Markets are just now approaching normal, finally shrugging off these waterlogged conditions and salvage-related impacts.

Weather conditions are just one variable in the mountains of data and correlations economists analyze. When forecasting stumpage prices, it is necessary to look at a number of factors. Oil prices are an important input, as are general economic factors like GDP growth and currency exchange rates. Forecasts should also account for industry effects (housing starts), local market nuances (ground conditions), and seasonal factors (holiday curtailments).

While forecasts will always be subject to the changes brought about by uncertainty, they remain extremely powerful tools. Stumpage price forecasts from Forest2Market provide an overview of current events that are likely to affect prices, how those factors correlate to price changes, and a reliable estimate of future prices.

Later this week, we will will take a closer look at how prices fared during the first quarter of 2014.