3 min read

Loss of Hardwood Markets Represents a Structural Shift Affecting Residuals

John Greene

:

January 17, 2019

This is the first in a series of posts covering the recently-published report compiled by Forest2Market titled “Changes in the Residual Wood Fiber Market 2004 to 2017.” Our analysis uncovered four key findings that show both structural and temporal market shifts in recent decades have impacted the markets for wood fiber residuals. This independent report was commissioned by Resources for the Future (RFF), the US Endowment for Forestry & Communities, Inc. (Endowment) and the National Wooden Pallet & Container Association (NWPCA).

As global consumer trends and demands continue to shift at an escalating pace, a new Forest2Market report shows that both structural and temporal market shifts in recent decades have impacted the markets for wood fiber residuals. The report analyzes data from the US Forest Service, Forest2Market’s proprietary database of timber transactions and other scientific research to understand the relationship between the supply and demand of wood residual materials over a 10-year period from 2007-2017.

The geographic scope for the study was divided into two broad regions of the United States: the US South and the Pacific Northwest (PNW). Study objectives included:

- Uncovering the underlying market forces that impact the residuals market

- Assessing the nature and implications of these impacts

- Determining whether the changes occurring in the market are:

- Fundamental, structural changes that necessitate a systematic problem-solving approach, or

- Temporary, short-term, cyclical changes that require a corporate-level response

The study found that there are four underlying market forces that most impacted the residual market.

Key Finding #1: There has been a structural decline in printing and writing papers and production of other end products derived from hardwood fiber.

The hardwood pulp and lumber production markets in the US have been in a state of structural decline for a number of years as consumer trends and preferences are moving away from products made from hardwood fiber. As a result, the mill portfolio in the US South has been dynamic, which has in turn impacted the residuals market.

Demand for printing and writing papers is declining 6% annually and is expected to continue. In 2017, newsprint demand was down 10% from the previous year and most of the newsprint plants in the US South have been closed or converted to other machines. In the past five years alone, three southern pulp mills have been converted from hardwood to pine—further evidence that hardwood pulp demand is steadily eroding. The recent demand trends for boxboard and liquid packaging have also been flat to decreasing. This has resulted in a 25% decrease in hardwood fiber demand in the past 10 years and expectations are that this market will continue to evaporate.

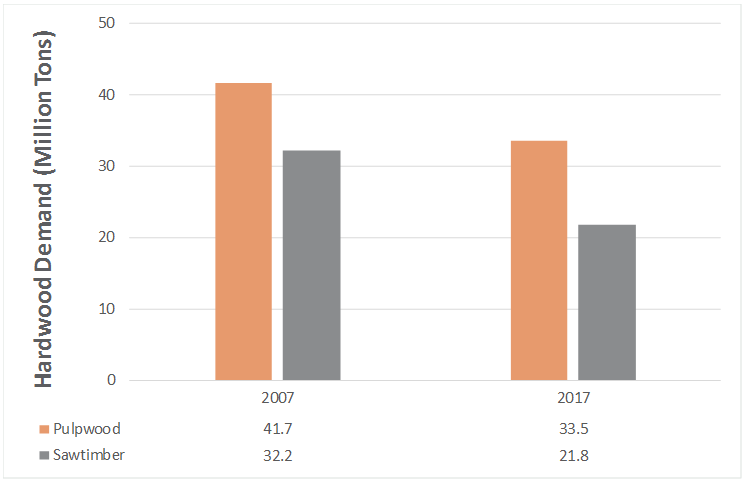

Demand for hardwood pulpwood and sawtimber has decreased by 8 million tons (20%) and 10 million tons (32%), respectively, and this change in demand has resulted in the closure of 66 hardwood sawmills throughout the US South since 2007. The hardwood lumber industry, which was hard-hit by the Great Recession, produced 30% less lumber in 2017 versus 2007 and residual production has also declined precipitously.

It is worth noting that while some of the hardwood resource does go into secondary manufacturing (furniture, flooring, cabinetry, etc.), the manufacturing process itself—and thus the residual material—has moved overseas due to cheaper production costs. US exports of hardwood logs to China reached nearly 1.4 million tons in 2017, a 270 percent increase over 378,000 tons in 2007.

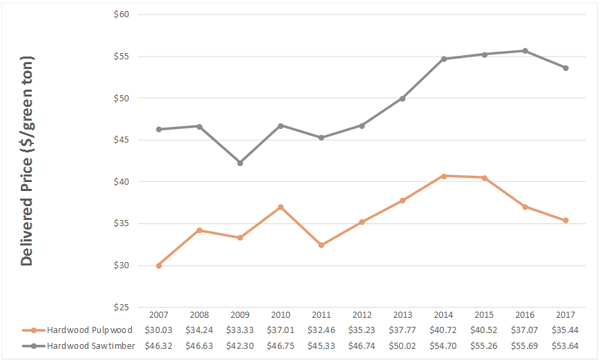

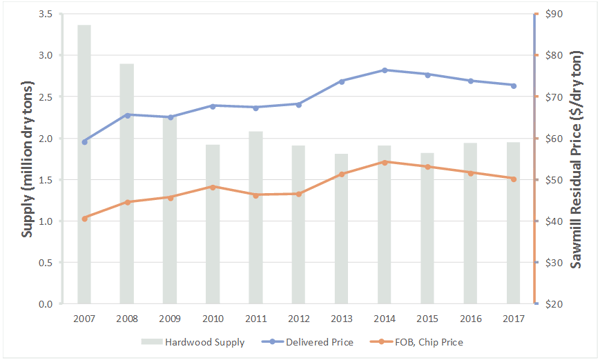

Interestingly, while the number of hardwood mills in the US South has decreased, the trend for hardwood pulpwood and sawtimber delivered prices has not. Unlike pine products, prices for both hardwood sawtimber and pulpwood have increased markedly over the last decade. However, the sharp rise in price after 2011 is more a function of supply than demand, as availability is driving price.

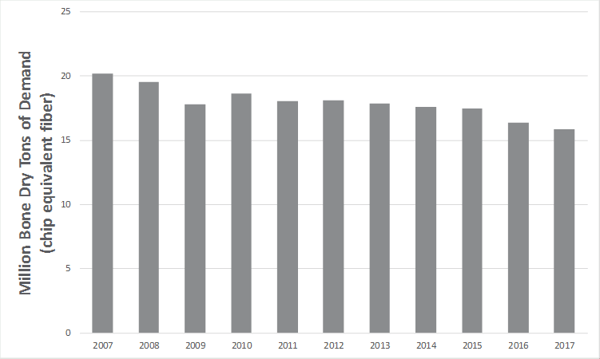

Unlike softwood, hardwood sawmill production—and thus residual production and supply—has not recovered to levels seen prior to the Great Recession in 2008. During the same time period, demand also decreased by 4.4 million bone dry tons.

Despite the drop in both supply and demand, prices for hardwood residual chips in the US South have increased by roughly $10/dry ton over the past 10 years. We would have expected a stronger price reaction in the hardwood residual market; however, the decrease in demand more than offset the decrease in supply, having only a marginal effect on price.

Interestingly, a recent corporate announcement from Georgia-Pacific (issued after the study was completed) supports the study’s key finding that hardwood markets continue to undergo a structural decline. Georgia-Pacific (GP) recently said it is leaving the paper business and will permanently shut down all paper machines, as well as its wood yard and pulp mill at its plant in Port Hudson, LA. While some employees will stay on at the plant in support of its consumer tissue and towel business, GP said the decision is not due to poor performance at the plant, but rather the declining paper market. The move follows GP’s closure of another paper mill in Camas, WA that was completed last May.

Conclusion

Consumer preferences run countercurrent to products made by hardwood sawmills and pulp mills, and new market entrants are not choosing hardwood as the feedstock of choice.

- Instead of fighting the inevitable decline, hardwood pulp mill operators have largely switched to pine pulp or taken mills out of production.

- The hardwood lumber industry has not adapted to new market realities as evidenced by declining mill numbers, as well as lumber and residual production.

As a consequence of these trends, Forest2Market’s report concludes that the hardwood residual market has undergone a tremendous structural shift—one the industry as a whole will have to address if it is to survive. Hardwood solid wood and pulp producers in the US South will continue to be challenged by these structural market changes as demand continues to shift to softwood products.