2 min read

Lumber Composite for June & July: A Monthly Comparative Analysis

Gabe Rogers : August 29, 2017

Forest2Market’s comprehensive lumber benchmark is designed specifically to help lumber manufacturers review recent historical prices and forecast upcoming lumber prices in order to make better operating decisions and improve profitability. This report is issued to customers every Thursday afternoon and is based on current transaction data, resulting in an extremely sophisticated and accurate market report. To provide an expanded view of the weekly lumber benchmark, I have compiled the data for June and July and created a monthly comparative analysis that really details the report’s value.

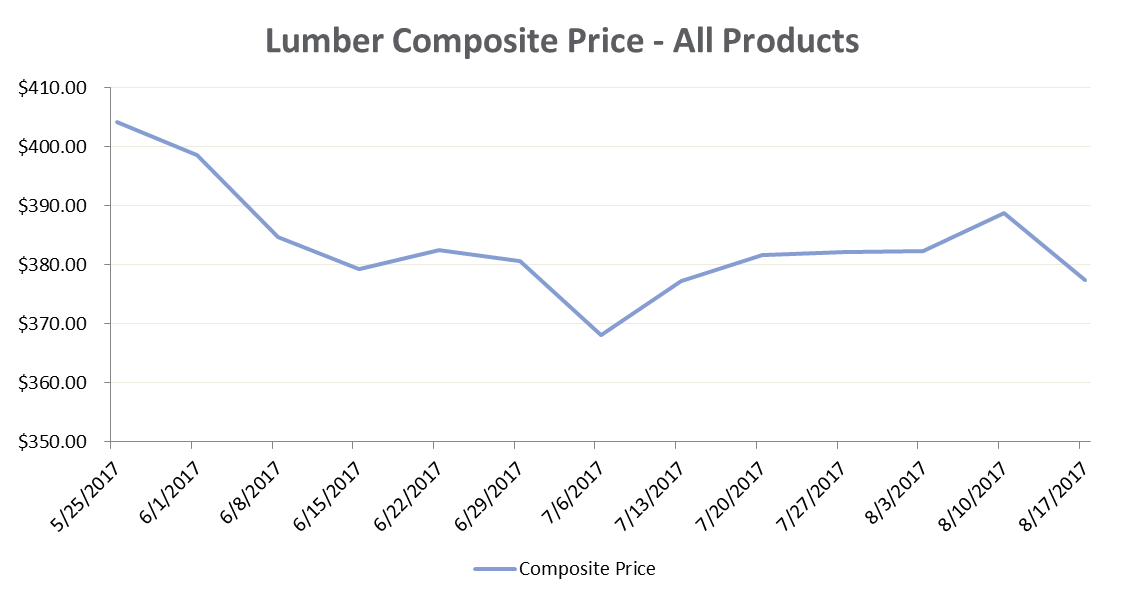

Composite Price

A composite price is a standard indexing method used for tracking the lumber market. An overall average is calculated by using volume for weighting by category, and the composite is affected by price, volume and relative value.

At the end of May, the composite price for all lumber products was roughly $405/MBF as noted in the graph above. With each ensuing week, the composite price decreased to approximately $368 and it wasn’t until early- to mid-July that the price started to move back up, eventually reaching $382. Looking at this change from a monthly perspective, the composite price decreased from a weighted average of $382 to $371—a 3 percent decrease. This gives an overall sense for market performance, but what about individual product segments?

Product Segments

Timbers (wood cut to a thickness greater than 2”, e.g. 4x4, 4x6, & 6x6) experienced an overall decrease of 31 percent in volume from June to July, while dimensional lumber (wood cut to a thickness of 2” or less, e.g. 2x4, 2x6, 2x8, 2x10, & 2x12) experienced a decrease of 4 percent in volume. The price for Timbers dropped from $412 in June to $407 in July, a 1 percent decrease. Dimensional lumber experienced a larger price decrease, slipping 3 percent from $373 to $362. Of the various grades of dimensional lumber, Grade #2 suffered the greatest price drop—falling 4 percent from $372 to $358.

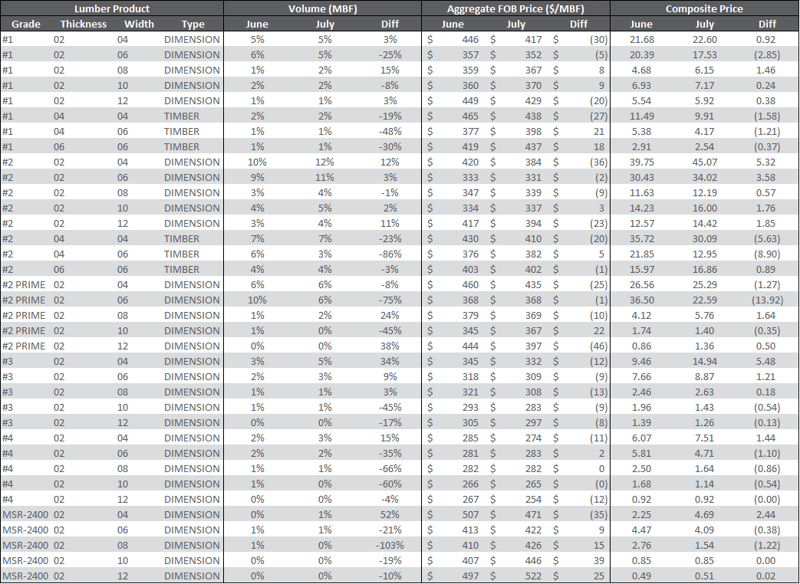

This data is very useful in helping lumber manufacturers understand broad segment trends, but further analysis is needed to really understand detailed product categories. The following table displays Forest2Market’s product categories for the same time period.

Do large volume swings have an effect on composite price? If we examine the #2 PRIME 02x06 lumber product above, the volume dropped more than most products (-75 percent) but the Aggregate FOB Price changed only minimally. Based on this information, it would seem that this volume decrease had little effect on the overall composite price. However, if we examine the total dollars and the composite breakdown, #2 PRIME 02x06 experienced the greatest effect on the change in composite price by a factor of -13.92.

Change Effect

Intuitively, one would assume that a negative volume difference combined with a negative price difference would result in a negative change effect on the composite price and vice versa for positive volume and price. This, however, is not always the case. Lumber product #2 02x08 experienced such a small negative change in volume and price that the change effect actually resulted in a positive effect of 0.57 on the composite price.

The lumber composite price is a highly complex index of the entire lumber market, and the shifts in individual product volume and price don’t always translate directly into positive or negative impacts. Rather, it is the combination of these shifts in relation to the other products that ultimately determine the direction and scope of impact to the composite price.

Forest2Market synthesizes all of this highly complex data before producing the weekly lumber benchmark, which results in a concise market report and operational tool. This report provides the most accurate market data available to help lumber manufacturers gain a competitive edge in a fast-paced, competitive global marketplace.