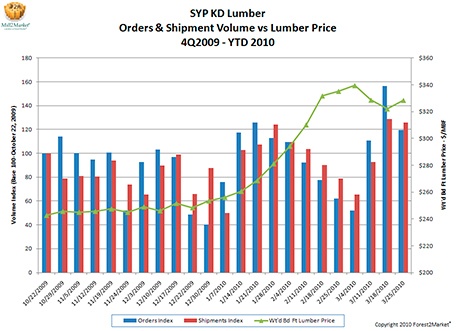

Based on actual data from orders and invoices, this chart captures the story behind lumber prices. It is a snapshot of the market through time.

Fourth quarter of 2009

Orders and shipments were fairly well balanced. Prices were stable as a result.

Holiday Weeks

Buyers took some down time during the weeks of Christmas and New Year’s, and orders dropped.

January

As the new year began, there was a sense of optimism that the mini-rebound we saw in the housing market in the fall would continue into the new year. During the week of January 7, buyers returned to the market and orders jumped.

As the increase in demand took shape, however, wet weather in the South limited supply of Southern Yellow Pine logs to sawmills. During the weeks of January 7-21, production—and therefore shipments—couldn’t keep pace with orders. Buyers, concerned they would not get adequate supplies, increased their orders and began paying higher prices. Dramatic upward momentum was underway.

February

This trend continued until the week of February 4, when orders and shipments found equilibrium, and the trend reversed. Demand retreated from the market and orders declined, partly in reaction to high lumber prices and partly in reaction to housing and construction statistics, which increasingly indicated a weak Spring market.

March

This drop in demand and the fact that mills could increase shipments led to a market correction in March. Prices softened as a result. The market responded dramatically to the lower prices. For the week of March 18, orders shot higher. Buyers were not only taking advantage of the price drop, they were also anticipating new activity spurred by the homebuyer tax credits.

Last week, prices rose for the second straight week. While supply is still hampered in areas, this rise is mostly demand driven. The Mortgage Bankers Association’s mortgage application volume figures, which increased 1.3 percent for the week ending March 26, indicated that homebuyers were rushing to take advantage of the April 30 deadline for the tax credit.

This level of detailed insight into the lumber market, plus weekly prices by species and length, are available.

Suz-Anne Kinney

Suz-Anne Kinney