From Forest2Market's January 2011 Economic Outlook.

The positive news from manufacturing continued into December and was joined by the service sector. The pace of growth in manufacturing picked up again in December, with the Institute for Supply Management’s Purchasing Managers Index (PMI) rising to 53.9 percent, from 52.7 in November (50 percent is the breakpoint between contraction and expansion).

Bradley Holcomb, chair of ISM’s Manufacturing Business Survey Committee, said this about the end of the year numbers: “Manufacturing is finishing out the year on a positive note, with new orders, production and employment all growing in December at faster rates than in November, and with an optimistic view toward the beginning of 2012 as reflected by the panel in this month’s survey.”

The non-manufacturing sector also edged up in December, reflected by a 0.6 percentage point rise (to 52.6 percent) in the Non-Manufacturing Index (NMI). Despite this growth, Anthony Nieves, chair of the ISM’s Non-Manufacturing Business Survey Committee, said this: “Economic growth continues to be slowed by the lag in employment.”

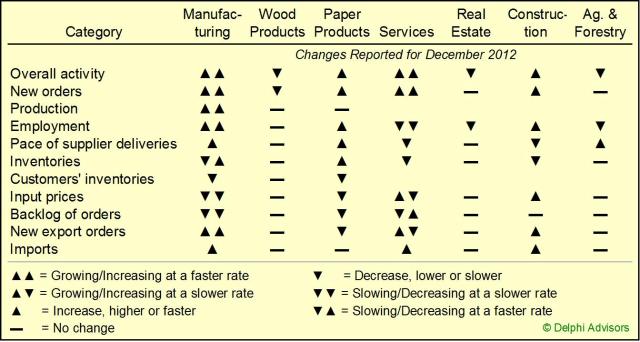

Table 1 highlights the changes in the ISM’s December reports for forestry related industries.

- Table 1: Performance overview of selected industries. Source: Institute for Supply Management

The only reported change in Wood Products reflected a slowdown in new orders. The “market has definitely slowed in the last month, and is expected to remain so this month,” wrote a Wood Products respondent. Paper Products expanded, the main forward-looking “negatives” being a decline in new export orders and a rise in inventories. Real Estate and Ag & Forestry both reported contraction in overall activity, while Construction expanded.

One cloud that could dim manufacturing’s silver lining is a potential explanation behind December’s PMI uptick: expiring 2011 business tax incentives. Sitka Pacific Capital Management’s Mike Shedlock presented a list of 10 such incentives and hypothesized that producers moved a significant amount of output forward in time to take advantage of those credits. If Shedlock’s thesis is correct (and it was lent credibility from a number of sources, including this Machinery respondent to ISM, who commented, “Business seems strong, but likely due to tax advantages of purchasing capital expense items”), manufacturing activity is likely to reset lower in/after January 2012.

Another survey conducted by the Chicago Federal Reserve echoed Shedlock’s prediction by noting national economic activity reflected in November’s index (-0.37) declined from October’s level (-0.11). In the Chicago index, a negative value indicates growth below the economy’s average growth rate, but not necessarily a contraction.

ISM’s latest semiannual economic forecast disagrees with the implications of both Shedlock’s thesis and the Chicago index, however. “Economic growth in the United States will continue in 2012,” begins the forecast’s executive summary. “The manufacturing sector, overall, is positive about prospects in 2012 with revenues expected to increase in 17 industries [out of 18 in the survey], while the non-manufacturing sector appears slightly less positive about the year ahead, with 15 industries expecting higher revenues [also out of 18 surveyed]. Capital expenditures, a major driver in the U.S. economy, however, will increase only modestly in the manufacturing sector, while investment in the non-manufacturing sector will remain essentially flat.”All of the individual industries we track each month (Table 1) expect higher revenues in 2012.

Suz-Anne Kinney

:

February 2, 2012

Suz-Anne Kinney

:

February 2, 2012