Wood fiber prices have been extremely flat in the Lake States region over the last two years despite an economy that has been growing at a strong pace. The same dynamic can be seen in the US South, though the price drivers and the supply/demand dynamics are different. What’s keeping prices in the Lake States so consistent?

The forest industry in the Lake States has some unique characteristics when compared to other timber-producing regions across the US. The area boasts an abundance of high-quality wood raw materials and has a long history in pulp and paper production. But that has changed in the last two decades as paper use continues to decline, which has changed the regional industry and the competition for forest resources.

The seasonality of timber harvesting is a significant driver of price in the Lake States region. While the US South experiences weather disruptions that affect fiber deliveries, the Lake States (and the Northeast US and eastern Canada) region is more unique in that fiber deliveries are significantly affected by the spring season for roughly 6 to 8 weeks. There is oftentimes discussion about limited logging and trucking capacity due to this seasonality, but really this is more a need of managing “surge” capacity at the right time as winter comes to an end. Not only is a surge needed in harvesting and trucking, but large inventory space is needed to store the fiber necessary to get a mill through the spring season. While all species groups are affected by seasonal access to timber, hardwood production is the main driver of the industry in the Lake States region.

As such, meticulous hardwood inventory management is key to understanding market pricing for all regional fiber. Hardwood inventories increase significantly in the winter to include as much as 80 days’ worth of system-wide inventory designed to last through the spring season. It is equally important for the system to maintain a minimum of 30 days’ worth of hardwood inventory during the rest of the year so that winter surge capacity is not stressed beyond its capabilities.

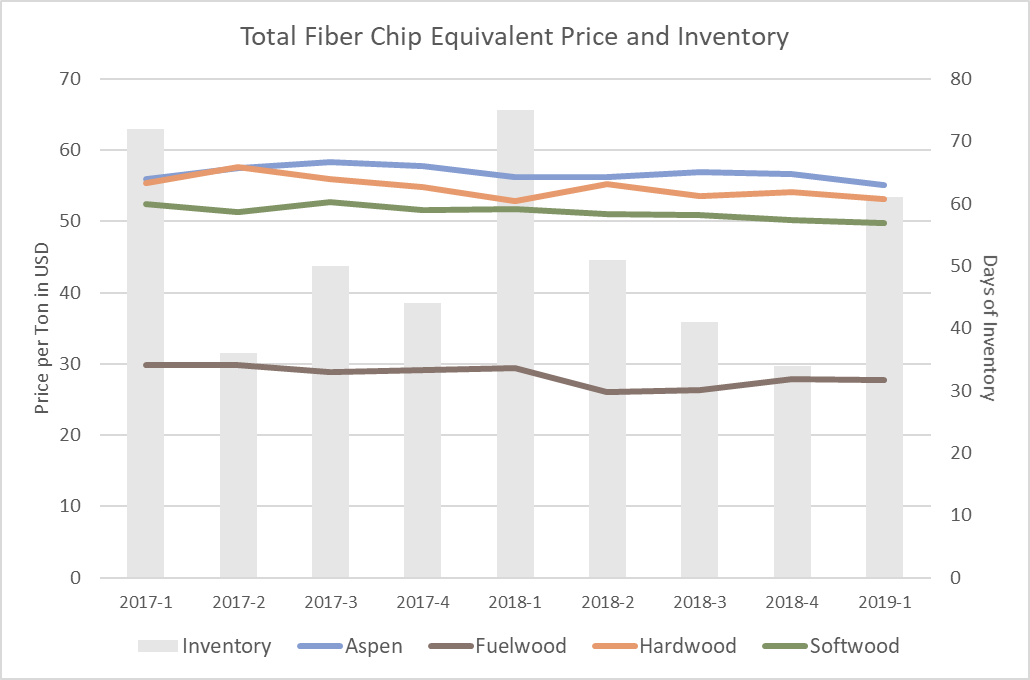

When analyzing the end-of-quarter hardwood inventory data over the last several years, we see a clear pattern of Q1 inventory building—typically over 70 days’ worth. When we overlay prices for each of the three species groups (hardwood, softwood, and aspen), there is no correlating increase or decrease as there was when inventories dipped below 30 days in 2Q2014. When that event occurred, prices spiked over 20 percent during the next year before leveling off in late 2016. Having healthy Q4 inventories (over 30 days) is key to making sure the “surge” logging and trucking capacity needed for late winter can handle the inventory build that is needed for adequate inventories the next spring/summer.

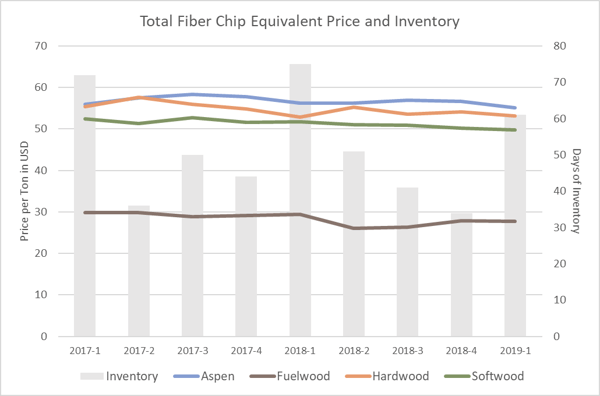

The chart below demonstrates very consistent quarterly inventory levels and relatively consistent price performance for all products since 2017. Over the two-year period, hardwood prices demonstrated the most volatility after peaking in 2Q2017, though they gradually ticked down by roughly 8 percent since then. However, notice the markedly lower inventory levels in 1Q2019. At roughly 62 days of average inventory for the quarter, these numbers are significantly lower than in years past.

Seasonality has a tremendous impact on wood fiber prices in the Lake States. As the weather begins to turn warm, the potential for a wet summer could impede harvest activity in the Lake States. Since inventories were lower during 1Q, this is a dynamic that regional mill facilities will need to monitor in the coming months to avoid a scramble to secure fiber.

Pete Coutu

Pete Coutu