2 min read

Pacific Northwest Log Markets: Domestic and Export Prices Diverge

Joel Swanton : February 26, 2019

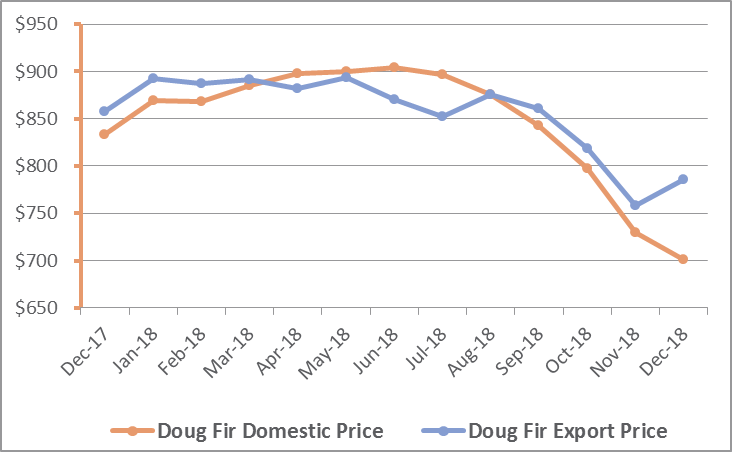

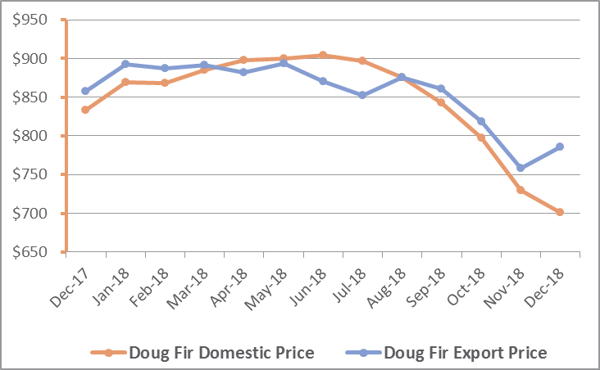

Beginning in 4Q2017, prices for domestic and export Douglas fir logs in the Pacific Northwest (PNW) rose steadily before they spiked in 2Q2018 to record levels. As I wrote in 4Q2018, log and lumber prices in the PNW began to drop precipitously by September of last year as lumber market speculation subsequently waned. We’re now halfway through 1Q2019 and the trend shows no signs of slowing, but how low can prices go?

Log Prices

In December 2018, the weighted average price for delivered domestic Doug fir logs was $701/MBF, which was 16% lower than a year earlier. Export prices followed a similar path to domestic prices throughout 2018, however notice the trend reversal in the chart below for December. In that month, export prices diverged significantly from the downward slide of domestic prices and jumped nearly $30/MBF, or roughly 4%.

Douglas Fir Log Prices

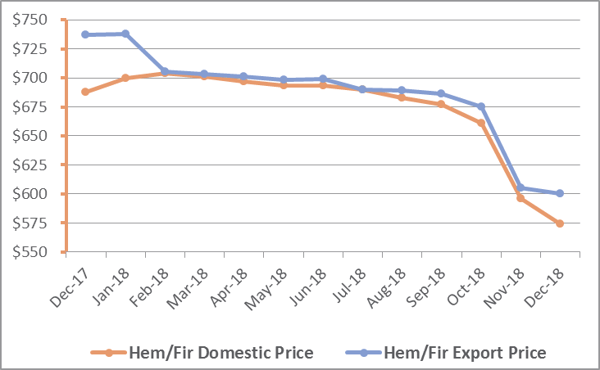

In December 2018, the weighted average price for delivered domestic Hem/Fir logs was $574/MBF, which was 17% lower than a year earlier. Export prices tracked almost exactly to domestic prices throughout most of 2018, however, like Doug fir export logs, the price disparity also grew in December as export prices declined at a much slower rate—0.8% compared to 4%.

Hem/Fir Log Prices

Near-Term Outlook

The combination of domestic and export competition for logs in the PNW drove prices to sustained highs for most of 2018, but a rebalancing of the market has largely taken place. There are three dynamics to watch as we progress through 1Q and into the busy part of the 2019 building season.

- Domestic log price decreases are a delayed reaction to the extreme volatility of lumber market in 2018. However, notice that lumber prices are beginning to flatten in the chart above while, again, log prices continue to drop. That delayed reaction will continue to affect log prices in the near term, but I don’t foresee Doug fir prices dipping below $650/MBF or Hem/Fir prices dipping below $550/MBF in 1H2019.

- The global trade and tariff situation has resulted in some shifting trade flows in the lumber market. Canadian exports to the US are down (though dollars are up), while exports to China have markedly increased. During late Q1 last year, transportation snags and rail car shortages in Canada were partly responsible for driving US lumber prices ever higher. BC rail service to the lumber sector will remain stretched thin as the Canadian rail lines prioritize services to grain and petroleum exports. Major BC lumber producers have announced or implemented significant production reductions as a result of reduced Annual Allowable Cuts (AAC) in the province. This situation will not change in the near term.

- Total breakbulk log exports out of the PNW (including British Columbia) were down 15% in 2018; exports to China alone were down 21%. However, the export pricing reported in the charts above suggests that these logs are poised to become more expensive in 2019. Some of this reduction in export volume is finding its way to the domestic market, which has helped to alleviate higher log costs for regional producers.

Log exports are directly affected by Chinese tariffs imposed in 2018. Though exports are somewhat reduced on the US PNW side, the market has partially absorbed the tariffs in the range of 10%. BC is moving to partially fill the gap, though recent policy announcements there may limit exports. While trade data is not yet available for FY2018, it is likely that Chinese tariffs affected exports from the US South in 4Q as well, and China is moving to secure replacement volumes from other destinations—New Zealand, South America and Western Europe. If those countries secure long term agreements, it will be difficult for the US PNW to maintain high prices if and when the tariffs are retracted.

The decrease in domestic prices is welcomed news for the regional sawmilling industry, as many of these producers were driven to reduce production—slashing operating hours, curtailing shifts or temporarily curtailing production altogether—over the last year. If we’ve learned anything in that time, it’s that the PNW log market will not stay in a state of inertia for long. Constant analysis of current market prices and market intelligence will be imperative to minimizing costs and maintaining profitability in a highly fluid and volatile market.