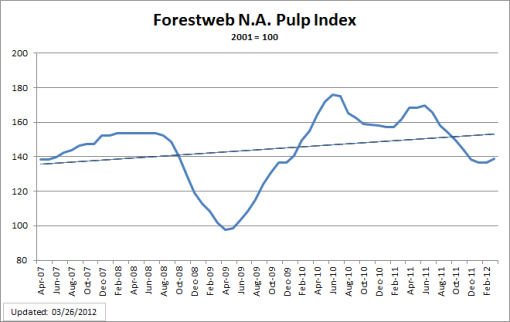

As we exit the first quarter of 2012, the Forestweb North American Pulp Index indicates that pulp prices are still below the 5-year trend line. Prices have stabilized, however, and appear to have started an upward trend.

As of March 26, the Forestweb North American Pulp Index had increased by 1.6% since January. That level—138.66—is 14.31% below March 2011’s level of 161.81.

NBSK list prices in March have remained at USD $870/tonne throughout March. In fact, NBSK has been within pennies of this price since the beginning of February. During March, though, some reports indicate that the supply of NBSK is tightening, the result of mill shuts, operational problems, and upcoming spring maintenance shuts. In addition, FOEX reports that the global supply/demand balance is healthy enough to set the stage for April price increases. One U.S. pulp sales agent told Diane Keaton of Industry Intelligence, “There appears to be some true demand, with papermakers around the world generally sitting on low pulp inventories. Paper production is up slightly in North America and more in Asia, and in North America, merchant inventories are down, leading to some restocking. Also the slight improvement in the economy has helped.”

These conditions led Domtar and Canfor Pulp—on March 15—to announce a $30/tonne increase in NBSK pricing for April 1. West Fraser, Tembec, Resolute Forest Products and International Paper all followed suit. In addition to tighter markets, FOEX mentioned the following reasons for the price increases:

- The continuing strength of the Canadian dollar

- The industry’s need to recover the ground it lost during the 2nd half of 2011

- A smaller gap between spot and contract prices in February/early March (spot prices have been reported at $20-$30/tonne higher in March)

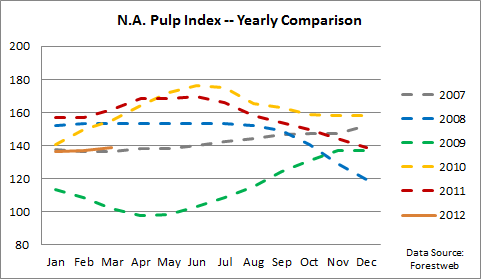

While most analysts believe the announced price increases will be achieved, there is a great deal of skepticism about whether the upward trend will hold into the 3rd quarter. In the 5+ year comparison figure below, the 3rd quarter drop can be seen in both 2010 and 2011 prices following June highs. It should be noted, however, that prices in those years were higher than current prices.

Another factor that could lead a 2nd half weakening in pulp prices is the threat of another recession that still looms over the global and US economies. According to Forest2Market’s Economic Outlook, this is still a distinct possibility:

“Were the U.S. economy immune to outside influences, recent data releases would tend to favor the idea of continued – albeit, sub-par – growth. GDP growth 4Q2011 was accelerating from levels in 2011, employment is finally picking up from when the recession ended in 2009, residential construction is gradually trending higher, and the manufacturing and service sectors are still expanding (although at a slower pace). The greatest domestic risk for the United States seems to be the condition of the U.S. consumer who is not spending and continues to deleverage. While headline inflation is not raging, prices are trending higher nonetheless; the combination of flagging personal incomes and rising fuel costs will discourage increased near-term consumer spending on non-fuel items.

The United States does not exist in a vacuum, of course. Another downturn could be just one domestic or foreign crisis away. [Considering the challenges of the European debt crisis, the fragility of the political situation in the Middle East, the possibility that Chinese growth is slowing and the inability of lawmakers to deal with US debt,] it is unlikely the future will unfold without a hitch. As a result, we continue to believe there is more downside than upside risk. As a result, we are maintaining our forecast for another recession by mid-year 2012. As stated in the past, we think the downturn will be comparatively mild and that residential construction (unlike the last recession and recovery) will perform its traditional role of pulling the economy out of the ditch by mid-2013.”

View a sample of Forest2Market’s Economic Outlook.

Comments

Monday Morning Wood: Demand declines in Newspaper

06-18-2012

[...] in an industry that tanked like the print media after the housing bubble broke, check out the Forest 2 Market blog. The bottom line is the structural changes in the media are also bringing change to other [...]

Suz-Anne Kinney

Suz-Anne Kinney