New-home construction in the US dropped unexpectedly in September primarily due to a fall in multifamily building. While the data was mixed, residential real estate continues to confound as the market can’t decide which way it wants to go from month to month.

Housing Starts, Completions & Permits

Housing starts dropped 9 percentage points to a seasonally adjusted annual rate (SAAR) of 1,047,000 units in September. Single-family starts accounted for 783,000 units, which is 8.1 percent above the revised August figure of 724,000.

The volatile multifamily segment plummeted 38 percent to a SAAR of 264,000 in September. Starts for multifamily buildings with five or more units fell to their lowest level since June, 2013. But with rents rising at their fastest pace in 10 years due to strong demand, September's drop is likely just temporary.

Housing completions were down markedly in September, while new permits showed a solid increase. Completions were at a SAAR of 951,000, which is 8.4 percentage points below the revised August estimate of 1,038,000. Permits were at a SAAR of 1,225,000, which is 6.3 percentage points above the revised August estimate of 1,152,000.

Regional performance was down across the board in September, as confirmed by the US Census Bureau report. Seasonally-adjusted housing starts by region included:

- Northeast: -36 percent; (-13.8 percent last month)

- South: -5.3 percent; (-13.1 percent last month)

- Midwest: -14.1 percent; (+6.4 percent last month)

- West: 0.0 percent; (+6.3 percent last month)

“Residential construction may have been a drag on growth in the third quarter,” said Ryan Wang, an economist at HSBC Securities USA Inc. “Multifamily construction is starting to level off,” though “single-family still seems to be on a gradual growth trend,” he added.

Builder Confidence

Home builder confidence inched down in late early October; The National Association of Home Builders’ (NAHB) index fell two points from the prior month to 63. However, that number is the second-highest level of the year, following a reading of 65 last month (a number over 50 indicates more builders view conditions as good than poor). “The headline index is consistent with higher new home sales over the next couple of months,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

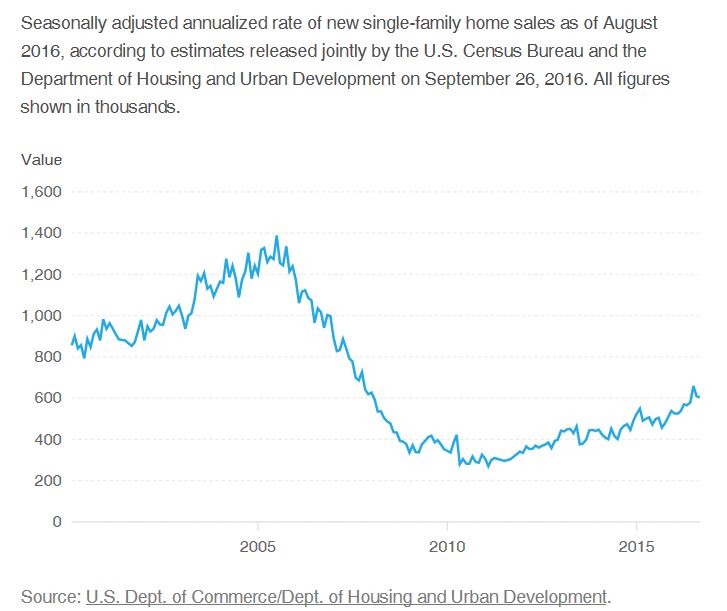

Mortgage Rates & Home Sales

The 30-year fixed mortgage rate ticked up slightly in September from 3.44 to 3.46. This is 10.5 percent below the January 2016 rate, and is the second lowest point it has been since April, 2013.

Sales of existing homes (roughly 90 percent of the housing market) have grown steadily this year, reaching a post-recession peak in June, according to the National Association of Realtors. Job growth, wage gains and low interest rates on mortgages have supported home buying. While low inventory of new and existing homes is driving up prices, some potential buyers are facing tough financial decisions as the millennial cohort begins to affect the market.

As we reported last year, millennials have distinct tastes, buying habits and concerns that are unique to their generation. While homeownership has not been a priority (primarily due to a dearth of affordable housing and a lack of savings, available jobs, income stagnation, etc.), millennials are beginning to tiptoe into homeownership.

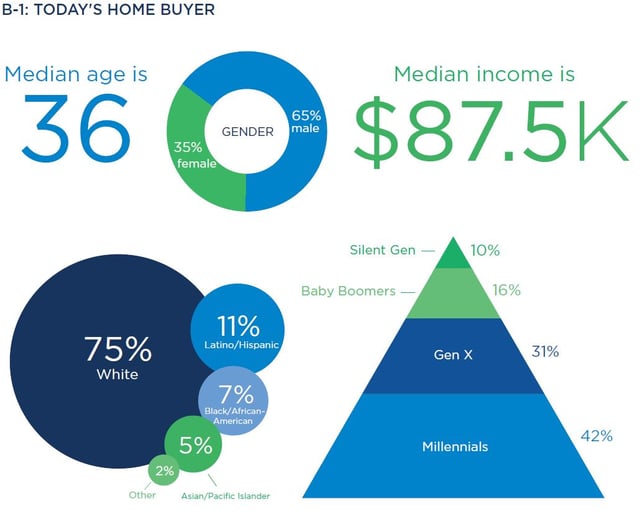

Zillow recently published a comprehensive, eye-opening report based on a survey of 13,000 respondents and found that first-time buyers account for 47 percent of purchases. (When the company conducted the same survey last year, it found that only 33 percent of prospective buyers were first-timers.) The report notes that “The home buying experience is both an intimidating financial transaction and an emotional milestone. Half of home buyers in the U.S. are under 36, meaning a new generation— Millennials—is shaping the future of real estate. Despite demographic reports about young adults’ urban lifestyles, Millennials share their parents’ aspirations for a single-family home, often in the suburbs.” Other insightful information from the report includes:

Buyer Data

- Half (50 percent) of today’s home buyers are under the age of 36, and 47 percent are first-time buyers. Solo home buyers are in the minority; most buyers are shopping with a spouse or partner (73 percent).

- Eighty-three percent of buyers are shopping for a single-family house. Their top considerations are affordability and being in a safe neighborhood.

- Across all generations, almost nine out of 10 buyers (87 percent) use an online resource at some point in their search for a home to buy.

- Millennial home buyers share many concerns and preferences with their grandparents’ generation, both choosing homes with shared community amenities and considering townhouses at higher rates than those ages 35-49. However, Millennials’ home-buying process is significantly different from their grandparents' process.

- Millennial home buyers wait longer to buy a first home than previous generations. The modern-day “starter home” is nearly as large as the median home for “move-up” buyers, and costs about 18 percent less.

- Millennial home buyers undertake far more social home searches, seeking input from friends, relatives and neighbors 58 percent of the time.

- Millennials scrutinize more agents, asking friends and family about their experiences with agents and reading online reviews more than other generations.

- When it comes to choosing an agent, Millennials and other generations share their top priority: a sense that an agent is trustworthy and responsive to their needs.

Source : Zillow Group, Consumer Housing Trends Report 2016

Source : Zillow Group, Consumer Housing Trends Report 2016

Seller Data

- Today’s sellers are most often members of Generation X (38 percent), and the majority (63 percent of all sellers) are listing a home for the first time.

- Those listing a home for sale commonly had a recent job change or promotion (26 percent), a shift in financial circumstances (24 percent), retirement (16 percent) or another life change, such as the birth of a child, marriage, divorce, or becoming an empty nester.

- Most sellers are trading their homes for one they see as an upgrade, seeking a median of 100 more square feet and a home that costs an average of 11 percent more.

- Unlike buyers, Millennial sellers are just as likely as older generations to use an agent for a sale. However, Millennials are more likely than older generations to use online resources in their sale as well.

- Sellers look to their agents most often for pricing help (50 percent) and contract negotiation (35 percent). Millennials tend to rely on their agent for legal advice and determining the best time to list their home for sale.

- Eighty-three percent of sellers make home renovations before listing. The most common improvements are painting (45 percent) and renovating the bathrooms (31 percent).

- When marketing their homes, Millennials are more likely than older sellers to use video footage (29 percent) and promote their listing on social media (28 percent).

- In the time it takes to sell—2.8 months on average—two-thirds of sellers (66 percent) elect to change their listing price at least once. Thirty-nine percent changed the listing price of their home two or more times.

In the wake of the latest housing data, Jonathan Gray, global head of real estate at The Blackstone Group investment firm commented, "The housing market is definitely a bright spot in the U.S. [economy].” He added that home building is not keeping up with demand and population growth, and "The result of that is you're seeing rising rents and rising home prices. And we expect that to continue." Gray also admitted that "We don't expect to see the growth in value in the next couple years that we've seen in the last four or five years. But we don't expect to see some sort of sharp decline in the near term."