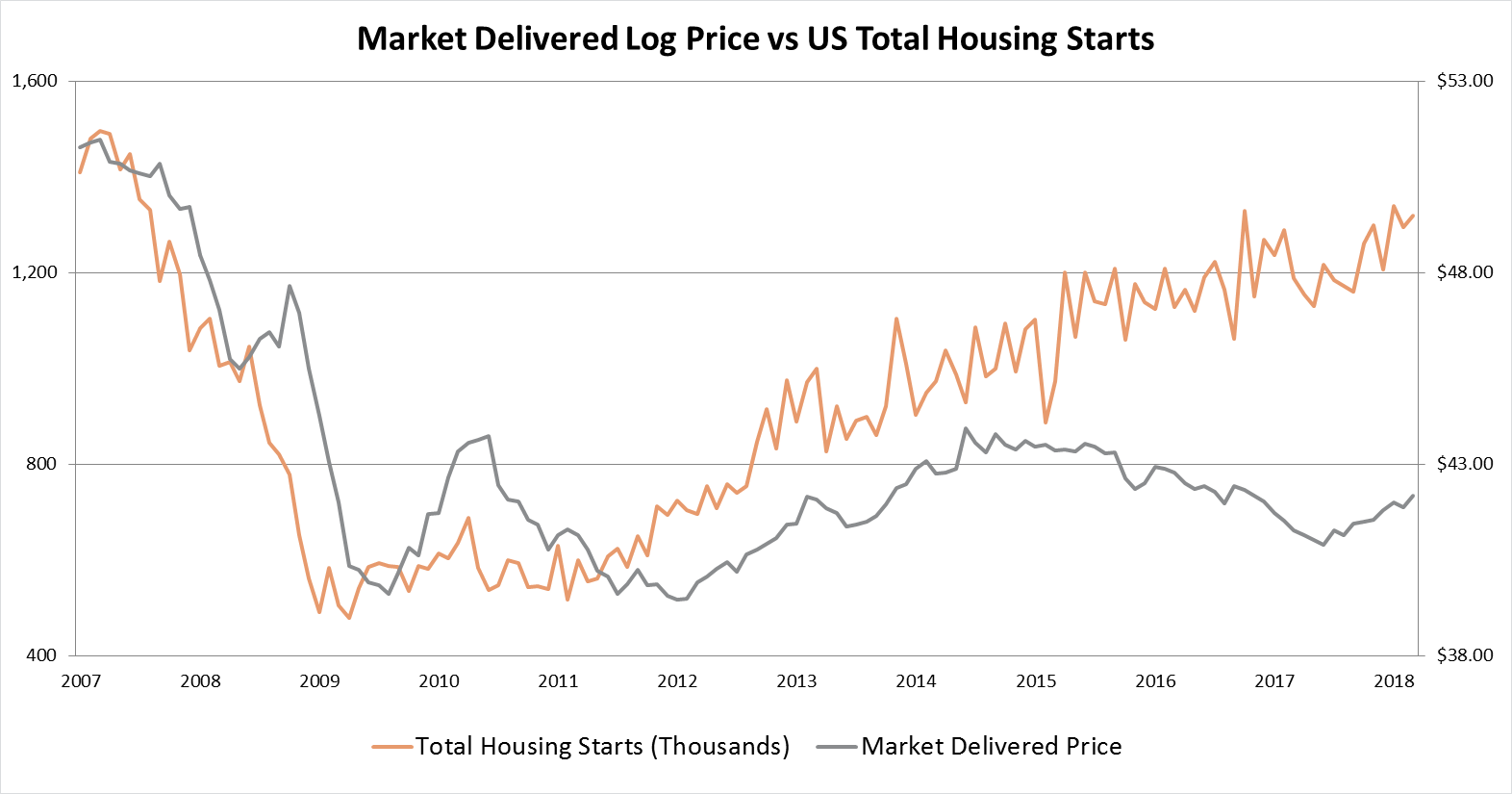

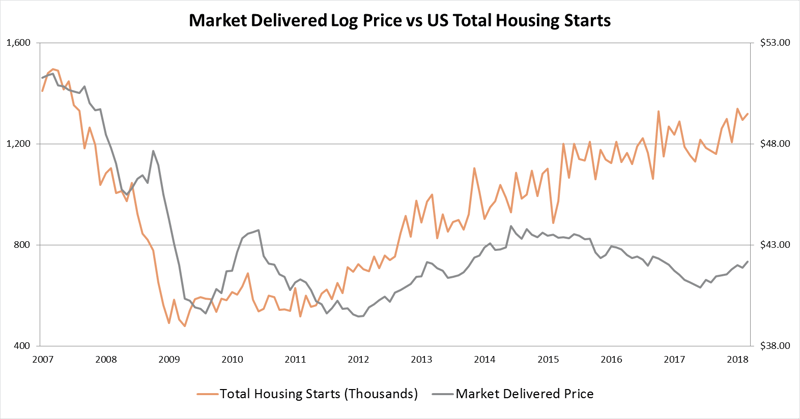

Southern yellow pine (SYP) lumber prices reached record highs just six months ago in a region where log costs have remained relatively flat for the last several years. This trend has driven high profits for SYP mills since buying logs is the single largest operating expense in lumber manufacturing. However, the current situation is not likely to last in the US South, as a 25 percent increase in lumber production volume over the next 3 to 4 years is expected to increase competition (and prices) for SYP sawlogs.

A number of mutual factors affect both lumber and log prices, but each regional market also has independent drivers that do not overlap, which is why there is such a disconnect in the US South. The two primary factors that drive log prices at both the mill gate and on the stump are the general economic principles of supply and demand.

- Supply of logs (as standing timber): While many mills were forced to adapt and improve efficiencies in the immediate aftermath of the great recession, many landowners pulled their timber off the market in anticipation of higher prices in the future. This combination has caused the total volume of logs on the stump to rise throughout the US South for the last decade. This oversupply combined with improved mill log-to-lumber yield is keeping log prices low, even as demand for lumber and sawmill production increases amid an improving housing market.

- Demand from mills: Over the last decade, SYP lumber production has increased from a low of 11.8 billion board feet in 2009 to a high of 18.2 billion board feet in 2017. Despite increasing demand over that time, the combination of an excess supply of standing timber and the surviving mills increased log-to-lumber recovery has kept log prices down. Pine log prices have remained pretty steady across the US South over the last decade.

An Inevitable Harvest Increase on the Horizon

For the average southern SYP sawmill, log cost can make up 75 percent of the total cost of the mills’ finished product; it is therefore the single most important cost component in the supply chain. Sawmill procurement teams are tasked with finding the perfectly sized log, maximizing the mill’s market share of that log (while not overpaying), and reducing the variability in log size and quality as much as possible to maintain profitability.

As more existing sawmills expand capacity and new greenfield projects come online throughout the South, log consumption in the region will increase significantly, which will result in additional competition and larger procurement zones for many mill facilities. To put a single example in perspective, a new greenfield mill producing 250 million board feet (MMBF) of lumber with a yield of 1 MBF per 4 tons will consume a whopping million tons of logs each year. It takes a resource-rich procurement zone to sustainably supply a facility of this size, especially if competitive mills access the same zone.

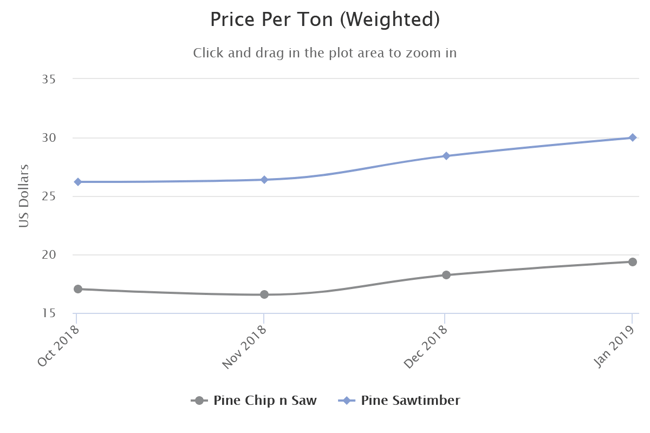

Even if stumpage prices remain unchanged in the near term, larger mills will access expanded procurement zones and incur higher hauling costs, and their delivered log costs will therefore be higher. Further, with such a dramatic increase in overall demand, stumpage prices will inevitably rise across the US South, especially in areas with lots of added capacity. We're already beginning to see increases take effect in some products.

Forest2Market’s transaction-based timber prices (stumpage) for the US South during a four-month period from the beginning of 4Q2018 through January 2019 suggest increased price volatility. On a Southwide basis, pine chip-n-saw prices increased 14 percent to $19.38/ton and pine sawtimber prices increased 12 percent to an average of $29.98/ton.

Increased regional log consumption will also require new logging and trucking capacity to meet the needs of larger, more modern sawmills. Contractor cost components (equipment, fuel, labor and insurance costs) continue to increase rapidly; skyrocketing insurance costs alone have become a real concern for many regional log transport companies, and wages may have to be markedly higher to attract new entrants into the industry.

All of these factors point to an increase in log price volatility across the South, both for stumpage values and costs on a delivered basis.

Joe Clark

Joe Clark