Three significant market dynamics are converging to drive southern yellow pine lumber prices higher as we head into the final part of the 2017 homebuilding season:

- Wildfires in western parts of Canada and the US are threatening timber supplies. Over seven million acres of land have burned thus far in 2017, making it one of the most destructive fire seasons in recent history and the USFS has spent more than $2 billion (a new record) fighting these fires. An infestation of the mountain pine beetle has also destroyed vast acres of timber in British Columbia (BC), the world’s largest exporter of softwood lumber. The beetle infestation has led to annual allowable cut (AAC) reductions, which has led to forecasts for a drop in timber supply of 25 percent over the next twenty years.

- Rebuilding efforts in the wake of Hurricanes Harvey and Irma will demand massive amounts of labor and resources. In Florida and Texas, over 600,000 homes will require some degree of construction repair. The temporary spike in lumber demand will result in essentially re-routing already allocated resources from a booming housing market in Texas.

- The US Department of Commerce has announced that it will postpone the final decision regarding the anti-dumping and countervailing duties on Canadian softwood lumber. The Department of Commerce will make its final decision regarding the anti-dumping and countervailing duties on Canadian softwood lumber in November, which has given Canadian producers a temporary reprieve. The decision could bring the total duties on Canadian softwood lumber to between 17 and 30 percent, which could have a profound effect on the North American lumber trade (and prices) for the foreseeable future.

While the tariff development is the only “man-made” factor affecting prices, it nevertheless may prove to have an impact on global lumber markets for years to come. We also recently discussed the looming lumber gap prior to the development of this devastating fire and hurricane season, which adds another layer of complexity to the situation. However, producers in the US South have the ability to efficiently ramp up production to meet demand and mitigate any long-term price increase.

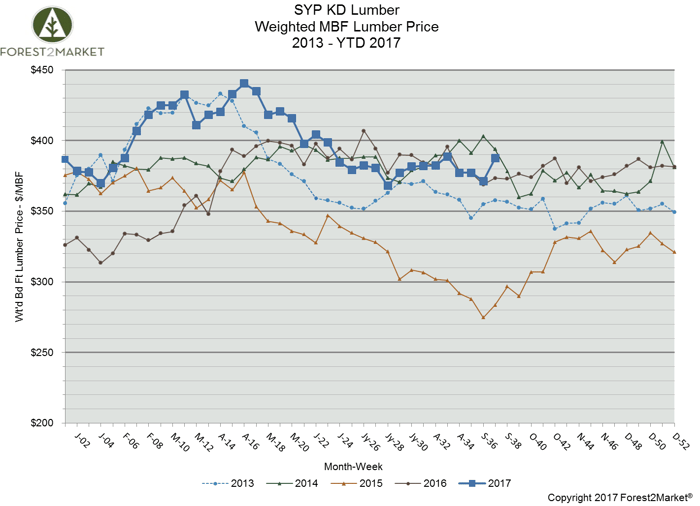

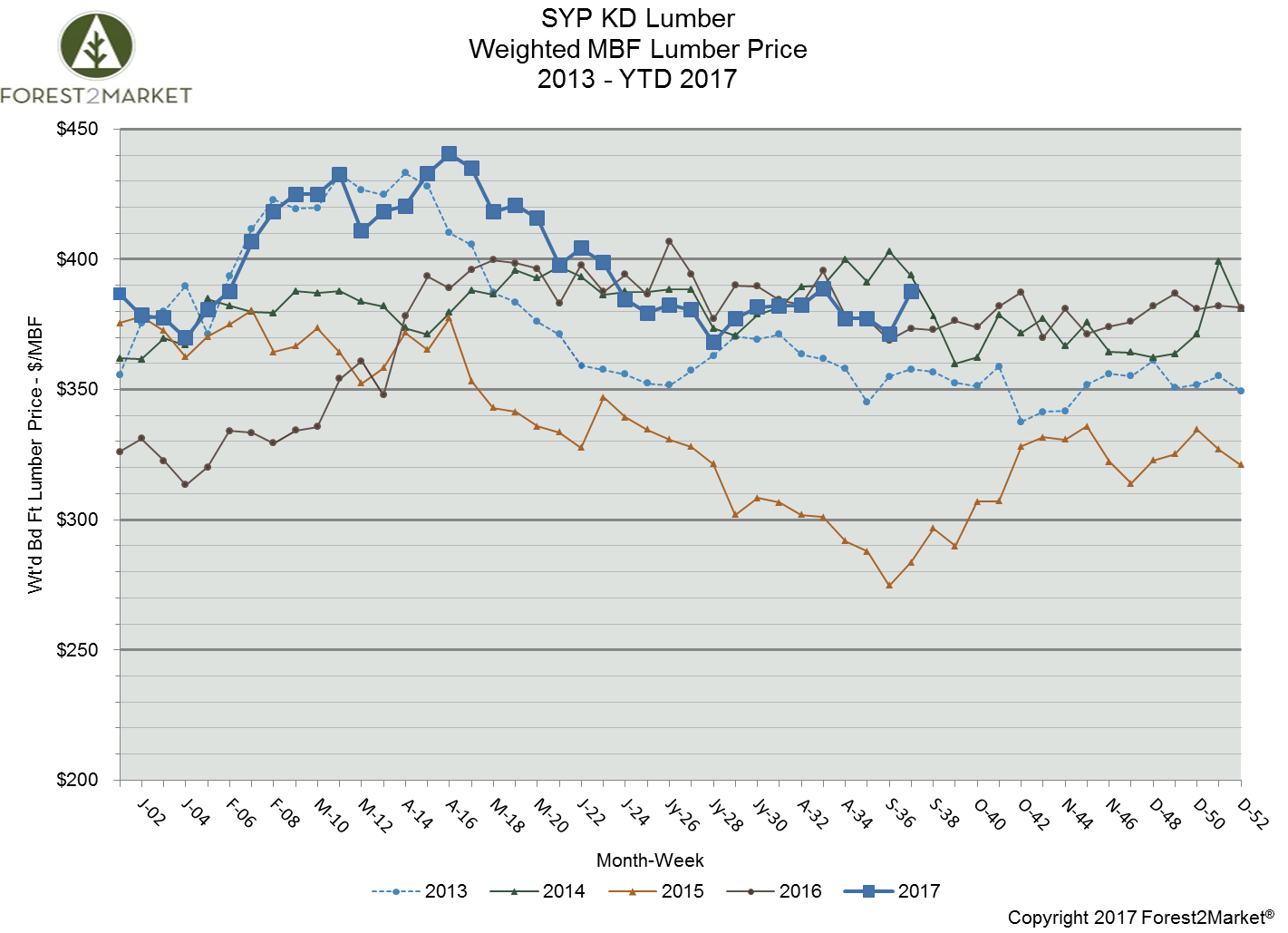

Southern yellow pine lumber prices have been surging since Harvey made landfall; the composite southern yellow pine lumber price for week 37 was at $388/mbf, which is up from week 36’s price of $371/mbf. Week 37’s price is also 2.6 percent above its January 2017 starting point of $378/mbf, and 4 percent above the 2016 week 37 price of $373/mbf.

A closer look at some of the prices we have seen since the beginning of the year: