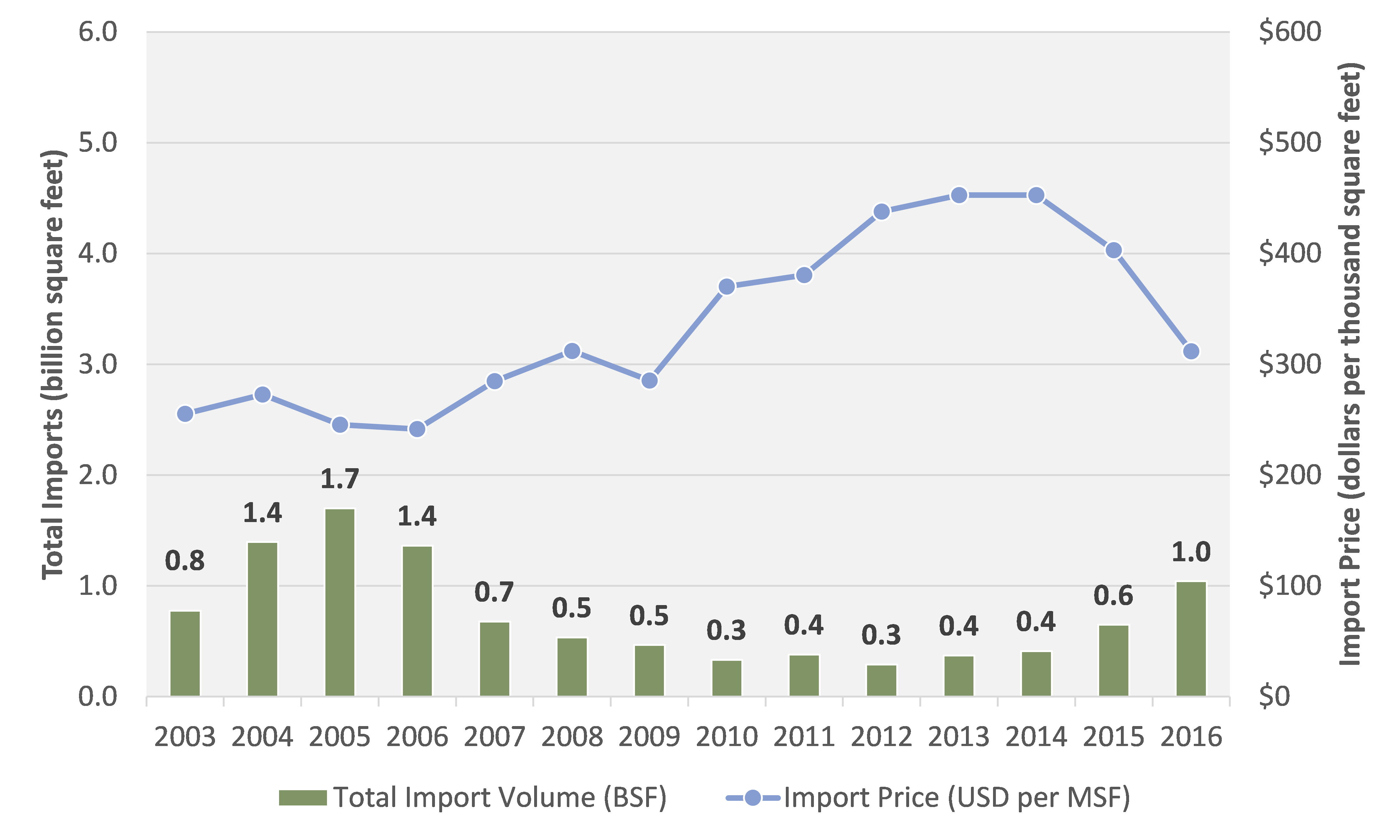

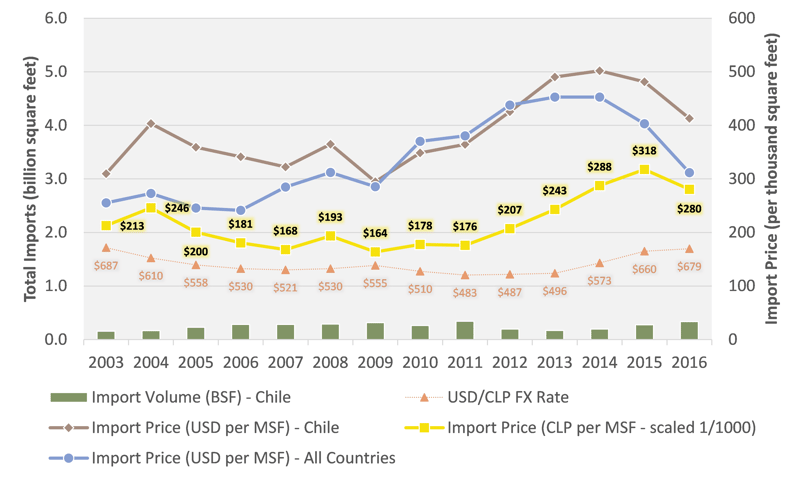

Based on US Census Bureau trade data through August, structural (conifer) plywood imports into the US are on track to increase 60.4 percent in 2016 to a total of 1.0 billion square feet (BSF)—roughly equal to 12 percent of domestic production. Continued improvements in housing and construction markets, along with a strong dollar, have contributed to this increase. At 1.0 BSF, 2016 imports will reach a 10-year high eclipsing 2007’s measurement of 0.7 BSF, but below the peak of 1.7 BSF in 2005 (Figure 1).

On a US dollar basis, import price trends mirror domestic price trends. After peaking at $452 per thousand square feet (MSF) in 2013-14, import prices have declined by 31.1 percent and currently average $312 per MSF.

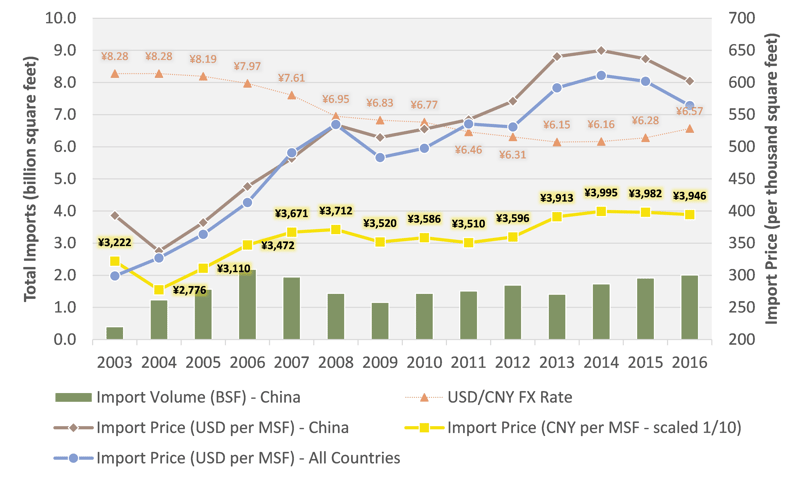

Figure 1 Structural (Conifer) Plywood Import Price and Volume Trend

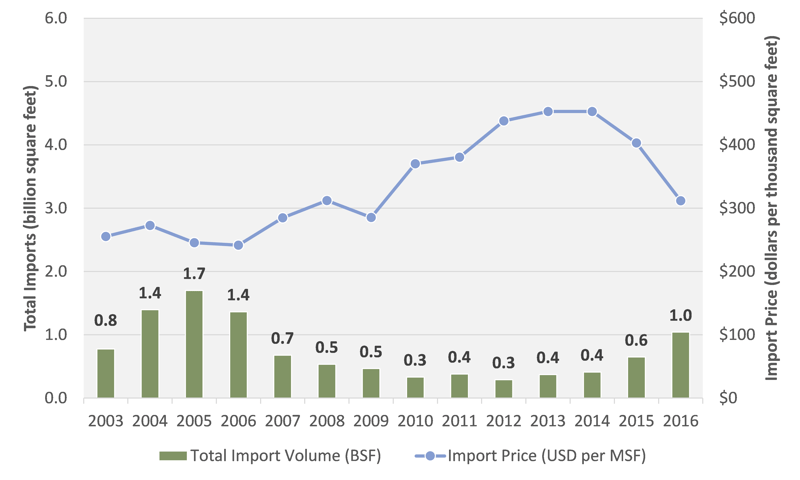

With the exception of China, almost all countries are on target to increase their volume into the US this year, but none more so than Brazil, who has cut into Chile’s market share. Brazil increased its import volume from 5 percent in 2011 to 57 percent in 2016 (Chile down from 90 percent to 32 percent) (Figure 2).

Figure 2 Structural (Conifer) Plywood Import Volume Trend by Major Importing Country

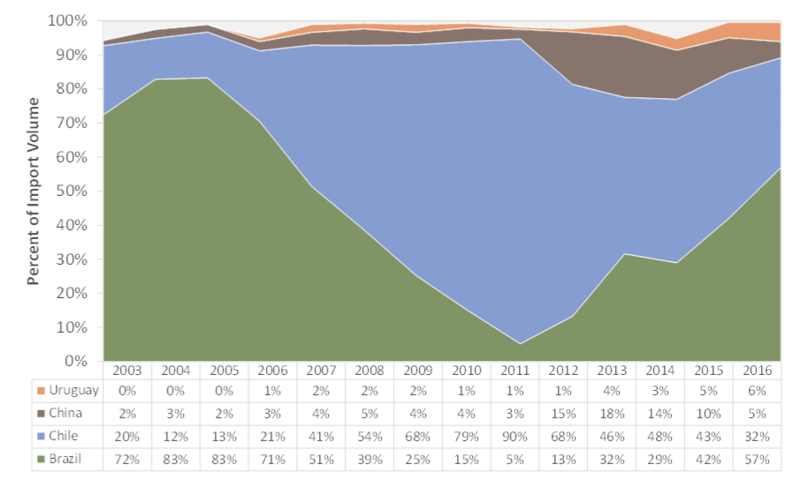

Since 2012, the US dollar price of Brazilian imports has sold at a discount (-$83 per MSF) when compared to the average of all other countries. Since the US recession, Brazil averaged roughly 0.1 BSF between 2009 and 2014. However, when its economy began to slide in 2015 and the Brazilian Real depreciated against the dollar (R$3.33 per USD), importers into the US were able to sell at a discount. For 2016, the Brazilian Real has continued to depreciate to R$3.59 per USD, causing import prices to reach a 7-year low of $252 per MSF (R$906 per MSF). As a result, imports from Brazil have increased from their average of 0.1 BSF to 0.3 BSF in 2015 and are on track to double to 0.6 BSF in 2016—moving from roughly 1 percent to 7 percent of domestic production (Figure 3).

Figure 3 Structural (Conifer) Plywood Import Prices and Volume from Brazil

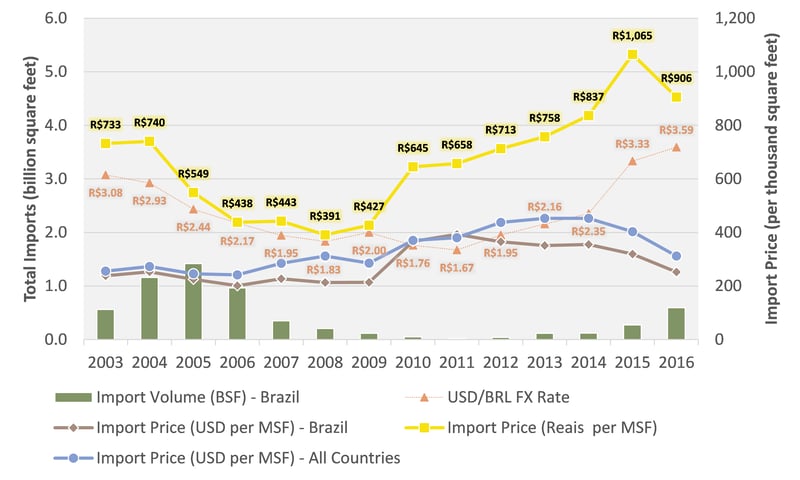

For Chile, imports are also on track to increase, but at a much slower pace when compared to Brazil. While the Chilean Peso has also depreciated against the dollar (CLP$679 per USD), the exchange rate has been more stable. As a result, the dollar premium of Chilean imports has expanded compared to the average ($38 per MSF in 2013 versus $101 per MSF in 2016) (Figure 4).

Figure 4 Structural (Conifer) Plywood Import Prices and Volume from Chile

Hardwood/Tropical Plywood

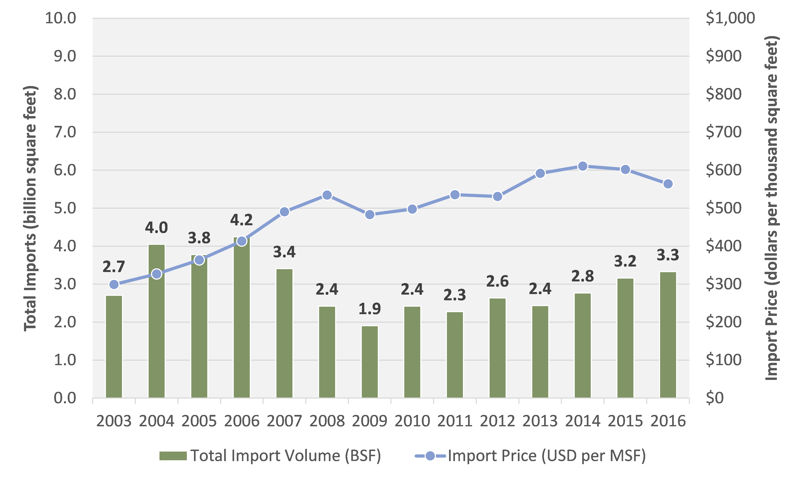

Decorative (hardwood/tropical) plywood imports into the US are on track to increase from 3.2 BSF in 2015 to 3.3 BSF—roughly a 5 percent increase. At 3.3 BSF, 2016 imports will nearly reach a 10-year high, just shy of 2007’s measurement of 3.4 BSF, but below the peak of 4.2 BSF in 2006 (Figure 5).

On a US dollar basis, import prices currently average $564 per MSF, down 7.7 percent from their peak in 2014.

Figure 5 Decorative (Hardwood/Tropical) Plywood Import Price and Volume Trend

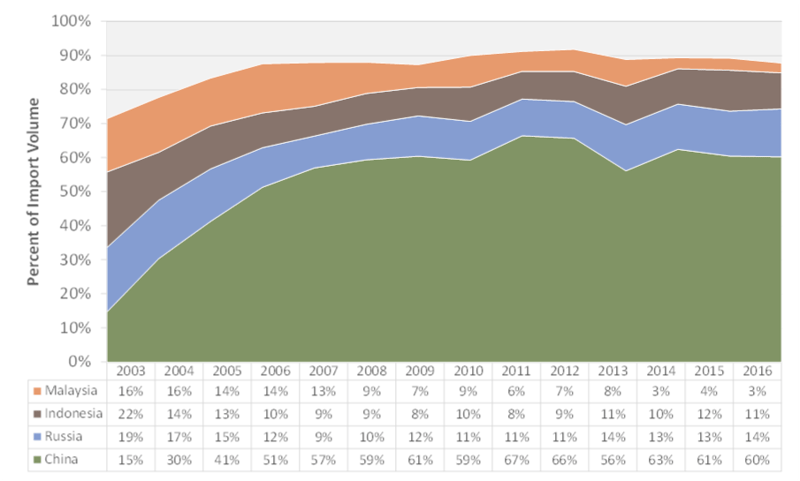

Trends for import market share have been relatively flat since the Great Recession of 2008, with China supplying roughly 60 percent of the import volume into the US. As of late, Russia has gained roughly 3 percent, mostly against China (Figure 6).

Figure 6 Decorative (Hardwood/Tropical) Plywood Import Volume Trend by Major Importing Country

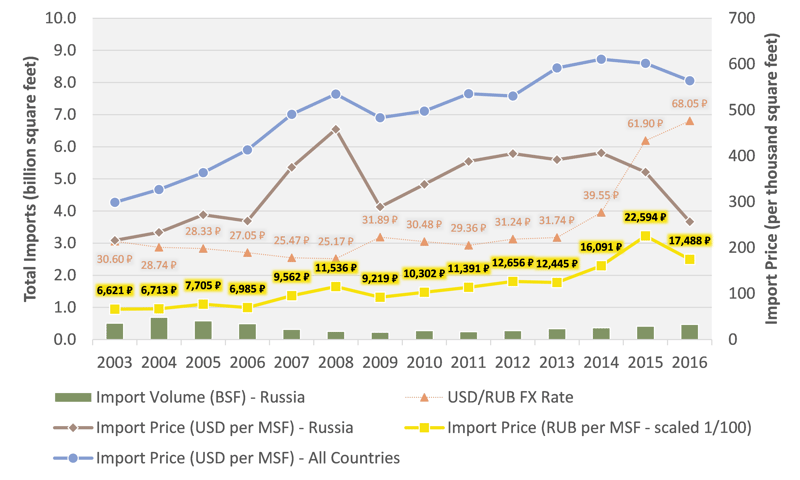

Both China and Russia are on track to increase their import volume by 0.1 BSF in 2016. However, due to the depreciation of the ruble, Russia’s discount has widened in 2016 ($237 per MSF in 2015 versus $307 per MSF in 2016) (Figure 7). China, on the other hand, has had its premium increase ($35 per MSF in 2015 versus $38 per MSF in 2016) (Figure 8).

Figure 7 Decorative (Hardwood/Tropical) Plywood Import Prices and Volume from Russia

Figure 8 Decorative (Hardwood/Tropical) Plywood Import Prices and Volume from China

Outlook

For 2017, our forecast calls for continued, gradual improvement in the US housing, construction and remodeling markets. It is more than likely that the US Federal Reserve will raise the federal funds rate in December 2016. This will have the effect of weakening the dollar against major currencies. We will likely see plywood imports flatten and begin to stabilize in 2017.

The segment most likely to be affected by these conditions will be structural panels from South America, particularly the interaction of import market share between Brazil and Chile. The Brazilian economy will continue to slowly stabilize, strengthening the Brazilian Real. Overall, we project the 2017 exchange rate to fall to around R$3.00 per USD making Brazilian plywood imports slightly more expensive, and weakening their market share of overall imports into the US in 2017.

Learn more about Forest2Market do Brasil:

Daniel Stuber

Daniel Stuber