4 min read

Supply Chain Price Differences Affecting the North America Pulp and Paper Industry

John Greene

:

April 23, 2019

Over the last two decades, several trends have driven customer preferences and changes in demand for forest and paper products. As a result of these changes, demand for one of the forest industry’s seminal products—printing and writing papers—continues to decline rapidly; over the last decade, production of printing and writing papers has declined by 6% annually.

Demand for newsprint has also continued to drop since the turn of the millennium—down almost 10% in 2017 from the previous year, and expectations are that this market will continue to evaporate. Most of the newsprint plants in the US South and Pacific Northwest (PNW) have been closed or converted to manufacture other products; the PNW alone lost seven major pulp and paper operations in the wake of the Great Recession in 2008.

However, the news is not all negative. Certain products are growing in the pulp and paper segment. Production is not disappearing altogether due to the digital revolution, but demand is indeed shifting from some paper products to other new ones.

- According to the American Forest & Paper Association, more than 95% of all products in the US are shipped in cardboard boxes. This product is very well-positioned in the growing e-commerce market, as online orders arrive in high-grade cardboard boxes to prevent damage during shipping. Over the last several years, this segment has increased production by nearly 2% annually.

- While demand for printing and writing papers has declined precipitously, demand for other pulp products has markedly increased—fluff pulp being the most obvious example. High-quality fluff pulp is an absorbent material made from bleached softwood cellulose fiber. While this is a relatively small market at only 6 million tons currently, worldwide demand is increasing at 4% annually.

Both above cases represent situations where a change in customer preference has not changed the demand for raw wood material, but rather has shifted the demand from one product to another. In many cases, a number of pulp mills dedicated to manufacturing printing and writing papers have been converted to produce fluff pulp, tissue and other products. Several facilities have already made this transition, including two International Paper Company mills in Franklin, Virginia and Riegelwood, North Carolina and one Domtar Inc. mill in Ashdown, Arkansas. While the processes involved in converting a mill to manufacture a different product can be very expensive, it is far less costly than a shutdown or a new building project.

Production and Raw Material Costs for the Paper Industry

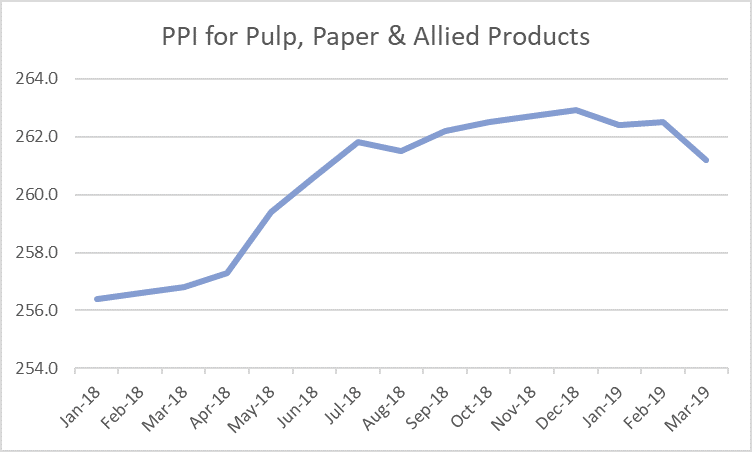

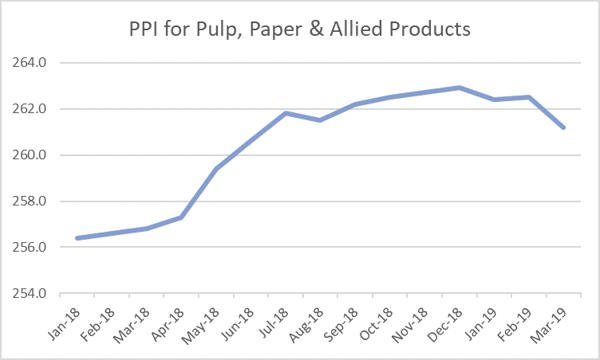

Industry consumption in the Pulp & Paper segment has flattened, which has further moderated raw material costs for fiber in most regions. The producer price index (PPI) for Pulp, Paper & Allied Products, which measures changes in prices received by domestic producers for their output, fell 0.2% in March driven in part by a strong US dollar, although the metric is up +2.3% YoY.

The cost of manufacturing these goods is trending up, but are raw material costs for pulp and paper manufacturers following suit? Regional differences in wood raw material costs are a market reality for all timber products, and the data demonstrates these disparities. We analyzed pricing over the last year to look for any correlation with the PPI numbers detailed in the chart above and, except for the US South, prices generally trend in line with the PPI.

US South

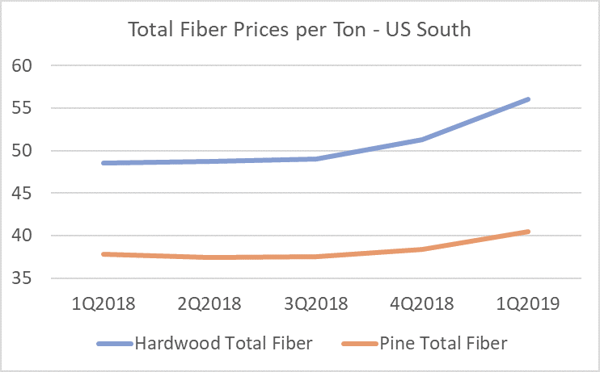

Total fiber prices in the US South were flat for most of 2018 but began trending up in 4Q and, more recently, have accelerated that pace in 1Q2019. Prices for hardwood total fiber increased roughly 15% YoY and prices for softwood total fiber increased roughly 8% in the same period. While the PPI has trended lower since the beginning of Q1, chip prices in the south have gone in the opposite direction.

Pulpwood prices have been driven by excessive precipitation over the last six months across the US South; rainfall for 2018 was well above average at about 63 inches according to the precipitation tool available via SilvaStat360. Timing of this precipitation has been critical to understanding the effects on timber availability and prices. For example, while 2015 was a very wet year by historical standards, SilvaStat360 demonstrates that the timing of rainfall in late 3Q2018 affected pulpwood pricing significantly more through the end of 2018 and into 2019.

Eastern North America

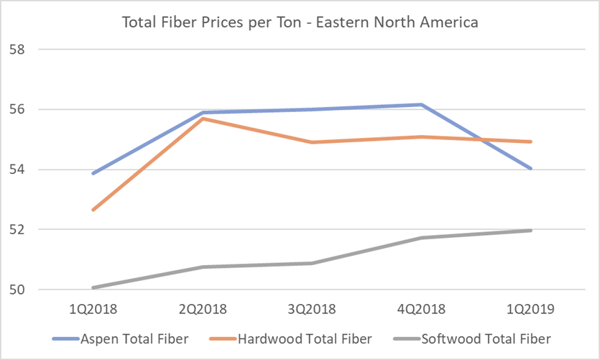

Prices for Aspen in Eastern North America (Northeast, Lake States and Eastern Canada) have followed a similar path to the PPI, however softwood total fiber prices have increased by 4% YoY and hardwood total fiber prices have increased nearly 5% YoY.

The seasonality of wood raw material deliveries in the Lake States and Northeast regions has a significant effect on the supply chain. Pricing is typically driven by market inventory levels of hardwood timber entering the winter season. As we have demonstrated in previous analyses, pricing levels are at risk when market inventories go below a 30-day supply when entering the winter season. However, mill inventory levels in the Lake States and Northeast have generally been consistent for the last several years and we have seen stable to decreasing prices in most species/products. One exception to this has been observed in Northeast softwood fiber pricing, where increased demand has driven a nearly 20% increase in pricing.

Pacific Northwest

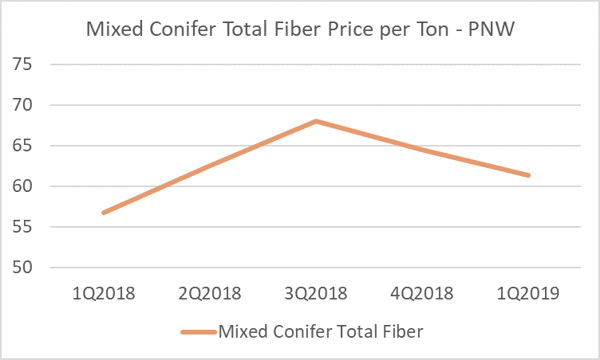

Prices for Mixed conifer fiber in the PNW have also followed a similar path to the PPI, surging 19% in 3Q2018 before moderating to roughly $62/ton[1] in 1Q2019. In the PNW, lumber production and resulting residual chip supply usually has a bigger influence on pricing than chip demand. Pulp mills and their woodyards in this region were designed to consume sawmill residual chips supplemented by off-site production of primary (chipmill) chips. As a result of the sawlog economy in the PNW and operational challenges with harvesting, a true pulpwood market has not developed as it has in other areas like the US South, for example.

The PNW is resource constrained, reliant primarily on finite private land production in the US. British Columbia mills are also fiber short due to reductions in their allowable harvests as a result of tree mortality from the mountain pine beetle outbreak and recent fire mortality. This severely limits sawmill expansion and caps residual production in the process.

However, it should be noted that prices increased through 3Q2018 despite high lumber production and increasing residual chip supply. This was due to increased demand from consumers and their jockeying for market share of residual chips in order to reduce their consumption of higher-cost chipmill chips.

Consumer trends have undoubtedly changed the landscape of the pulp & paper segment over the last few decades, and the forest industry must be prepared to cope with even more changes in the future. But market changes also create new opportunities, and we are seeing those opportunities take shape in today’s P&P market. Based on the pricing outlined above, there is still a healthy demand for wood fiber from pulp and paper manufacturers throughout North America. While the end-user paper products may change—as well as the wood raw materials, equipment and technology used to create them—a healthy demand for wood fiber still exists to serve a growing customer base of pulp and paper products.

[1] Units have been converting to green short tons for comparison purposes.