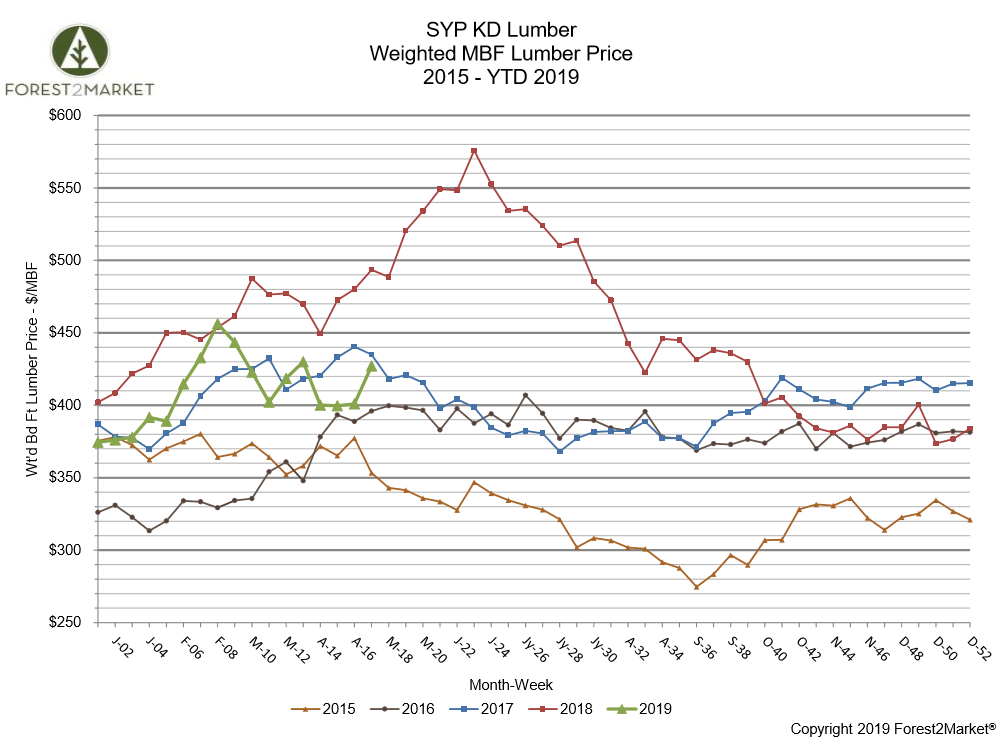

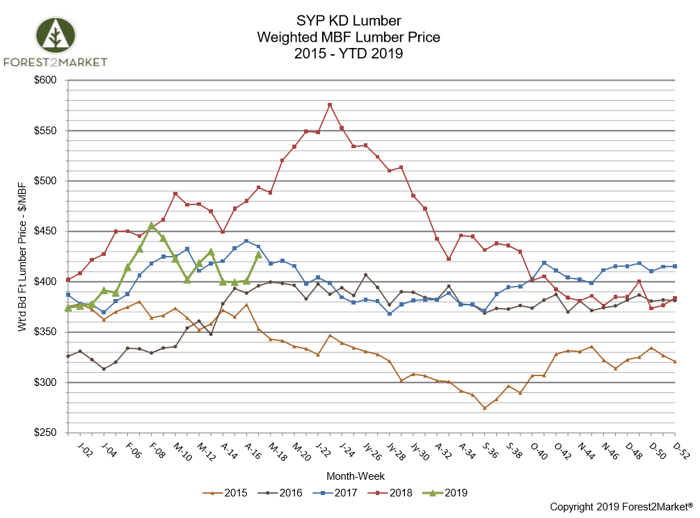

After three weeks of flat performance throughout most of April, southern yellow pine (SYP) lumber prices surged late in the month. As winter finally gives way to some warmer temperatures and the building season kicks off in earnest, lumber prices have displayed less volatility when compared to 2018.

Forest2Market’s composite southern yellow pine lumber price for the week ending April 26 (week 17) was $427/MBF, a 6.5% increase from the previous week’s price of $401/MBF, but a 13.4% decrease from the same week in 2018.

- 1Q2019 Average Price: $410/MBF

- YTD Average Price: $409/MBF

Following a series of recently-announced sawmill curtailments and closures in the Pacific Northwest and British Columbia—primarily the result of high log costs and timber availability constraints in combination with weak lumber prices—demand for SYP, as well as imports from competitive foreign producers, is poised to increase should housing starts experience a surge. However, that prospect seems somewhat dim in the near term based on disappointing segment performance in both February and March.

A recent Reuters article on March’s housing starts performance noted that “The weak report bucked a recent tide of upbeat data, including retail sales, trade and construction spending, that indicated the economy regained speed late in the first quarter after appearing to stumble at the turn of the year.” "Waiting for construction activity to pick up after a sharp drop in mortgage rates is like waiting for Godot," said Chris Rupkey, chief economist at MUFG in New York. "It is hard to know what is ailing the home construction industry."

Also of note, the World Trade Organization (WTO) announced its decision earlier in April regarding the latest softwood lumber trade dispute between the US and Canada. Per an article in The Missoulan, “… the international body upheld part of the U.S. Department of Commerce's decision to place antidumping duties on imported Canadian softwood. The decision could be appealed, and it's just one of three softwood-related cases that the two countries have pending before international panels.” Both countries have 60 days to decide whether to appeal the WTO ruling.

When analyzing the historical SYP price data, we have reached that point in the season where prices generally go one of two directions for the next several months. Prices in 2018 spiked to historical highs, which lasted through August. However, prices in 2015, 2016 and 2017 trended lower from early May through the end of the summer months.